Melbourne's stellar mid-year price growth leaves other capital cities behind: CoreLogic

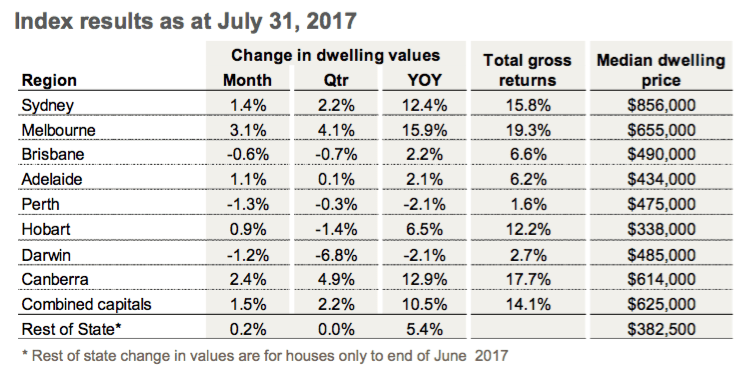

A 3.1 percent gain in Melbourne dwelling prices over the month drove combined capital figures in the July 2017 CoreLogic Home Value Index.

The July 2017 CoreLogic Home Value Index results recorded a 1.5 percent rise in dwelling values across the combined capital cities.

Tim Lawless, CoreLogic head of research , the latest housing market results highlight the diversity of housing market conditions, with dwelling values down over the month in Brisbane (-0.6 percent), Perth (-1.3 percent) and Darwin (-1.2 percent).

“The recent bounce in capital gains may be partially due to a recovery from the seasonal slump in values recorded in April and May," he said.

"However, other factors, such as stamp duty concessions for first home buyers in New South Wales and Victoria, may also be having a positive impact on market demand.

“It’s still too early to measure the effect of first home buyer incentives, which went live on July 1st. However historically, the first time buyer segment has been very responsive to stimulus measures.”

"Despite the higher month-on-month capital gains in June and July, the quarterly trend rate of growth has clearly reduced.

"The rolling quarterly pace of capital gains across the combined capitals has fallen from 3.6 percent in February earlier this year to reach 2.2 percent at the end of July.

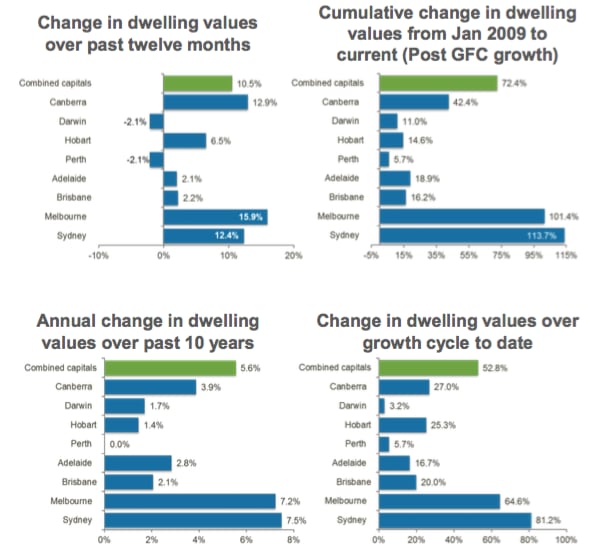

"The slowdown in growth conditions is most evident across the hottest markets, with the quarterly growth trend reducing from 5.0 percent in Sydney earlier this year to 2.2 percent at the end of last month.

"Melbourne growth conditions have also slowed, though to a lesser extent, with growth easing from a 2017 quarterly peak of 5.5 percent to 4.2 percent.

“Melbourne appears to be benefitting from consistently high population growth which is creating strong demand for housing, as well as consistently high jobs growth and more affordable housing options relative to Sydney.”

"At the other end of the growth spectrum, Perth and Darwin have continued to see dwelling values slip lower over the month, taking the cumulative decline to 10.2 percent in Perth and 14.5 percent in Darwin since both markets peaked in 2014.

"The ease in the rate of decline has been most visible in Perth, providing a signal that the Western Australian capital may be approaching the bottom of the downturn; listing numbers have been falling across Perth which is a positive sign of improving conditions, and transaction numbers have found a new floor at around 2,500 sales per month."