Tech companies to drive Sydney CBD office tenancy: Cushman & Wakefield

Technology firms have become a key driver of Sydney CBD office demand, according to recent research by property firm Cushman & Wakefield.

Macquarie Park, previously Sydney’s main tech hub, has been displaced by the CBD because of the growth in cloud computing, technological innovation in a range of service industries and a desire to attract and retain the best talent to offices which are strongly serviced by public transport and close to retail precincts, says Cushman & Wakefield’s Tech and the city report.

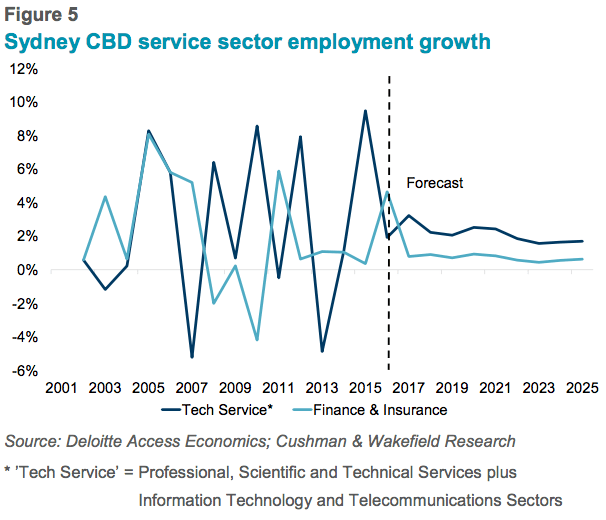

In fact, tech is expected to take over from the finance and insurance sector as the key driver of CBD office demand in Sydney. Demand from tech companies for CBD space is expected to grow more than three times that of the finance and insurance sector over the next five years, it says.

“Large tech firms taking up residence in Martin Place over the past few years has been a well told story for the Sydney CBD office market. However, rise of tech firms in the CBD has been much broader based with many smaller firms taking up space across the CBD,” it says.

Over the past few years Apple, Dropbox and LinkedIn have taken up office space in Martin Place, but the expansion of tech firms in the CBD has been much broader based.

Cushman & Wakefield Research identified around 40 leases signed by tech companies over the past 12 months across the CBD, in building grades ranging from Premium to C. Lease size varied considerably also with space requirements ranging from 100 sq m to over 17,000 sq m.

The range of tech tenants that have taken up space highlights the diversity of the sector. While LinkedIn is known for social media, Amazon for e-commerce and Apple for products such as phones, tablets and computers, tech is extending its reach into a variety of service sectors. For example, tech tenants that have recently leased space in the CBD have areas of speciality including labour hire; education; travel; expense management; digital forensics; online security; trading and portfolio management.

The largest overall lease, recently completed by Cushman & Wakefield, is the +17,000 sq m Sydney Startup Hub at Wynyard Green which is expected to open its doors in Q4 2017. While not specifically a tech tenant, the Startup Hub is a NSW Government initiative to create a startup and innovation centre and most of the residents are likely to be tech orientated.

Service sector and tech driving Sydney CBD office demand

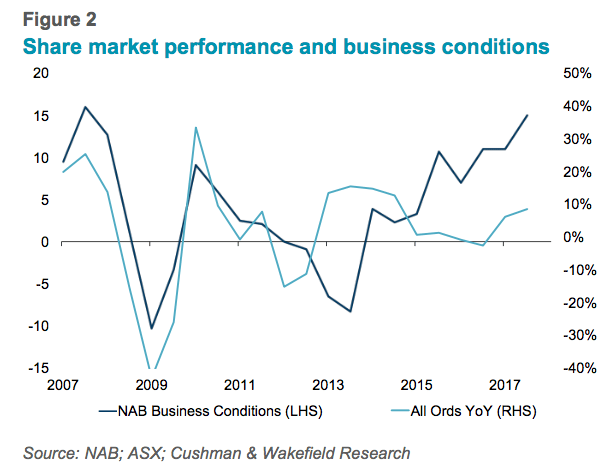

Office demand in the Sydney CBD has traditionally been driven by the ups and downs of financial markets. With around 30% of the CBD workforce employed in the Finance and Insurance sector, changes in CBD office demand have historically been correlated with share market performance. However, in recent years the relationship has broken down with relatively strong demand for office space despite soft share market performance.

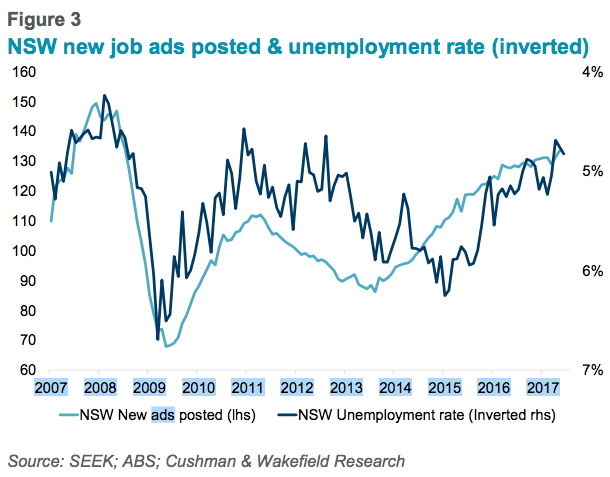

But while the finance sector accounts for a large part of the CBD workforce, an even larger percentage, about 40%, are employed in other service sectors such as Professional, Scientific and Technical Services, Admin and Support, Real Estate and Information Media and Telecommunications. These sectors are currently doing well, as indicated by the NAB Business Conditions Survey (Figure 2), which is near a 10 year high and is helping to drive relatively strong employment growth (Figure 3).

Why do tech tenants now favour the CBD?

For many years, Sydney’s tech hub was Macquarie Park. This was driven by a range of factors such as a desire to create a Silicon Valley/Stamford University type research and innovation relationship with Macquarie University, campus style office accommodation and access to warehousing space for inventory.

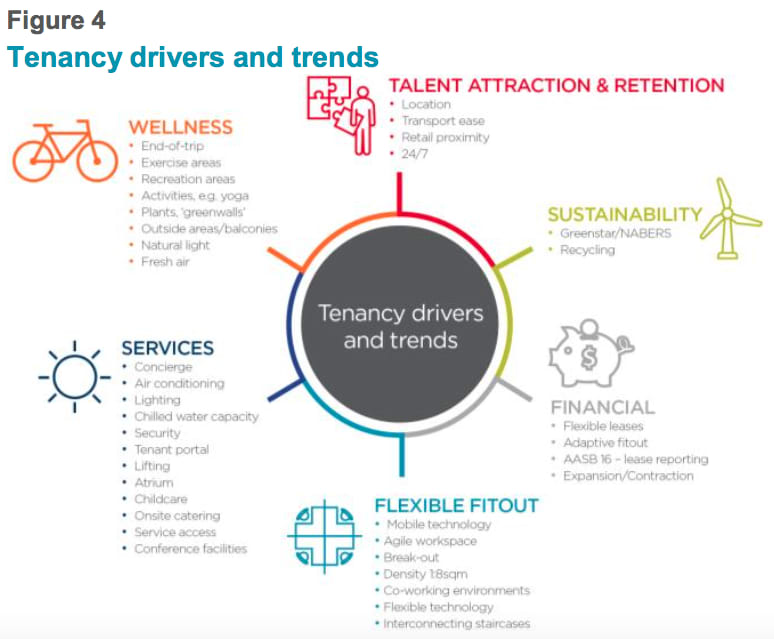

However, software applications are now usually supplied over the web rather than on disks and with people the major asset of tech firms, management are keen to establish a work environment to attract and retain the best talent.

The Cushman & Wakefield 2017 office leasing: Trends and Outlook survey noted that proximity to public transport and retail amenities were primary considerations for tenants. With many tech firms operating globally on a 24/7 basis, the CBD offers the best access to Sydney’s transport network and excellent retail amenities.

Future growth

With technology being increasingly integrated into all aspects of our lives, employment growth and demand for office space associated with the tech sector is likely to continue to grow.

Deloitte Access Economics has forecast that Sydney CBD employment growth in the two sectors primarily associated with technology, i.e. Professional, Scientific and Technical Services and Information Technology and Telecommunications, is forecast to average 2.5% pa over the next five years, compared to 0.8% pa for the Finance and Insurance sector (Figure 5).

This equates approximately to an additional 12,000 ‘Tech Service’ jobs compared to about 3,750 finance roles or, at 8 sq m per person, a requirement for about 96,000 sq m of Tech Service space compared to 30,000 sq m finance space. However, it should be noted Finance and Insurance sector roles are increasingly tech related as the industry becomes more automated.