Lendlease, Investa likely to surpass Dexus as largest Sydney CBD office owners: Colliers

The Sydney CBD office market has a strong supply pipeline lined up with 470,000 sqm expected to be added by 2022, which will also bring a churn in office ownership levels, according to new analysis by commercial real estate firm Colliers.

The new supply in the next 5 years will push up some landlords up the ranks.

Lendlease and Investa are expected to surpass Dexus, becoming the first and second largest office owners within the market, respectively, says CBRE report author Kristina Mastrullo.

Lendlease’s Darling Square is due for completion late this year and Circular Quay Tower is slated for completion in 2021, while Investa’s 151 Clarence Street (Barrack Place) is due late 2018 with 60 Martin Place shortly after in the first half of 2019.

Taking into account withdrawals, such as 39 Martin Place which will make way for the Martin Place Metro Station Precinct, Dexus will slip to no. 3 position among largest office owners.

So, where will the supply come in?

Sydney CBD’s Core precinct will take on 51 percent of total office development activity over the next 5 years, says the analysis.

“The Core will remain the most sought after precinct once 60 Martin Place, Wynyard Place, Circular Quay Tower and Quay Quarter Sydney are completed, driving future rental growth,” says Mastrullo in the note.

Over the last twelve months, the Core precinct has outperformed all others with an annual increase in net effective rents of 33.6 percent. The Western Corridor is due for 24 percent of overall development activity as 10 Shelley Street is due to come online along with Darling Square and Barrack Place.

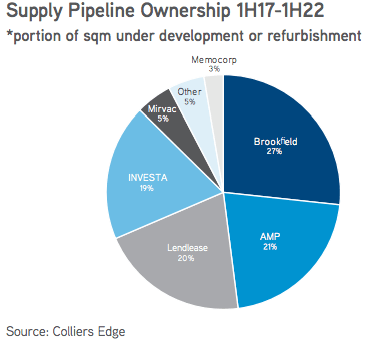

After combining full and partial refurbishments with new development supply, Brookfield is responsible for the largest portion of total-square-metres-under-development over the next 5 years within the Sydney CBD at 27 percent. Brookfield’s total development activity equals over 110,000 sqm which includes the full refurbishment of 10 Shelley Street and developments Darling Park 4 and Wynyard Place.

AMP, Lendlease and Investa are closely ranked however Lendlease is only set to contribute new-development supply, whereas refurbishments (full and partial) constitute a sizeable portion of AMP’s and Investa’s overall construction activity over the next 5 years.