Spring auction clearance rates not fading like past selling seasons

We all know Spring as supposedly the best time to be bringing your home to the market.

What is often forgotten is that if everyone acts in the same way looking to sell during Spring, there is a lot more competition amongst vendors and it can be more difficult to sell. In fact, looking at auction markets, the clearance rate quite regularly falls during Spring as volumes rise.

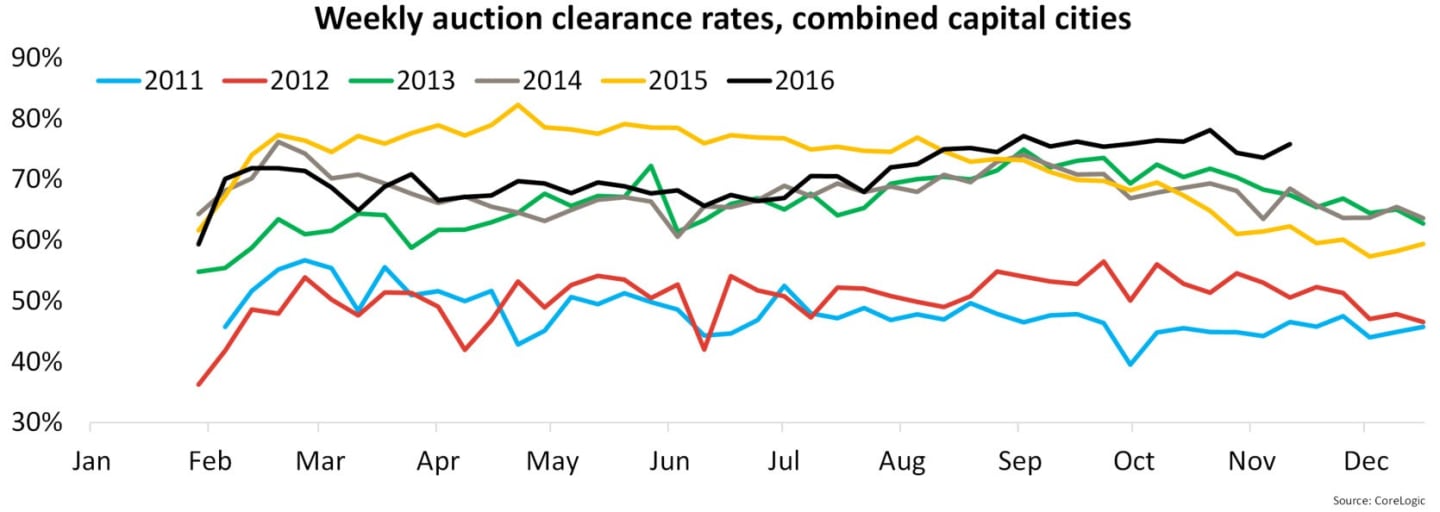

On a weekly basis throughout 2016, auction clearance rates across the combined capital cities have been recorded at an average of 70.9 percent. If we compare this to the previous years, the average weekly auction clearance rates were recorded at: 48.0 percent in 2011, 50.4 percent in 2012, 66.2 percent in 2013, 67.8 percent in 2014 and 72.0 percent in 2015. Over recent years clearance rates have fallen over the final quarter of the year, however, this year there has been no such fade-away in clearance rates. In comparison to 2015 for example, auction clearance rates were much higher earlier in the year than they have been this year while in 2015 clearance rates faded substantially over the final quarter of the year.

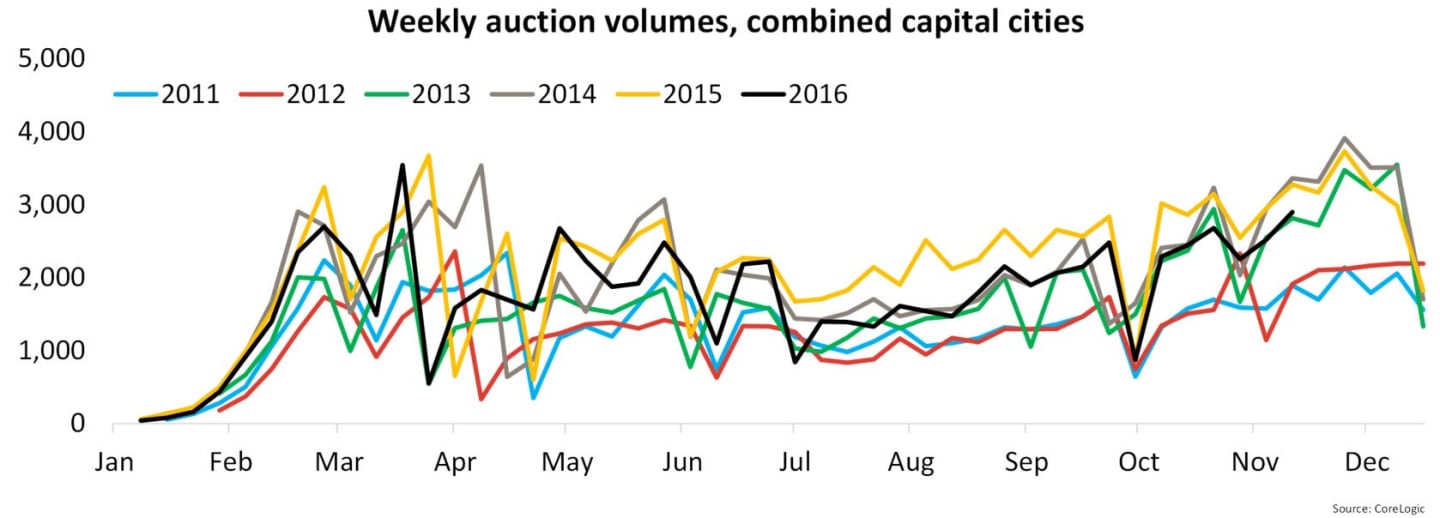

The average number of properties being put up for auction each week has been lower in 2016 than it has been over recent years. So far in 2016, there has, on average, been 1,765 auctions each week across the capital cities. By comparison, average auction counts over recent years have been recorded at: 1,384 in 2011, 1,334 in 2012, 1,733 in 2013, 2,029 in 2014 and 2,170 in 2015.

Auction volumes so far this year have been similar to those in 2013 however, in 2013 average clearance rates were on average quite a bit lower at 66.2 percent compared to 70.9 percent this year. If we look at the past three years auction volumes through the final quarter of the year, we can see volumes rising through Spring as the selling euphoria hits. So far this year, , volumes have risen but they have not hit The Heights of 2014 and 2015, subsequently auction clearance rates have so far not faded through the end of the year like they did in 2014 and 2015 and have in each of the previous years highlighted.

A lower volume of auctions overall has certainly been a key driver of why auction clearance rates have been stronger this year. Importantly, this is not just a feature of the auction market itself, new and total listings in the two largest auction markets (Sydney and Melbourne) are lower than they were a year ago so overall, there is less stock available for sale to choose from.

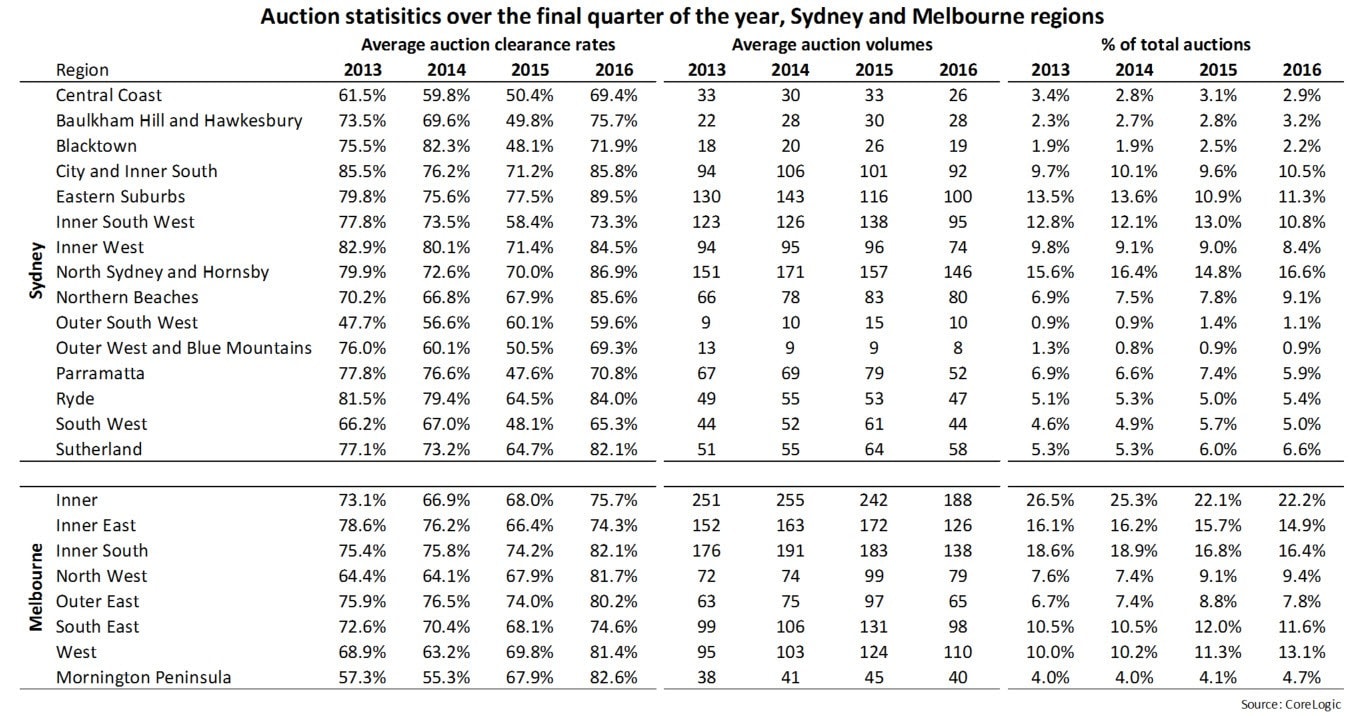

Focusing on auction statistics for the final quarter of each of the past four years in the regions of Sydney and Melbourne it shows that almost every region in both cities has seen an increase in average auction clearance rates so far in 2016 compared to 2015. At the same time, average auction volumes are lower than they were last year across all regions of Sydney and Melbourne.

In Sydney in particular the regions that have had relatively weaker auction clearance rates over recent years have generally so far this year seen proportionally fewer auctions. This seems to suggest that vendors are getting more selective about using an auction to sell in those areas which are not traditional auction-centric markets.

The combination of fewer overall properties for sale, fewer homes being taken to auction and vendors being more selective around which homes to auction seems to be resulting in much stronger auction clearance rates. Additional factors over the year such as lower interest rates are also likely to be supporting the market. If these conditions persist, it is reasonable to expect that for the remainder of 2016 and into 2017 the auction market will remain strong.

Cameron Kusher is research analyst for CoreLogic. You can contact him here.