An insight into Sydney, now one big building site

Quite remarkable that the Lower North Shore property markets are showing no signs of slowing as we edge closer to Christmas.

What is very clear is that all but guarantees another very strong March quarter for 2017, where beyond that would be anyone’s guess.

Whilst many expect that the Reserve Bank of Australia will cut the cash rate in the next six months we are now starting to witness some small Australian lenders increasing their rates which sends a loud signal that we may now be witnessing the end of the low rates. I made a phone call and was advised that ING have the lowest rate presently at 3.84 percent over five years fixed. ME head of home loans, Patrick Nolan, said: “The increases were based on increasing swap rates – up 40 basis points since the end of August – and increasing cost of deposit funding.”

Yes, there will be casualties, more particularly the interest only borrowers. I read a sage quote by a banker on Twitter who said: “If anyone is taking out a 20 – year mortgage and they don’t believe rates will rise, I’d ask them if they should be making this investment. It is an unrealistic proposition,” he said.

What needs to be factored in is that wages rose by 1.9 per cent during the September quarter, which was a record low according to the Australian Bureau of Statistics.

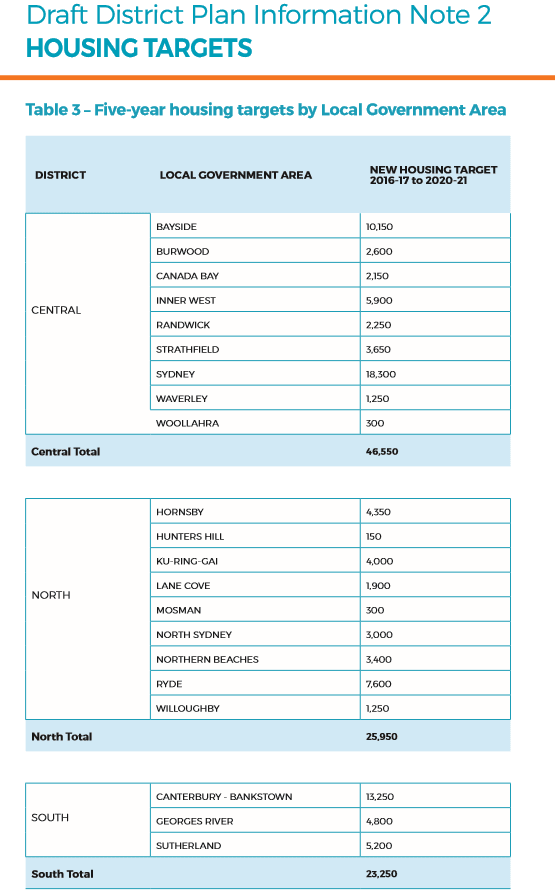

The NSW Government’s property development arm known as the Greater Sydney Commission released this week the first draft for the five – year housing targets by Local Government Area. A total of 23,250 new properties have been approved, with Mosman to build 300 new properties and North Sydney 3,000 and the Northern Beaches an additional 3,400.

I really find this quite intriguing with present data suggesting that Sydney is now facing an imminent over – supply. NSW is in the process of building 55,000 new apartments with thousands more on the planning desks awaiting approval.

As these apartments are completed this will be a significant lever in reducing rents. When I look at Mosman I observed from CoreLogic that the rental median for a house in Mosman is $1,600.00 per week which is a 16.4 per cent increase over the last five years. The rental median for an apartment is $580.00 per week which is a 16.0 per cent increase over the last five years.

From an economic perspective, this is good news for NSW as it will drive employment as well as productivity. Property investors need to look closely at where their respective investment properties are within the Local Government Areas to ascertain what impact this unprecedented apartment building bonanza will have. One would have to say that in the short – term in the case of Mosman that apartment rents will be coming down. Even more so in North Sydney as they have a massive 3,000 apartments to be built over Mosman’s 300. For the fortunate ones if you own a residential development because it just doubled and trebled in value with the new high density legislation.

What needs to be acknowledged is this is what we call the new market and should not be confused with the established housing market as we are building apartments not houses. Although one point that springs to mind is that investors will be forced to renovate existing apartments if they are going to compete in the market on a rental dollar basis as they will be up against brand new apartments.

The building industry has never seen a better future although little consideration has been given to existing property owners who must contend with greater traffic congestion on our roads. So, if you thought our roads are congested now this week’s announcement will only make the situation worse.

Over time this will see more businesses moving to the suburbs, so a smart town planner must be marinating these development sites with a combination of commercial, retail and residential. Although we all know that this won’t happen as that would be the intelligent outcome to try and ease traffic congestion. Happy to bet now that these new developments will be strictly residential only although I will be more than happy to be wrong with this.

What is happening in Sydney will also see many leave Sydney for quieter and a more stable lifestyle. Whatever the outcome this will have plenty of Sydneyites re – considering their respective futures.

ROBERT SIMEON is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985.

He has also been writing real estate blog Virtual Realty News since 2000.