Source: ASX: MEA

McGrath's diagnosis left little doubt as to the reason for this, being excessively high stamp duty costs.

It's a point I've visited here often before.

Stamp duty bands were designed with far, far lower dwelling prices in mind.

By consistently refusing to raise stamp duty and land transfer brackets authorities are effectively loading more and more up front tax on to property purchases (in addition to other taxes, such as rates and land taxes).

By effectively raising the stamp duty from a bit over 1 percent of the purchase price three decades ago to around 4 percent, the tax has gone from being a consequence or by-product of the transaction to an actual barrier.

No doubt the stamp duty windfall has been great for state governments and their overflowing coffers, particularly in New South Wales which has raised $8.6 billion in the last year alone and where we have net debt of less than zero for the first time ever.

Unfortunately, the high transactional cost of moving is predictably leading to 'asset lock in' and indirectly impacting labour force mobility.

Meanwhile investors remain wedded to their buy-and-hold strategies since if they choose to sell they get hit with capital gains tax (not that this stops unthinking 'think tanks' from campaigning for higher CGT).

As for non-residents, presumably some of them must sell but I've rarely come across it, probably because they purchase expensive new property and it can take years to break even on that type of stock with its inherent price premium (particularly now with the new levies on foreign buyers loaded on top of stamp duties, plus land taxes).

Asset lock in

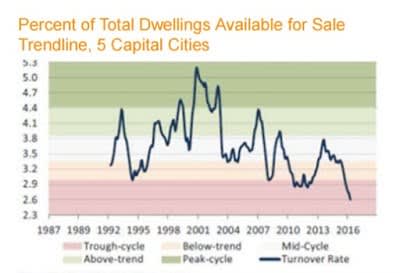

Unsurprisingly capital city owners of houses now hold on to their houses for 10.7 years on average, way up from 6.7 years in 2005.

Owners of apartments now hold for 9 years, well up from 5.9 years in 2005.

The negative feedback look has become self-fulfilling, with so little stock available prospective capital city vendors are hesitant to list for fear of becoming locked out of rising markets.

Due to low listing volumes, McGrath implied that we can expect to see low transaction volumes in FY17.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.