Owner occupiers dominate the Newcastle industrial market

Warehouse and workshops rents improved slightly during the second half of 2016 in Newcastle, with rental rates ranging from $90 to $110, according to Colliers International's latest report.

Warehouse rents continue to comprise the majority of vacant space within prime industrial locations such as Beresfield, Thornton, Mayfield and industrial suburbs surrounding the Port of Newcastle.

Rental rates are predicted to improve during 2017 due to a recovering economy and the increasing presence of owner occupiers absorbing vacant stock.

Incentives within the Newcastle market are typically associated with the leasing of larger facilities for lease terms greater than three years and range between 8 per cent to 10 per cent of the lease term certain.

The majority of lease deals negotiated during the second half of 2016 in prime industrial areas have featured incentives less than this, with most incentives being experienced for older industrial facilities in secondary and fringe industrial locations.

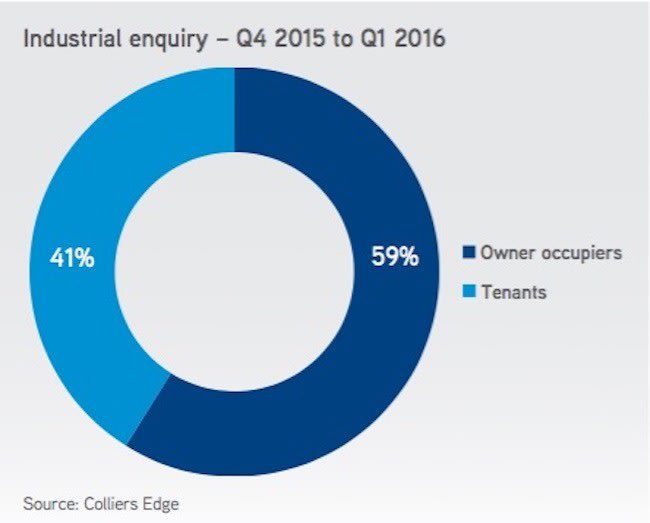

The current low interest rate environment, a strengthening local economy and stable industrial land values have contributed towards increased enquiry from owner occupiers within the Newcastle industrial market during the second half of 2016 (approximately 15 per cent from Q1 2016).

This increased demand from owner occupiers has resulted in an uplift in values for properties sold with vacant possession.

Colliers International has witnessed properties being listed for lease receiving strong demand from owner occupiers, with circa 60 per cent to 70 per cent of properties listed for lease being sold.

Colliers International expects owner occupiers to continue to dominate enquiry throughout Q4 2016 and Q1 2017.

The higher ratio of owner occupiers to tenant enquiry is highlighted in the following graph.

Increased demand from owner occupiers capitalising on the historically low interest rates and improving business confidence, has resulted in uplift in values for properties sold with vacant possession.

The most prevalent has occurred within the sub $1.5m price bracket due to affordability for self managed superannuation funds, seeking opportunities within premium industrial locations such as Beresfield, Cardiff, Thornton, Warabrook and inner city locations.

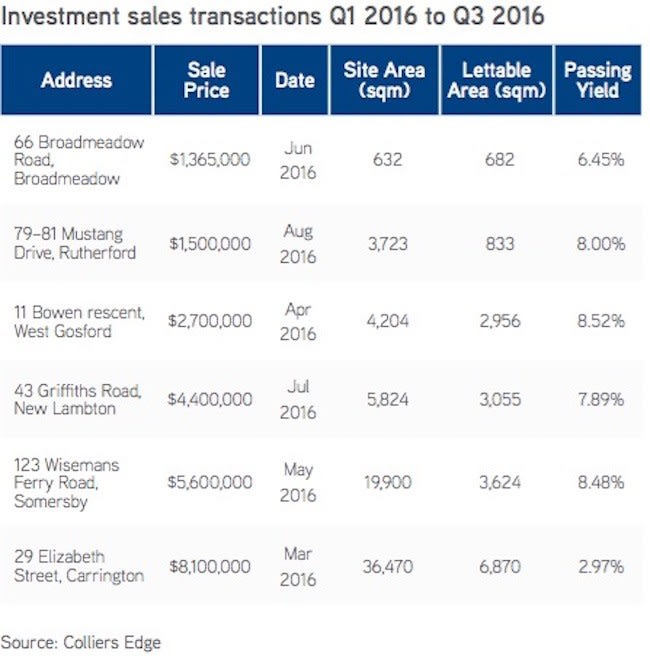

The demand in the investment market for high quality industrial assets in Newcastle, the surrounding Hunter and Central Coast Regions continue to firm.

Small to medium sized facilities are achieving yields ranging from 6.45 per cent for inner city showroom/warehouse facilities in prime locations to 8.52 per cent for larger industrial facilities with strong lease covenants.

Recent notable industrial sales indicate strong demand exists from high net worth investors and self managed funds.

The main attributes these investors are looking for include location, covenant strength, lease term/Weighted Average Lease Expiry (WALE), lease provisions and building age/capital expenditure requirements.

Recent transactions within the Newcastle region from Q1 2016 to Q3 2016 are listed in the table below.

The Newcastle Region industrial land market is showing signs of improvement reflected in increased enquiry level and demand for larger lot sizes.

Demand for industrial land during the second half of 2016 has steadily improved, primarily driven by owner occupiers looking at site specifics and value for money offerings; however access to labour is also a key driver in the Hunter market.

This has been evidenced with developments by Sandvik at Heatherbrae, WesTrac at Tomago and Bradken in the Steel River Estate at Mayfield West, Aurizon at Hexham and Aldi’s proposed NSW Distribution centre in Beresfield.

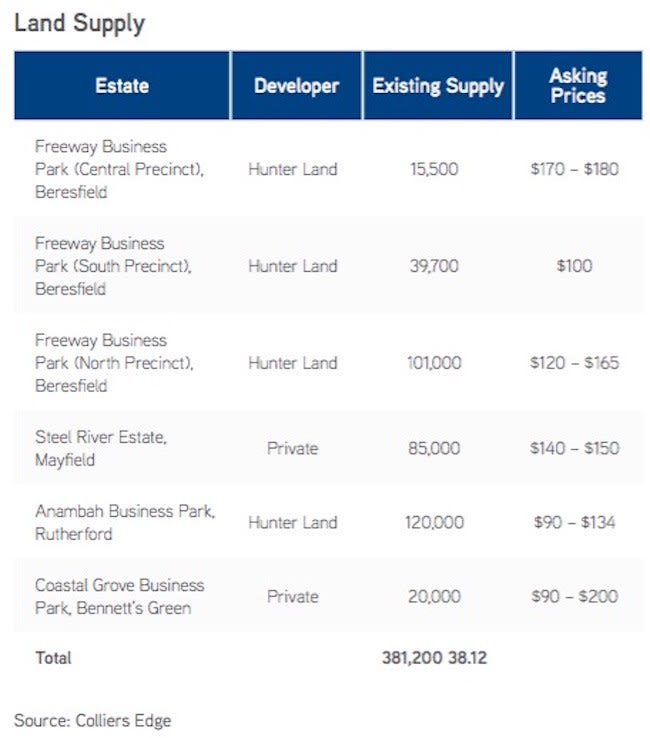

Serviced industrial land supply is limited to around four key industrial precincts including Beresfield, Rutherford, Steel River Estate in Mayfield and Cardiff. Supply and pricing as at June 2016 is as follows: