Many factors in play for sub-regional shopping centre success: Savills

In times of economic uncertainty retail property is largely regarded as a defensive investment due to the large percentage of non-discretionary spending supporting income streams, such as food.

Over the past 25 years, shopping centres have been increasingly acquired by institutional owners who could actively manage, develop and maintain these centres. The global financial crisis severely curtailed the purchasing power of institutions and allowed other buyers to enter the market.

A sub regional shopping centre is generally defined in the industry as a local shopping centre comprising at least one full line supermarket, a full line discount department store and around 40 or more specialty shops.

The total gross lettable area of retail floorspace will typically range between 10,000 and 30,000 square metres. The key features include convenience and an expanded range of food, fashion and services, located in residential areas servicing many immediate neighbourhoods. Trading hours will generally be extended and will cater for basic day-to-day retail needs.

Clearly, a number of important factors impact the performance of a sub regional shopping centre. The performance of the supermarket and discount department store has a very strong bearing on the returns of the centre. The supermarket and discount department store can be impacted by the range on offer, the price point, the ratio of car parking and opening hours. This, in turn, can impact the performance of the adjoining specialty stores.

The catchment area also impacts the performance of the centre. The road system, the points of access and competition are important factors. Critically, the size and age of the population as well as capacity for growth in population over the long term can have a material impact on centre performance. Increasingly, ethnic factors are playing a role as centres need to deal with strong levels of immigration.

Employment

The retail sector always faces cyclical and structural issues. Some cyclical issues are starting to move in its favour.

Employment is growing strongly in four or five sectors and shrinking in four or five sectors and the jobs gained and lost are not necessarily in the same physical place. This means certain catchment areas are doing it tough and some are doing well.

The size and shape of the workforce has a profound impact on retail property because wages determine spending and jobs de ne catchment areas. Australia is almost unique in the world as being one of very few countries that have expanded their workforce over the last decade. The size of the Australian workforce continues to grow and unemployment edges down.

This has occurred partly because wages growth has been insipid allowing more workers to be hired than may otherwise be the case. Asset price inflation has bolstered household wealth whilst household income growth has been subdued. Positive contributions to household spending capacity have come in the form of lower interest rates, lower petrol prices and greater comfort around job security. Nevertheless, growth in household disposable income remains below average.

The newly arrived population has a profound impact on property because they need somewhere to live and goods to put in their homes. Instant housing and bulky goods demand. Less people leaving the country means fewer houses freed up for those arriving.

With the size of the workforce growing and more people coming into the country (and less leaving), it is little wonder that a record level of housing construction is underway. A moderation in bank lending coupled with changes to taxation on foreign investors and stringent planning rules has seen a recent fall in dwelling building approvals. This leads us to believe we are at, or near, the peak in housing construction for this cycle.

Consumer spending

Changes in consumer spending patterns since 2007 appear to have had an adverse effect on department store, apparel and discretionary retailing turnover generally.

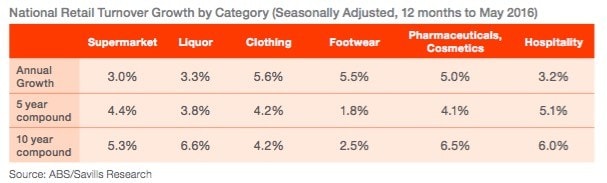

This has impacted tenants in regional and some sub regional shopping centres. Some sub regional shopping centres have been immune from this. The ABS turnover statistics in the accompanying table show strong growth over a long period in most of the retail categories found at a sub regional shopping centre. Supermarkets have been enjoying strong turnover growth as have their associated liquor stores.

Discount department stores dealing in electronics, household goods including furniture and discount clothing have also enjoyed strong turnover growth. Associated specialty stores such as a chemist, a take away food store, a bakery, a newsagent and other local service providers such as a dry cleaner may be found in the tenancy mix.

The structural issues facing retail are more formidable but not insurmountable. Savills expects the retail sector to evolve to take advantage of the structural issues rather than be over-run by them. The ageing of the population will continue to create challenges for retailers as they jockey for the dollars of retirees.

Retirees can be expected to prefer services over goods and will not necessarily continue to dwell in their traditional catchment areas. Internet retailing has already changed the face of retailing for certain categories of goods and will no doubt continue to evolve and challenge more categories over time. New business models are establishing themselves.

Sales activity

Savills recorded $1.9 billion of sub regional shopping centre transactions nationally in the 12 months to June 2016, commensurate with $1.9 billion in the previous year and up on the five-year average of $1.6 billion.

In the year to June 2016, 20 sub regional shopping centres were sold against 23 the previous year and is commensurate with the five year average of 20 sales per annum.

There are several factors at work in the capital markets which are having an impact on asset prices. First, there is an abundance of debt and equity available to purchase prime commercial assets on current metrics; second, the pricing of debt and equity domestically, and especially overseas, continues to fall; third, investment fundamentals are sound with no oversupply, little vacancy and good rental growth; and, finally, catchment area fundamentals remain appealing with strong population growth, low unemployment and stable to rising household incomes.

Institutions remained active in the investment market for the 12 months ended June 2016, purchasing 77% of all sub regional shopping centres sold. Foreign investors continue to pursue sub regional shopping centres purchasing 9% of sub regional shopping centres sold. Conditions for Australian institutions have continued to improve and so private investors are increasingly finding themselves unable to compete.

The average initial yield analysed from transactions of sub regional shopping centres in the year to June 2016 was 6.84% and compares to 7.47% the previous year. The average equated market yield analysed from transactions in the year to June 2016 was 6.97% and compares to 7.49% the previous year

. Prime neighbourhood yields at 6.75% in 2006, softening 100 basis points to 7.75% during the GFC and firming 200 basis points to 5.75% currently

. Prime sub regional yields were also at 6.75% in 2006, softening 50 basis points to 7.25% during the GFC and firming 150 basis points to 5.75% currently

. Prime regional (excluding super regional) yields were at 4.75% in 2006, softening 100 basis points to 5.75% during the GFC and firming 100 basis points to 4.75% currently

Given the falling costs of both debt and equity and the adopted “lower for longer” view of Savills Research we believe there is more yield compression to come.

Nationally, shopping centre investment yields have continued to firm as highlighted in the both the chart below and in the tables of recent transactions. Sub regional shopping centres continue to transact across a broad range of yields in line with the characteristics of the individual properties.

Sub regional shopping centre yields as at June 2016 currently range between 5.75% and 7.00%. Typically, yields have firmed from the trough in 2010 by 160 basis points for sub regional shopping centres.

Outlook

Australia has been enjoying strong population growth for over a decade and this policy of immigration retains bi-partisan support at Federal Government level.

The history of wealth (and real estate wealth in particular) is the history of immigration. Australia, and Australian capital cities in particular, is forecast to enjoy the fruits of strong immigration.

Retail property can be expected to be a beneficiary of strong population growth. Clearly, some catchment areas will do better than others and this will continue to present the greatest challenge and greatest opportunity for investors.

Catchment areas that can grow their populations through new land release or infill development or pro-active planning policies, should show dramatic increases in turnover especially if the ability to increase retail floorspace is limited. Conversely, those catchment areas that cannot grow their populations with limited available new land supply, draconian or archaic residential planning systems and the capacity for expanded retail competition should deliver below average increases in turnover.

Savills is of the view that interest rates will be “lower for longer” and, combined with a weight of investment capital, should continue to see assets keenly sought after and strong yields given prevailing catchment area fundamentals.