Investors re-entering the housing market but should do so with caution: Cameron Kusher

At the end of 2014, the Australian Prudential Regulation Authority (APRA) wrote to mortgage lenders reinforcing what they saw as sound mortgage lending practices.

The key points from that letter were that serviceability policy limits should be based on mortgage rates at least 2 percent above the product loan rate with a minimum floor assessment of 7 percent.

The second point was that APRA was going to impose a speed limit on investment credit growth to lenders of 10 percent per annum. It is important to note investment credit refers to total outstanding mortgages not new lending.

The impact of these policies was likely to be that as interest rates fell, more buyers weren’t encouraged into the market because mortgages were being granted based on the ability to repay a mortgage at 7 percent interest which was well above standard rates at that time. The other impact was that the 10% cap on investor housing credit growth would slow demand from the investment segment as there was less new lending to go around.

While the serviceability limits mean that new first time buyers are unlikely to come into the market as interest rates fall, it does nothing to discourage current owners from buying investment properties or upgrading homes. Given that the vast majority of home loans are on a variable rate, interest rate cuts have an almost immediate impact on household budgets.

While the serviceability limits won’t result in marginal purchasers entering the market, as interest rates have come down it appears that home owners that weren’t previously considering buying an investment property or upgrading have come out of the woodwork and decided to purchase.

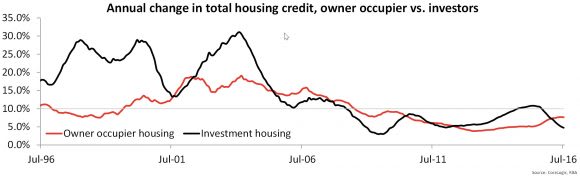

It is somewhat difficult to gauge exactly how effective the serviceability changes have been, but the 10% cap on investor housing credit led to a significant decline in growth in lending to that market segment. Shortly following the implementation of the investor lending cap we also saw lenders place an interest rate premium on investment mortgages. This muddied the waters somewhat because a lot of mortgages which were previously designated as investment mortgages were reclassified as owner occupier mortgages.

Nevertheless, annual investor housing credit growth peaked at 10.8 percent in May 2015 according to Reserve Bank data and the latest data shows that it has slowed to growth of 4.8% over the year to July 2016. Investor housing credit growth has slowed dramatically since its recent peak following these curbs and over the past year has increased at its slowest annual pace since November 2009.

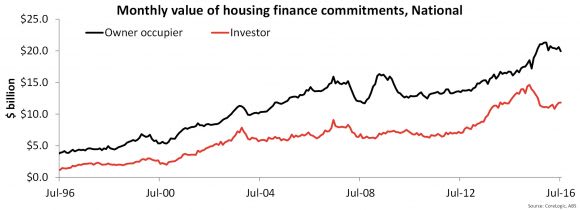

Housing finance data which tracks new lending, has showed a bounce in new lending to investors over the three months to July 2016. Over that period, the monthly value of investment lending has increased by 9.2 percent from $10.8 billion in April 2016 to $11.8 billion in July 2016, new lending to investors is at its highest level since August 2015. With investor housing credit growth well below 10 percent per annum, it is clear that lenders have scope to now offer more lending to the investment segment and clearly there are investors grabbing that opportunity.

But why is this the case when you have a record supply of new housing under construction, record low rental yields and a historically weak rental market? We are about to delve into some possible reasons why, for some investors, housing investment still makes sense however, investors looking to purchase residential properties should be aware of the potential risks on the horizon.

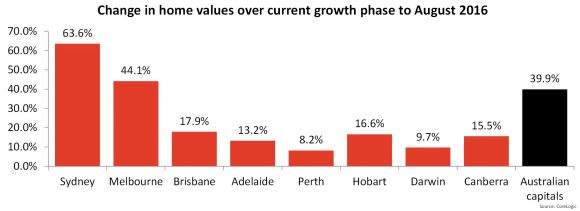

Capital growth

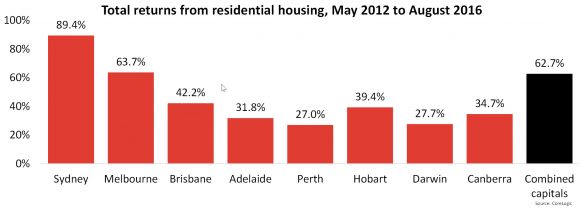

Since the current growth phase commenced in June 2012, combined capital city home values have increased by 39.9%. As the above chart shows, the growth has been very uneven with Sydney and Melbourne leading the way in terms of value growth and rises relatively moderate elsewhere. After such a long growth phase, the question must be asked as to how much longer the growth can continue for in Sydney and Melbourne, particularly considering the affordably obstacles that are becoming more pronounced and the diminishing yield profile caused by the fact that dwelling values are rising at a much faster pace than rents.

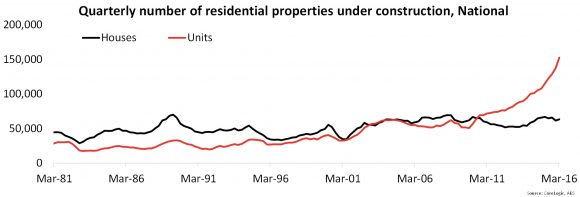

Housing supply

The supply of new housing under construction is at a record-high with an historic high level of units under construction. The 2011 national Census showed that units were much more likely to be occupied by renters than houses. At that time, and across homes occupied on Census night, 21.8 percent of houses and 57.8% of units were occupied by renters.

Of course housing choices are likely to have shifted somewhat since that time but the fact is likely to remain that units are much more likely to end up as rental accommodation than houses are. As a result a large proportion of these units recently built and under construction will end up as rental accommodation. In many cities we are also already seeing a significant difference in the rate of growth for houses as opposed to units.

Rental markets are showing the weakest growth conditions on record, in fact, capital city rental rates are -0.5 percent lower over the past year. In the two cities where the highest level of investment activity is occurring, Sydney and Melbourne, rents are unchanged in Sydney and 2.4 percent higher in Melbourne. For units specifically, rental rates are 0.7 percent higher over the year across the combined capital cities with rental rates 1.8 percent higher for Sydney units and 1.3 percent higher for Melbourne units.

There is a large supply of housing stock that is going to be added to the market over the coming year(s) in these cities and others. Most of the supply is in the form of units, which as shown are more likely to be rental properties. Subsequently it seems as if landlords are set to find it more difficult to keep renters and may have to reduce rents in order to keep their properties tenanted over the coming years. Higher vacancy rates may be felt by those landlords who own units that are in need of repair or refurbishment as tenants look for higher quality or new rental accommodation that may be more comfortable at a similar rental rate.

Rental returns

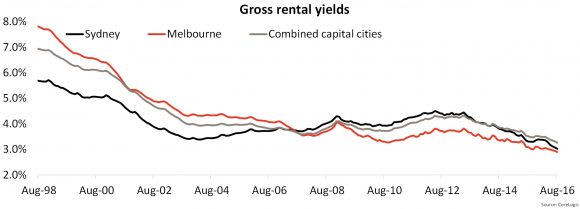

Rental yields are expressed as gross figures so the net returns are likely to be much lower than the headline figure. The gross rental yield has been forced lower over recent years due to little rental growth (and falls in some areas) coupled with comparatively high levels of home value growth. As a result, at the end of August 2016 the combined capital cities gross rental yield was recorded at an historic low 3.3 percent with figures of 3.0 percent in Sydney and 2.9 percent in Melbourne.

A couple of things to note about the yield figures; firstly they assume that a property is occupied for 100 percent of the year and secondly they are based off current values, most investors would not borrow 100 percent of the loan value for an investment property. Given these two points, lower than 100 percent occupancy would reduce the yield however, borrowing less than 100% of the property’s value would increase the yield.

As pointed out earlier, units are much more likely than houses to be used for rental accommodation and there is a record pipeline of unit stock under construction. Gross rental yields for units specifically are higher than those for houses and recorded at 4.1 percent for combined capital city units, 3.9 percent in Sydney and 4.0% in Melbourne. Each of these figures are at historic lows and have trended lower over recent years. Nevertheless, when you factor in a level of equity used to purchase investment properties the returns are still far superior to most other asset classes.

Total returns

Click to enlarge

When you factor in rental returns and capital growth, the total returns from residential property remain attractive. Over the past year, total gross returns across the combined capital cities have been recorded at 10.7% with each capital city other than Perth and Darwin recording total returns in excess of 7.0% over the past year. Since home values ended their most recent declines in May 2012, combined capital city total returns have been recorded at 62.7% and no capital city has recorded returns of less than 25% over the period

Other asset classes

A major reason why investors remain attracted to residential property is due to the fact that with low interest rates and low economic growth internationally, returns have reduced. Based on the most recent end of month data, 10 year Australian Government bonds were yielding 1.88 percent, 1 year term deposit rates were 2.65 percent and total returns from the ASX 200 were 9.3 percent. The safe investment classes of bonds and term deposits are providing extremely low returns. At the same time total returns from equities have been much stronger however, equities are a more volatile asset class than housing.

While the housing market has provided relatively strong investment returns over recent years and may continue to provide comparatively strong returns over the coming years, there are certainly some headwinds that investors need to be aware of. Keep in mind too that the purchase cost of a residential property is significantly greater than investing in other asset classes. The additions to housing supply underway and the weakening rental market should provide a level of caution for investors.

Given the cost of housing and the looming challenges we would expect that although there is likely to be some further uplift in investment demand it is unlikely to result in growth in investor credit to head back towards the 10%pa speed limit. Investors will also need to be much more selective around which properties they choose given achieving strong returns are seemingly going to be more difficult to achieve over the coming years given the looming headwinds described within.

Cameron Kusher is research analyst for CoreLogic. You can contact him here.