Office markets on the eastern seaboard heat up on investment inflows

Increasing capital flows into Australia's major office markets in 2016 has resulted in competition for quality assets heating up, with property experts predicting continued yield compression and rising sales volumes in the second half of the year.

Competition for prime metropolitan office investments in the eastern seaboard markets of Sydney, Melbourne and Brisbane is rising among large offshore investors, according to Colliers International research.

The biggest jump in metropolitan office investment volumes to date in 2016 has been recorded in New South Wales, with $2.3 billion of sales recorded in Sydney’s metropolitan market year-to-date compared to $1.8 billion in the Sydney CBD.

“Whilst there is still healthy investor appetite for CBD assets with four months to run in the calendar year, the narrowing gap between CBD and metro investor volumes points to increasing attention being paid to non-CBD office assets,” said John Marasco, Colliers International managing director of Capital Markets & Investment Services.

“Analysis of sales volumes in Sydney, Melbourne and Brisbane, when comparing metro office to CBD office markets, sees investment levels weighted towards CBD markets. However, as CBD office yields have compressed sharply, capital has begun to shift to metropolitan office investment in 2016.

“The focus and competition for prime office grades is moving into the metro markets. The recent tussle for control of GPT’s metropolitan office fund, which contained seven A Grade fully leased assets, is a sign of the sentiment to come for securely leased, high quality metropolitan assets, which is likely to lead to a further sharpening of yields.”

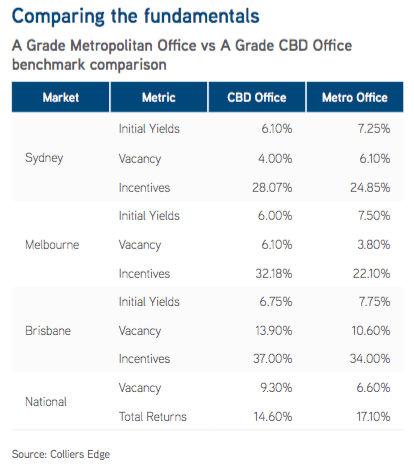

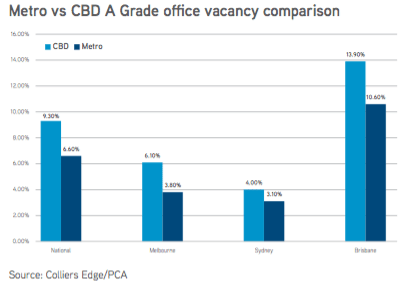

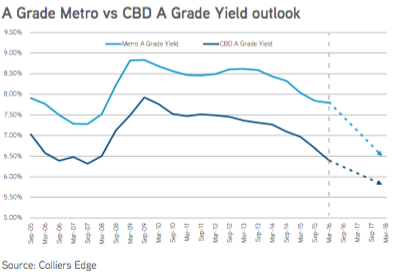

Luke Dixon, Colliers International director of Research, said the combination of lower vacancy, falling supply and higher total returns would typically correspond with a similar fall in initial yields and tight pricing. However, in the case of A Grade metropolitan office, yields had remained firmly higher relative to their CBD counterparts and compressed at a slower rate over the past three years.

“CBD A Grade yields have compressed by over 120 basis points across the east coast, whereas east coast metropolitan A Grade yields only compressed by 60 basis points,” he said.

“A significant factor in the strong performance of A Grade CBD yields has been the volume of domestic and offshore capital pursuing opportunities.

“Enquiry volumes for investment sales of CBD assets, is almost double that seen in metropolitan sales campaigns. This weight of capital can in part can be explained by the volume of stock available between the two markets.

“A Grade office in the Sydney, Melbourne and Brisbane accounts for a total of 11.7 million square meters versus 6 million square meters in their metropolitan counterparts, reducing the available pool of assets for investors.

“CBD ownership is highly concentrated amongst institutional owners, with over 50% of Premium and A Grade CBD stock owned by longer term investors such as super funds, REITs and wholesale funds. Metropolitan markets are more diverse in their ownership, with higher numbers of private investors who may be more motivated to sell as investor demand for high quality metropolitan office assets increases”.

“However, the sharp compression of CBD office yields has seen capital begin to shift to metropolitan office in 2016.”

A comparison of offshore and domestic transactions in these key metropolitan office markets points to momentum tipping back towards offshore investors in 2016. Significant metropolitan transactions year to date have been led by offshore investors such as Deutsche Bank, Ascendas and Blackrock.

“Total investment volumes are still heavily skewed towards domestic investors, with local knowledge and teams on the ground giving them a strategic edge on offshore competitors,” Marasco said. “However, with the increasing maturity of Asia Pacific and European investors in the Australian market we anticipate rising levels of offshore interest in the medium term.”

“Yield spreads will prove too attractive, and metropolitan spreads relative to CBD spreads will narrow under the weight of increasing investment.

“Based on the rising volume of investment sales in metropolitan office markets, and strong fundamentals supporting rental growth and valuation uplift, we anticipate strong investor activity in the metropolitan office market resulting in capital rates across these markets compressing sharply over the next 12 to 18 months.”

Competitive acquisition conditions in major eastern seaboard markets are already being seen. The recent tussle for control of GPT’s metropolitan office fund, which contained seven A Grade fully leased assets, is a sign of the sentiment to come for securely leased, high quality metropolitan assets.

According to Colliers International’s new H2 2016 Metro Office Research & Forecast Report, rental growth has been seen in most major metropolitan office markets this year, with demand for space generally improving, resulting in decreased vacancy.

The report found residential conversion remained a key issue in most markets, in particular those markets which were not protected with a commercial zonings.

Residential conversion-driven withdrawal is shrinking the pool of available metropolitan assets,” Dixon said.