New lending to investors and interest-only lending jumps over June quarter

The Australian Prudential Regulation Authority (APRA) released its June 2016 quarter property exposures data earlier this week.

The data looks at exposure to the property market by Australian Authorised Deposit-taking Institutions (ADI). It’s valuable because it provides deeper insight into lending from mortgage lenders which isn’t available from the Australian Bureau of Statistics (ABS) monthly housing finance data.

At the end of the June 2016 quarter, across all Australian ADI’s, there was $1.437 billion in outstanding residential mortgages to households.

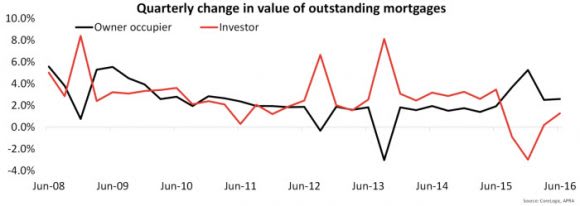

The value of outstanding mortgages has increased by 8.1 percent year-on-year, which is the slowest year-on-year growth rate since the June 2014 quarter.

Outstanding mortgages include $930.4 billion outstanding to owner occupiers and $506.3 billion outstanding to investors.

The value of owner occupier mortgages has increased by 14.8 percent year-on-year, its largest rise since March 2010.

The value of investor mortgages outstanding has fallen by -2.4 percent year-on-year, its greatest decline on record.

To put the investor lending slowdown into perspective, 12 months ago investor mortgage credit had increased by 12.7 percent.

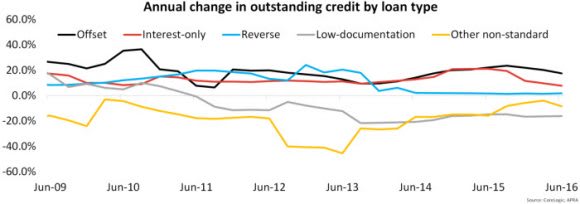

Taking a look at potentially higher risk forms of lending, in June 2016 there was $557.0 billion in outstanding mortgage credit for interest-only mortgages, $2.753 billion for reverse mortgages, $24.7 billion for low-documentation mortgages and $1.0 billion in other non-standard mortgages.

Almost two-fifths of the value of outstanding mortgages (39.3 percent) is for interest-only mortgages.

Year-on-year there have been increases in the value of mortgage credit for interest-only (+7.7 percent) and reverse mortgages (+1.8 percent) while credit for low-documentation (-16.2 percent) and other non-standard loans (-8.5 percent) has fallen.

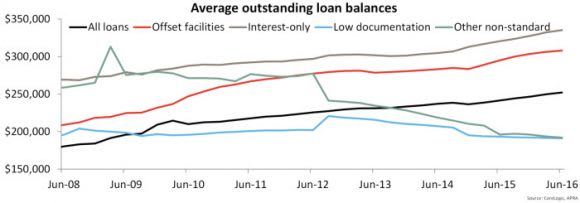

The average outstanding mortgage balance was $252,100 which was 4.5 percent higher over the year to June 2016.

Across the different mortgage types the average outstanding balances were recorded at: $308,000 for loans with an offset, $335,200 for interest-only loans, $97,400 for reverse mortgages, $191,000 for low-documentation loans and $191,900 for other non-standard loans.

The average balances have increased over the year for loans with an offset (+4.4 percent), interest-only mortgages (+4.6 percent) and reverse mortgages (+2.7 percent) and fallen for low-documentation loans (-1.2 percent) and other non-standard loans (-2.2 percent).

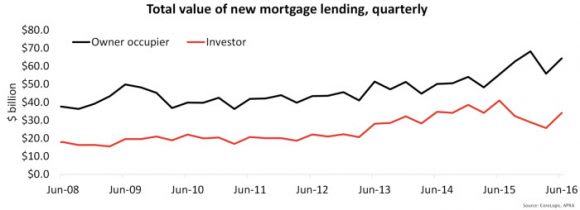

Looking at new lending over the June 2016 quarter, there was $98.4 billion in new mortgage lending, $64.4 billion of which was for owner occupiers and $34.0 billion for investors. It was a record quarter with the value of lending 20.7 percent higher over the quarter and 2.1 percent higher year-on-year.

Over the quarter the value of lending to owner occupiers rose by 15.2 percent while investor lending jumped 32.5% to its highest level since June 2015.

Year-on-year owner occupier lending is 16.2 percent higher while investor lending is -16.9 percent lower. While investment lending has certainly increased of late, it is difficult to know exactly how much is being driven by more volume and how much is being driven by borrowers taking out larger mortgages.

No data was available this quarter on new low-documentation lending however, there was $35.6 billion in interest-only lending, $136 million in other non-standard loans, $47.4 billion in loans from a third part source $3.5 billion worth of loans approved outside of serviceability. Although new interest-only lending is -19.1 percent lower year-on-year, it increased by 25.1% over the quarter which is in line with the significant jump in new lending to investors.

It was also the largest quarter since June 2015 for other non-standard loans. The $3.5 billion of loans approved outside of serviceability was the lowest since the March 2015 quarter.

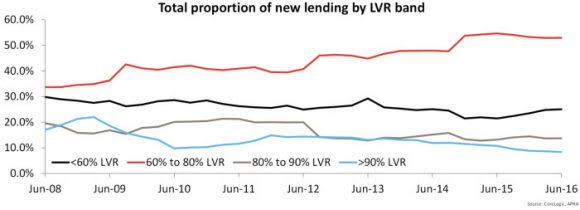

Looking at the loan-to-value ratios (LVR) on new mortgages over the quarter it is clear that lenders and or borrowers are becoming more conservative and using larger deposits. Over the quarter, a record-high 78.0 percent of mortgages had an LVR of less than 80% (meaning the borrower had a deposit of at least 20 percent).

Over the quarter the value of lending increased across each of the LVR bands shown however, year-on-year the value of lending for LVRs of less than 60 percent is up 19.2 percent, for LVRs between 60 percent and 80 percent it is -1.1 percent lower, for LVRs between 80 percent and 90 percent it is 6.1 percent higher and for LVRs above 90 percent it is -20.7 percent lower. Encouragingly, just 8.3 percent of all new mortgages had an LVR of more than 90 percent which is a record-low.

Overall the data shows that there has been a rebound in new lending to investors and a commensurate increase in interest-only lending over the past quarter. After annual investor housing credit growth has slumped to well below APRA’s 10%pa speed limit it is clear that some lenders have scope to dial-up their lending to investors. It also shows that despite historically weak rental markets and record low rental yields that there remains demand from the investment segment of the market.

While investment lending has lifted over the past quarter, the data is showing there is a more conservative approach to high LVR lending. The ongoing declines in lending with an LVR above 90 percent is encouraging because it should lead to reduced risk.

Over the coming quarters we’ll be closely watching how much higher investment lending lifts.

Keep in mind that despite record low yields, the returns are still superior to putting money in a term deposit, especially once you factor in the recent capital growth as well. Interest-only lending trends will also be important to watch with APRA already having raised concerns about that particular type of lending.

Cameron Kusher is research analyst for CoreLogic. You can contact him here.