Bumpy ride buying new apartments in Melbourne, Brisbane and Sydney: Edwin Almeida

Considering and discussing, the purchase of an investment property opens up all sorts of arguments, discussions and from time to time, polarizes the parties involved.

This is not to mention also spoiling a friendly neighborhood BBQ or coffee catch-up with a friend.

One of the many and current topics of discussion is whether we should buy new and off-the-plan apartments in one of the main three capital cities of Australia; namely Brisbane, Melbourne or Sydney?

I have taught and have written about off-the-plan purchases. The following reason for buying can be used as a blanket approach when considering a new apartment purchase. Notwithstanding, this strategy may be considered across any city or development, as a matter of course.

The main beneficial reason why an investor would buy a new apartment, before completion, was simple to understand in previous years. Developers needed pre-sales to support their construction application for the banks.

Pre-sales which are now predominantly called off-the-plan sales, had one major attraction in the past, which now appears to be lost. As an off-the-plan purchaser, there was a benefit; we bought early and saved from 5 and up to 10 percent the value “at the time” off the purchase price. This was measured against prices of similar completed apartments, on the day.

The current trend and market for off-the-plan purchases.

The current trend however, has bucked the reasoning behind the support given to developers with pre-sales.

On the one hand, developers have become greedy and with the support of the financial sector, have increased the asking price.

In other words, we now pay tomorrow’s market value for the apartment and with no added discount as a benefit. The underlying question is “but why?” This is all because of the highly speculative new client base: the overseas investors that have come in and in large numbers. As well as the Self-Managed Super Fund (SMSF) vehicles, set up for local speculators and investors.

Both overseas and SMSF investors are fueling the new-apartment development bubble as has never been seen before. With this in mind, developers and marketing companies have been able to increase:

- The end property values to account for market forces that has seen a huge upswing in prices; and

- To pay for the high commissions paid out to marketing agents and the financial sector. Commissions in the tune of 8-10 percent.

The repercussion of industry greed

The outcome of the high prices charged for new-apartments and higher commissions than the industry norm is a no-brainer; the losers are the buyers, most of the time.

For years, I have been discussing the need for the Real Estate Industry and watchdogs to tighten controls against this push, but my calls have fallen on deaf ears and the outcome is:

1) We now have an understated over-supply of apartments across Brisbane, Melbourne and Sydney;

2) The rental market cannot and will not effectively absorb the new supply, which will have an increase in rental vacancies; and

3) The inevitable, valuers will value down apartments to safeguard their client’s interest, the banks.

We may well see drops of 20-30 percent in values and in the near future. Likewise, rental yields will diminish to 60-70 percent off what they are today.

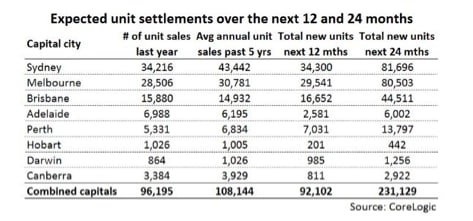

Supply chart of apartments to be completed in the next 12-24 moths

Where to from here?

I have been asked by friends, clients and family; where to from here? I have shared the following with them for over 12 months and only now the mainstream are coming to the party.

1) Hold and wait; wait for another 6-12 months before looking to buy, if you need to buy new.

2) Most of the new apartments are under-engineered, badly built and come with a lot of issues.

3) Have you noticed that most spruikers try and only sell you, new and off-the-plan apartments? and

4) Communicate as much as possible with local real estate agents that don’t have invested interest in the new development. After all, they may be the ones that will manage the property for you.

The caption below is an article recently posted by a colleague of mine. It is a timely argument of what is to come. This is all due to the huge oversupply of high-rise development. When we match this information with the number of apartments currently under construction; it appears to be the makings of a nightmare for investors in high-rise developments.

The full article may be found on: https://mortgageeproperty.com/foreign-investor-settlement-risk-soaring.html

Tips in managing your investment

If you do find yourself in a position that you have bought an off-the-plan apartment and your property is in the final stages of settlement; I recommend the following tip, to minimize long term vacancy.

Don’t rely on the selling agent’s “marketing company” to lease your apartment, particularly if they were the leading agency in the sales phase. You only have to ask; how many other investor’s apartments are they also trying to lease out?

Now if you are looking to invest in new apartments, our old and proven theory remains steadfast. Invest in low set building blocks and preferably one’s that have no more than three levels.

More importantly, be sure to and look out for the next article on: buying in low set building blocks, versus high rise apartment blocks; winners and losers.

EDWIN ALMEIDA is licensee in charge of Just Think Real Estate.

He is also the creator of Oz Real Estate.TV and a presenter for propertyinvestingvault.com.