Public transport initiatives lift Australia's investment project pipeline

GUEST OBSERVER

The Deloitte Access Economics “Investment Monitor” provides a detailed snapshot of Australia’s investment project pipeline. The database contains details on 1,073 projects valued at $20mn or more, as at June 2016. Here we provide an update of the key results.

Note, the full value of a project is included in the investment pipeline until the project is either completed or deleted. This differs from official estimates of the existing “work pipeline”, which is the value of work yet to be done on a project currently under construction.

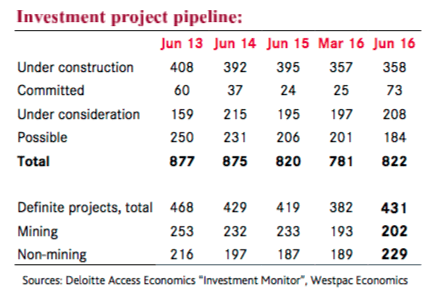

The Investment Monitor estimates the total project pipeline to be $822bn at present. That is a $42bn increase on March, reversing declines over the second half of 2015, to be $2bn higher than a year ago.

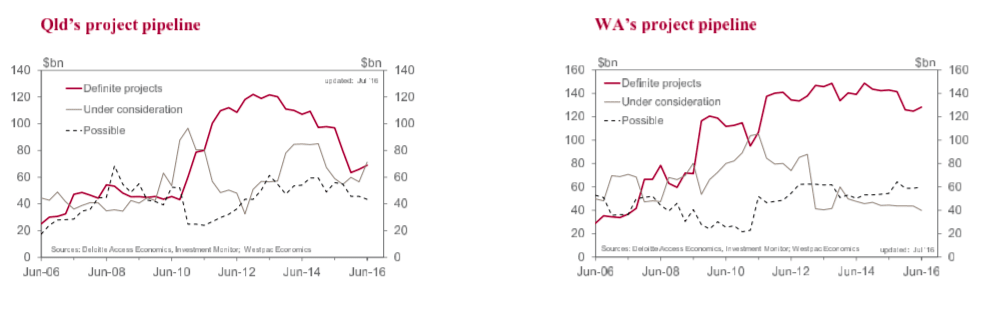

Significantly, the value of definite projects (those either under construction or committed) rose by $49bn to $431bn, to be $11bn above a year ago but $37bn below the peak of three years earlier.

Potential projects (either under consideration or possible) are valued at $391bn, some $10bn lower than a year ago.

As we have highlighted previously, the project flow is changing course on a stream of new public transport initiatives. That was the clear theme in the latest update.

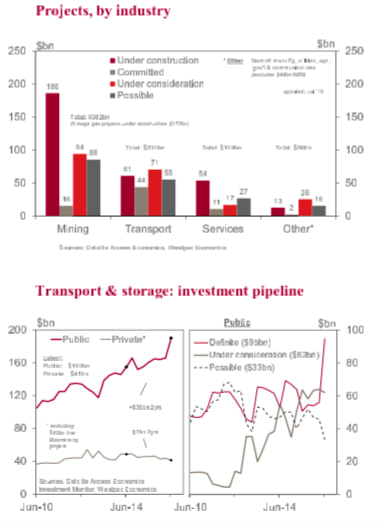

In June, $39bn of the $49bn increase in total definite projects was explained by public transport initiatives. Following the round of annual state budgets, there are now 29 public transport projects at the committed stage, with a combined value of $44bn, up from 19 with a value of $5bn in March. The transport & storage investment pipeline in total is $231bn, dominated by the public sector, $190bn.

The oil and gas sector accounted for the remaining $10bn increase in definite projects in June, most of which was a $7.6bn cost blow-out on the Inpex Ichthys gas field project to $45bn. Phase 2 of the Greater Western Flank project in the Pilbra WA, valued at $2bn, entered the database in June, at the committed stage, with a 2016 H2 start date.

The mining project pipeline, totalling $382bn, of which $202nd is at the definite stage, will thin considerably when the 5 remaining mega gas projects, with a combined value of $172bn, are completed over 2016 and 2017, with potential slippage into 2018.

The non-mining investment pipeline (excluding transport and ex the $44bn NBN), is $165bn, unchanged over the past two years. Of that, $80bn are definite projects, up $2.4bn on mid-2015. Notably, the investment pipeline of accommodation projects, with the low AUD boosting tourism, is valued at $23bn and while that is unchanged on a year ago there has been some transition to the definite stage, up $3bn over the year to be $5.6bn.

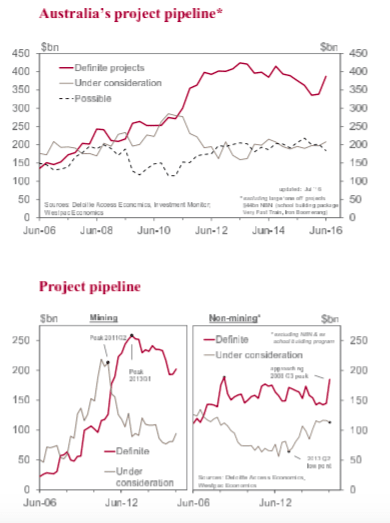

Mining projects

The mining sector project pipeline is valued at $382bn currently, a $22bn partial rebound on March but still $22bn lower than a year earlier and well below the $478bn peak at end 2012. (Note, mining-related projects can be included in other sectors, e.g. transport & storage.)

The 5 mega gas projects under construction are together worth $172bn. By LNG projects: Gorgon, $61bn, which moved to the start-up phase in the first half of 2016, is to be fully completed by late 2016; Origin’s Australia Pacific LNG $25bn project, Qld, second production train is expected to start production in Q4 2016; Wheatstone, $29bn LNG project in the Pilbara WA, start- up has been delayed to mid-2017; Prelude, $12bn floating LNG platform, Kimberley WA, 2017 start-up potentially delayed to 2018; and Ichthys $45bn project, NT, second half of 2017.

As to oil and gas projects currently under construction, while the combined full project value is $179bn, the pipeline of work outstanding is $35bn, as estimated by the ABS (for March).

Excluding the 5 mega gas projects, the mining project pipeline is: $210bn in total, of which $30bn is definite, $94bn is under consideration and $86bn is possible. The commodity price slump over recent years raises doubts as to how many of these potential projects will proceed near-term.

Transport & storage, public projects

Transport projects in the public sector was a key mover in the June quarter, following the recent round of annual state budgets. Notably, the state government’s have found the capacity to lift public investment, a much needed development.

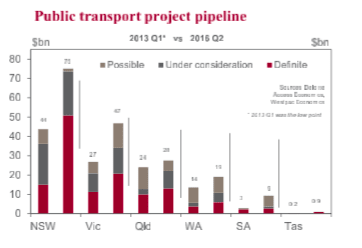

Transport & storage projects in total are valued at $231bn in June, dominated by the public sector, at $190bn. Looking back over recent years, the public transport investment pipeline initially rebounded in 2013; moved higher in 2014; marked time in 2015; and jumped in June 2016, up $24bn on three months ago. By stage, the public transport pipeline is: $51bn under construction (unchanged from 3 months ago); $44bn committed (+$39bn); $62bn under consideration (–$2bn); and $33bn possible (–$12.5bn).

Relative to a year ago, the definite projects pipeline is up $44bn, with gains by state of: NSW, +$17bn to $51bn; Victoria, +$15bn to $21bn; Qld, +$7bn to $13bn; WA, +$2bn to $6bn; and SA, +$2.5bn to $2.7bn. Of note, advancing to the definite stage were: in NSW: Sydney Metro stage 2, $12bn; Pacific Highway upgrade Woolgoolga to Ballina, $4.4bn; in Victoria: CityLink upgrade, $1.3bn; Melbourne Metro, $11bn; Dandenong Rail Corridor, $1.6bn; in Qld: new generation rollingstock & WULKURAKA maintenance centre, $4.4bn; Toowoomba second range crossing, $1.6bn; in WA: Forrestfield Airport Rail Link, $2bn; NorthLink WA, $1.1bn; and in SA: five road projects, with a combined value of $2.5bn.

Public transport projects under consideration are: in NSW, $23bn, including a second tunnel under Sydney harbour, $10.4bn + $4.5bn; Western Sydney light rail, $2.9bn; and Western Sydney airport, $2.5bn; in Victoria, $13bn, including $5.5bn North-Esat (missing) link; and $5.5bn, Western Distributor; in Qld, $9bn, incl’ Brisbane underground train/bus terminal, $5bn; in WA, $5bn, including Perth Freight Link, $1.9bn and Perth light rail, $1.9bn; and there is also the $10bn Melbourne to Brisbane inland rail link.

Andrew Hanlan is senior economist for Westpac and can be contacted here.