Sydney office rents surge ahead in Q2 2016: Cushman and Wakefield

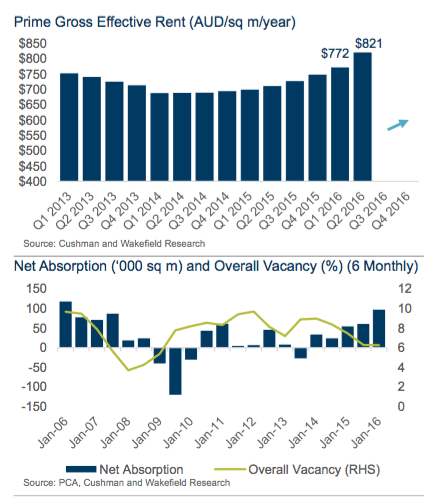

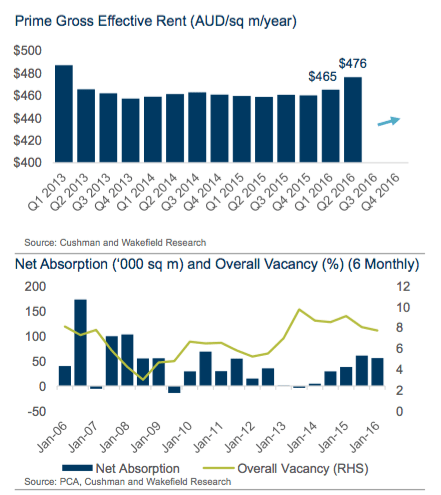

Landlord-favourable markets have allowed Sydney and Melbourne CBD office markets to record their strongest rental growth in over five years, according to real estate services firm Cushman and Wakefield's latest report.

Their MarketBeat report series for Brisbane, Melbourne and Sydney CBD office markets reveals that growth in service sector employment is driving strong demand in Sydney and Melbourne, but Brisbane is yet to feel the effects.

Above average economic growth in New South Wales of 3.5% over the past year, compared to trend of 3.1%, has continued to fuel demand for office space. Vacancy has remained tight despite an injection of new supply to Sydney CBD in the first half of 2016, including international Tower 3 and 200 George Street.

“Enquiry levels have been very high in Sydney. When combined with limited vacant space has resulted in gross effective rents rising over 6% this quarter. This is the strongest quarterly gain we have seen in Sydney since 2008,” said Tim Molchanoff, head of Office Leasing.

While CBD office rental growth has been stronger in Sydney, Melbourne's CBD is also experiencing rising demand with no new stock added in Q2 and vacancy below the long-run average. The landlord favourable market has resulted in prime net rents rising 3.3% in Q2, the strongest quarterly rise since 2011.

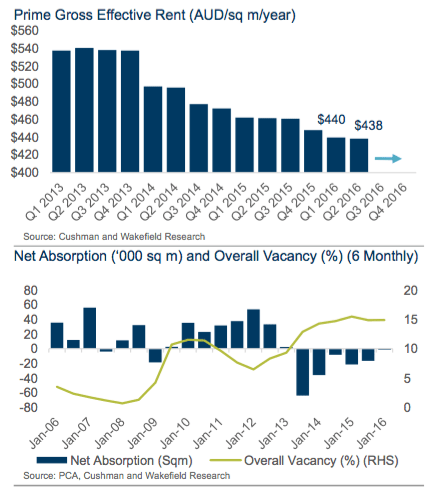

In contrast, rents in Brisbane eased further over the quarter. The market is set to experience double the long-term average new supply in 2016, with over 133,000 sqm expected over the year. While this new supply will keep direct vacancy at near record levels, much of the impact has now been priced into prime market rents.

“We estimate that the market is now at, or near, the bottom of the cycle. Although there are green shoots of recovery such as ongoing employment growth in the finance sector, it will likely take some time for a significant tranche of this current vacancy to be absorbed," said Dr Dominic Brown, head of Australia & New Zealand Research.