Investors, owner occupiers making things tough for first home buyers: CoreLogic RP Data's Cameron Kusher

While home value rises have been moderate over recent years outside of Sydney and Melbourne, it provides little comfort for first home buyers in the two largest cities who struggle to compete with those that already own homes.

In 2008, combined capital city home values fell by -6.1 percent in the space of 9 months. By the end of the year, home values had reached and began to climb thereafter.

The drivers of this growth was largely two forms of stimulus: aggressive interest rate cuts and a boost to the First Home Owners Grant (FHOG). Since the boost to the FHOG was removed and many of the existing grants were removed or scaled back, first home buyers have continued to languish at near record low levels. The harsh reality is that first home buyers are struggling to compete with those who already own a home or who are investing.

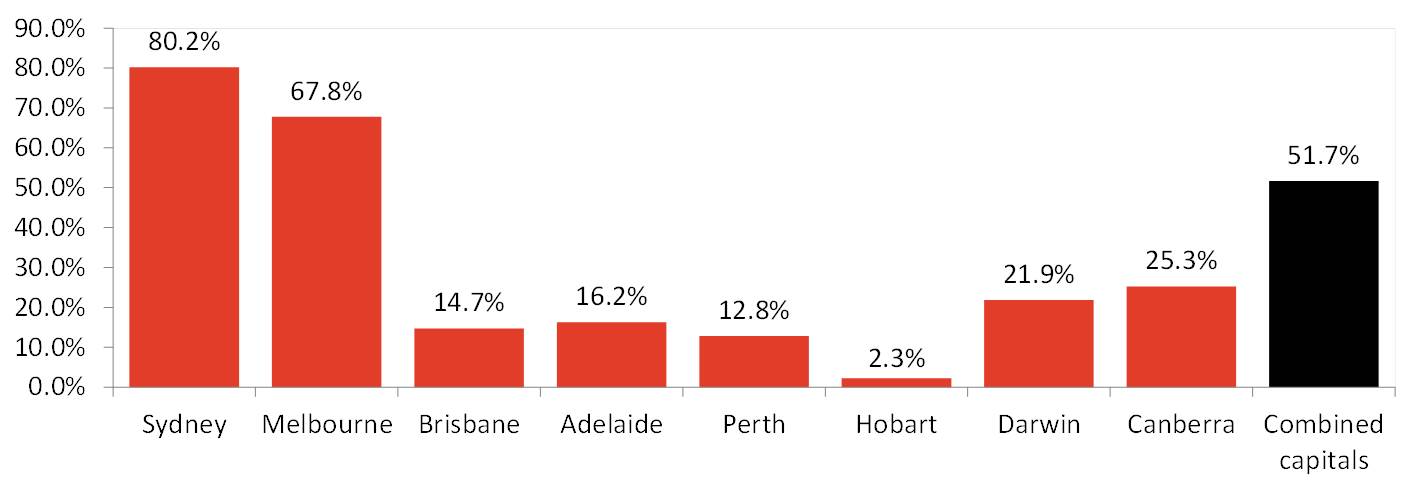

The first chart highlights the increase in home values across each capital city from December 2008 to April 2016. Another way to think about this is that if in December 2008 you owned a home worth $500,000 it is now worth $758,418 which is $258,418 more than in December 2008. Looking at this same calculation across each capital city, the increases in value over that time based on a $500,000 home owned in December 2008 are: Sydney ($400,825), Melbourne ($338,866), Brisbane ($73,417), Adelaide ($81,029), Perth ($64,096), Hobart ($11,263), Darwin ($109,293) and Canberra ($126,262).

Cumulative change in home values

December 2008 to April 2016

While the value of a home owner’s property has undergone massive rises, the increase in inflation and wages has been comparatively more sedate.

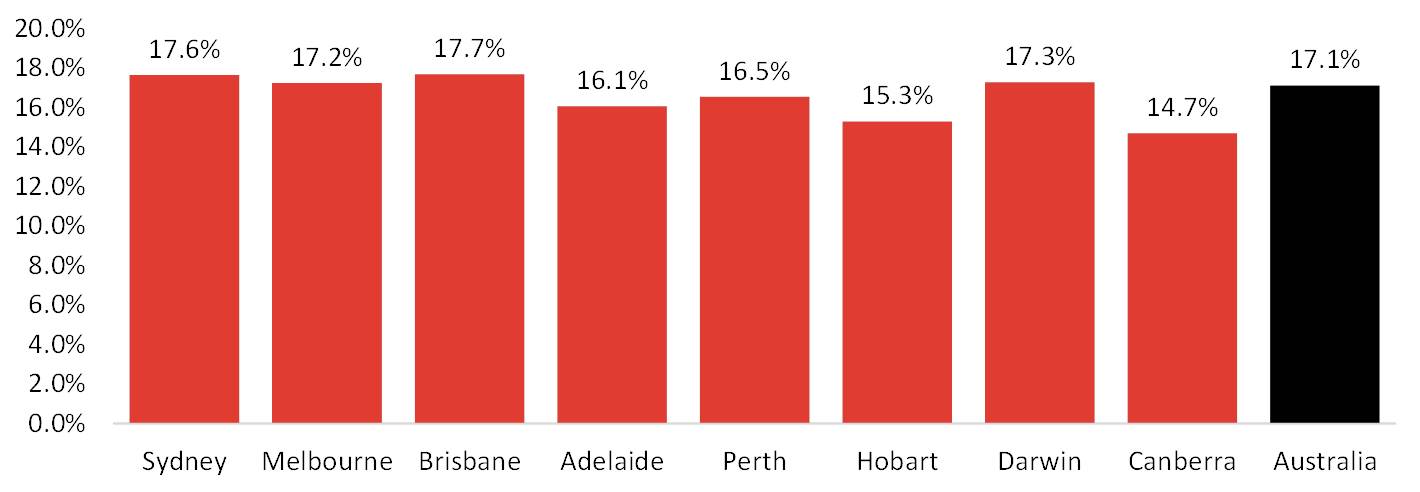

Cumulative change in CPI (inflation)

December 2008 to March 2016

Although combined capital city home values have increased by 51.7 percent between December 2008 and April 2016, inflation has increased by a significantly lower 17.1 percent over the period. CPI has increased by a greater amount than values in Brisbane, Adelaide, Perth and Hobart indicating ‘real’ home values have fallen. Meanwhile in Sydney, Melbourne, Darwin and Canberra CPI growth has lagged that of home value growth.

Looking at wages growth between December 2008 and March 2016, it shows that nationally and in New South Wales, Victoria and the ACT it has lagged value growth across the capital cities. It should be noted that wages are now growing at the slowest pace in at least 18 years and that the increases highlighted do include strong wage increases in the latter part of the mining boom. Nonetheless, the data highlights that in NSW and Vic wages are increasing at a much slower pace than home values in Sydney and Melbourne are.

Cumulative change in Wage Price Index

December 2008 to March 2016

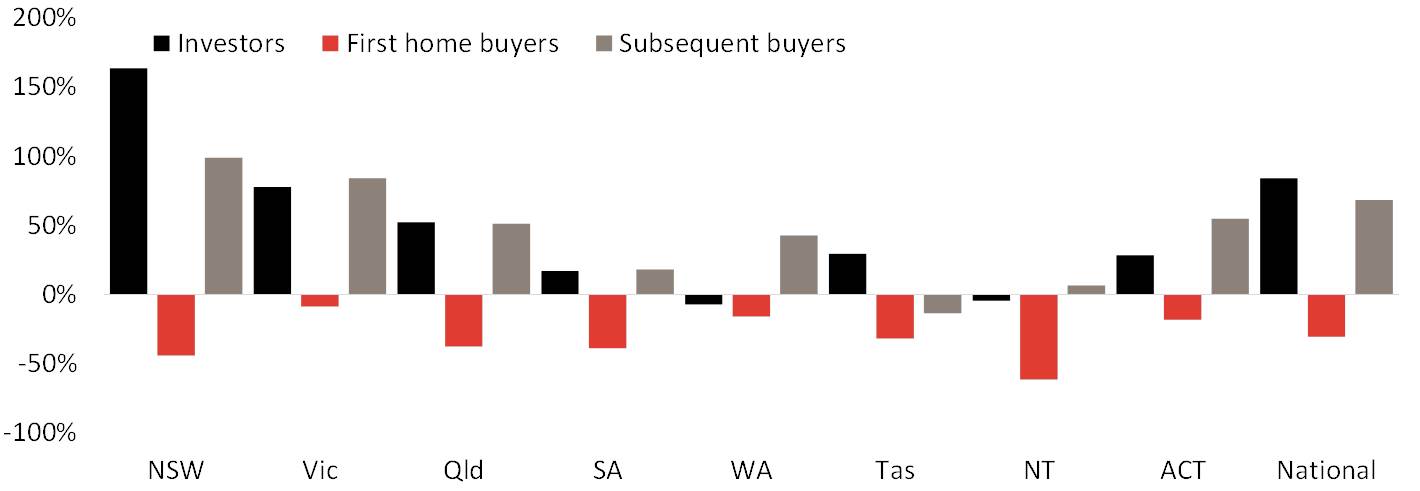

The final chart shows the change in the value of new lending (excluding refinances) to investors, owner occupier first home buyers and subsequent buyers between December 2008 and March 2016. The chart highlights how the value of lending to owner occupier first home buyers is now lower than it was in December 2008 across each state and territory. This has occurred despite the increase in home values over the timeframe. While lending to owner occupier first home buyers has fallen, lending to investors and subsequent buyers has increased in most states and territories with substantial rises in NSW and Vic.

Change in the value of new lending to investors, FHB and subsequent buyers

December 2008 vs. March 2016

While outside of Sydney and Melbourne home values have increased below or at a similar pace to inflation and wages, it is a very different story in the two largest capital cities. Existing owners of homes in Sydney and Melbourne have seen a significant increase in the ‘real’ value of their home. Subsequently those that do not yet own struggle to compete with investors and upgraders that have been so active in the market and already have significant equity.

The simple answer to this problem is that first home buyers in Sydney and Melbourne should look to buy properties outside of these cities however, that may be a little simplistic. Job creation has not been as strong outside of Sydney and Melbourne and for many moving interstate, employment opportunities are generally a big decision. Even buying outside of Sydney in nearby regional cities may not be attractive because transport infrastructure does not provide quick and efficient access to Sydney and Melbourne from nearby regional cities.

We certainly don’t advocate for the return of grants for first home buyers as they have tended to just push up the cost of housing. Prospective first home buyers are facing some tough choices as they compete with other segments of the market who may have larger budgets or a great deal of equity behind them thanks to a history of strong capital gains. Remaining (or joining) the rental market is one option that many may choose, considering weekly rents are down 0.2 percent across the combined capitals.

Those choosing to rent may decide to make their first home purchase an investment property in a location that is more affordable and better suits their budget. For those first home buyers looking to buy their first home to live in, their options will often be limited to the city outskirts if they are to purchase a detached dwelling, or compromising on space to live closer to where they work and play by choosing a higher density option.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.