Melbourne, Sydney driving industrial market: Savills

Manufacturing in Melbourne, and pharmaceuticals and logistics in Sydney, are driving strong industrial markets with the demand for land in both cities pushing up values and triggering rental growth in Sydney, while pre-commitments are strong in Melbourne, according to the latest industrial leasing data from Savills Australia.

Savills’ industrial leasing summaries reveal a tale of two economies with states beset by the end of the mining investment boom continuing to struggle while Melbourne and to a lesser extent, Sydney, forge ahead.

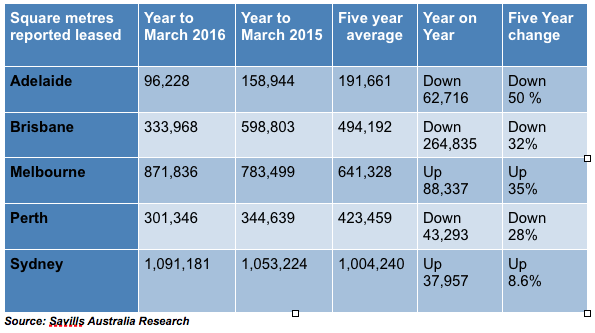

In the last 12 months to March, 2,694,559 square metres of industrial space was leased across Adelaide, Brisbane, Melbourne, Perth and Sydney markets, slightly below the five-year average, according to Savills’ national head of research, Tony Crabb.

Melbourne and Sydney together accounted for 1.96 million square metres of the total – a rise of nearly 20 per cent on the five-year average - while Adelaide, Brisbane and Perth were down more than 34 per cent from 1,109,312 to just 731,542 square metres leased.

Melbourne has been the bolter with leasing up nearly 90,000 square metres on the previous 12 months and more than 230,000 square metres, or 36 per cent, on the five-year average, while Brisbane is nearly 33 per cent down on the long-term average

Crabb said the data unequivocally illustrated the variance in economic fortunes the mainland states had experienced since the end of the mining investment boom.

"This is just what the doctor ordered. The end of the mining investment boom meant the national economy had to look to other sectors to drive growth and that is clearly what is happening.

"The lower Australian dollar has played no small part in the resurgence of the manufacturing sector, especially in Victoria, Australia’s manufacturing heartland, and that has been the key to a much more lively industrial market, while the drop in the oil price has been a timely boost for the transport & logistics sector,’’ Crabb said.

The lower dollar has increased export competitiveness with some companies reportedly considering returning manufacturing operations to Australia and others putting on staff to handle increased export orders, according to the Australian Industry Group.

In Victoria, the automotive industry suppliers have not totally shut down as was feared, due to the impending closure of car manufacturing, with a significant number of supply-chain manufacturers diversifying and restructuring, state government data shows.

The AIG’s Australian Performance of Manufacturing Index jumped by 2 points to 53.5 points in February, its highest level since July 2010, which, according to AIG, indicated a stronger rate of expansion. The rise was the eighth consecutive monthly rise above 50 points (net expansion) and the longest continuous run of expansion since 2006.

Crabb said the leasing results were also in accord with the latest NAB Monthly Business Survey for March which showed a jump in both business conditions and confidence to their highest level since 2008: "(Providing).. more assurance that the Australian economy is weathering the global challenges well, and is successfully transitioning through the end of the mining boom’’.

The strong demand for land in Sydney was now driving rental growth, said Savills’ head of industrial, Darren Curry.

"The market in Sydney is pretty hot with significant buy orders from numerous high profile institutional investors and a groundswell of pre-leases with well over 100,000 sqm soon to be announced driven heavily by requirements from the pharmaceutical industry and 3PLs (third party logistics).

"In Melbourne, it’s a similar story. We are now seeing the emergence of a new speculative industrial construction push and that is driving land values around key transport routes.

"While rents remain stable in Melbourne, a 20 per cent jump in land values over the last 24 months is now driving rental growth in Sydney, particularly in South Sydney and Western Sydney,’’ Curry said.

According to Victorian head of industrial David Norman what is driving the Victorian leasing market are pre-commitments - 309,691 square metres in the 12 months to March - with retailers with online presence and corporates looking for efficiencies through consolidation, the key players.

The leasing summaries show businesses requiring industrial space for the purposes of Manufacturing/Engineering were the most active leasing 351,436 square metres in Melbourne, while Transport & Logistics firms were the most active in Sydney leasing 475,948 square metres.