Deal volumes expected to slow after two years of $15 billion investments in office market: JLL outlook

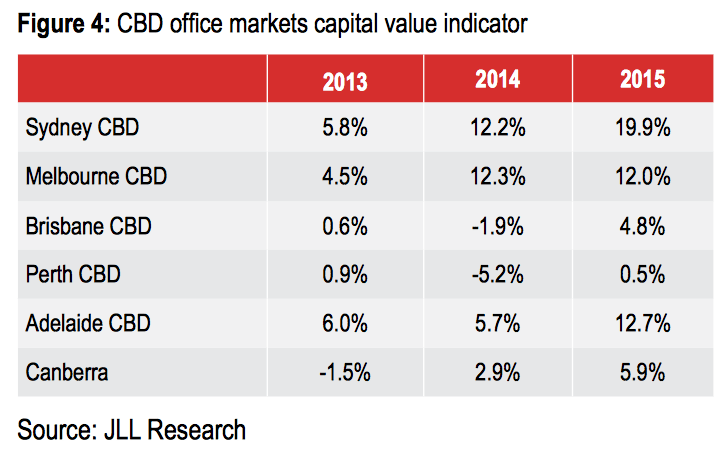

In a low growth world, investors have reassessed return expectations from core real assets and settled for returns between 6.50 percent - 7.50 percent, according to JLL's Australian Office Investment Review & Outlook Report.

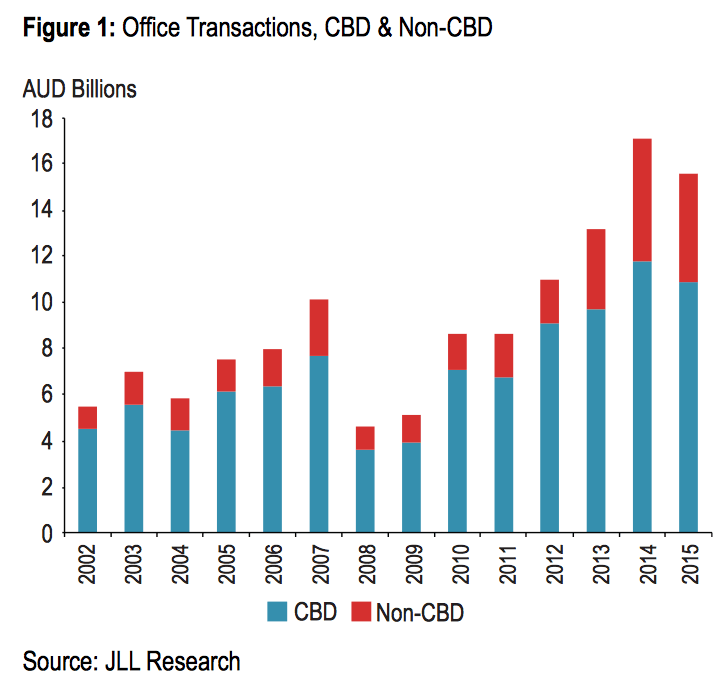

Transaction volumes for Australia’s office investment market surpassed the $15 billion mark in 2014 and 2015, highlighting the depth of liquidity in the sector and the demand for core assets, the report said.

While new sources of capital will enter Australia in 2016, transaction volumes are expected to be lower with activity concentrated in the $50 to $200 million lot size.

“Office investment markets were very active over 2014 and 2015 with high levels of liquidity, multiple capital sources competing for single assets along with multi-asset offerings. New pricing benchmarks were achieved in Sydney and Melbourne with prime office yields nudging down to 5 percent,” said Rob Sewell, JLL’s head of Office Investments – Australia.

“In 2016, investors will concentrate on acquiring assets with strong income growth potential.

“While we are forecasting above-trend rental growth in Sydney and Melbourne, the performance will be uneven and certain sub-sectors such as A grade will outperform.

“There is a strong argument now with so much growth expected in the A grade sector that these assets should command prices reflecting yields lower than premium.

“Investors have accepted core returns will be lower for longer. However, they are now being faced with the prospect of a lack of genuine vendors in 2016. These investors will be forced to pay a further premium to unlock assets. This may lead to some assets being traded below 5 percent by a few groups who have very specific mandates.

“There is a resistance by the majority of investors to go below 5 percent, and with so few opportunities to consider the capital will realise they will have to move quickly to find core style assets in markets such as non-CBD Sydney and Melbourne, as well as Canberra and Adelaide.

“Brisbane saw great activity in 2015 and we expect this to continue in 2016. Perth had increased interest from investors throughout 2015 as a counter-cyclical play and we expect to see transaction activity result this year.

“Vacancy movements are more closely linked to fluctuations in supply than to demand and limited development activity from 2017 provides an environment where vacancy will tighten and effective rents will increase,” JLL’s head of Strategic Research – Australia, Andrew Ballantyne, said.

JLL projects that area-weighted CBD prime gross effective rents will increase by an average of 4.8 percent per annum between 2016 and 2019.

“The effective rent recovery in Sydney and Melbourne provides an additional ingredient to the investment thesis and some core investors will consider opportunities that provide some leasing market exposure to the 2017 to 2018 period," Ballantyne said.

“Furthermore, core+ and value add investors will dedicate greater resources to exploring counter-cyclical opportunities in markets where the leasing fundamentals are more challenging.

“The yield spreads will be compelling for investors that can navigate idiosyncratic risks factors. As an illustration of the opportunity, the spread between average secondary yields in Brisbane and Sydney is 210 basis points – 115 basis points wider than the 10-year average of 95 basis points,” said Ballantyne.

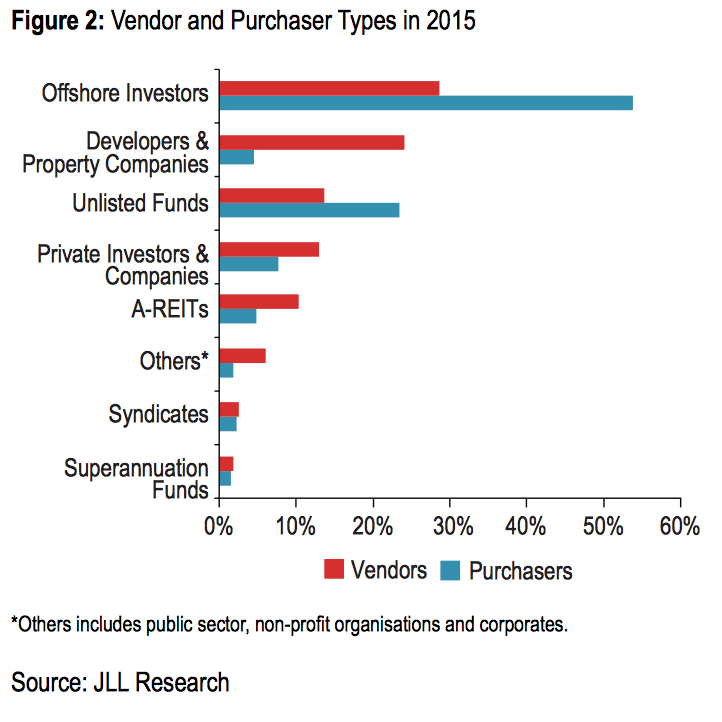

“The recent volatility in equity markets is reinforcing the defensive characteristics of real estate. Australia is a beneficiary of pension funds adopting a higher allocation to real estate and a higher allocation to Asia Pacific. As a result, new sources of capital will emerge for core assets in 2016," said JLL’s head of International Investments – Australia, Simon Storry.

“Sovereign wealth funds have been active buyers of commercial real estate in global gateway cities. A high proportion of sovereign wealth funds are oil-dependent funds and the correction in crude oil prices will negatively impact fund inflows.

“As a result, we could see less activity from oil-dependent sovereign wealth funds in on-market campaigns in 2016 and 2017. However, this gap will be taken up by strong demand by Singaporean and European institutions,” said Storry.