Australia's office market a mixed bag, Perth near bottom, Darwin outlook bleak: HTW March property clock

Australia’s office market offers a mixed bag from one coast to the next.

Demand for space from tenants and level of landlord investment has fluctuated widely between the regions, so choosing the right fundamentals has become ever more important, according to valuation firm Herron Todd White latest property clock for offices.

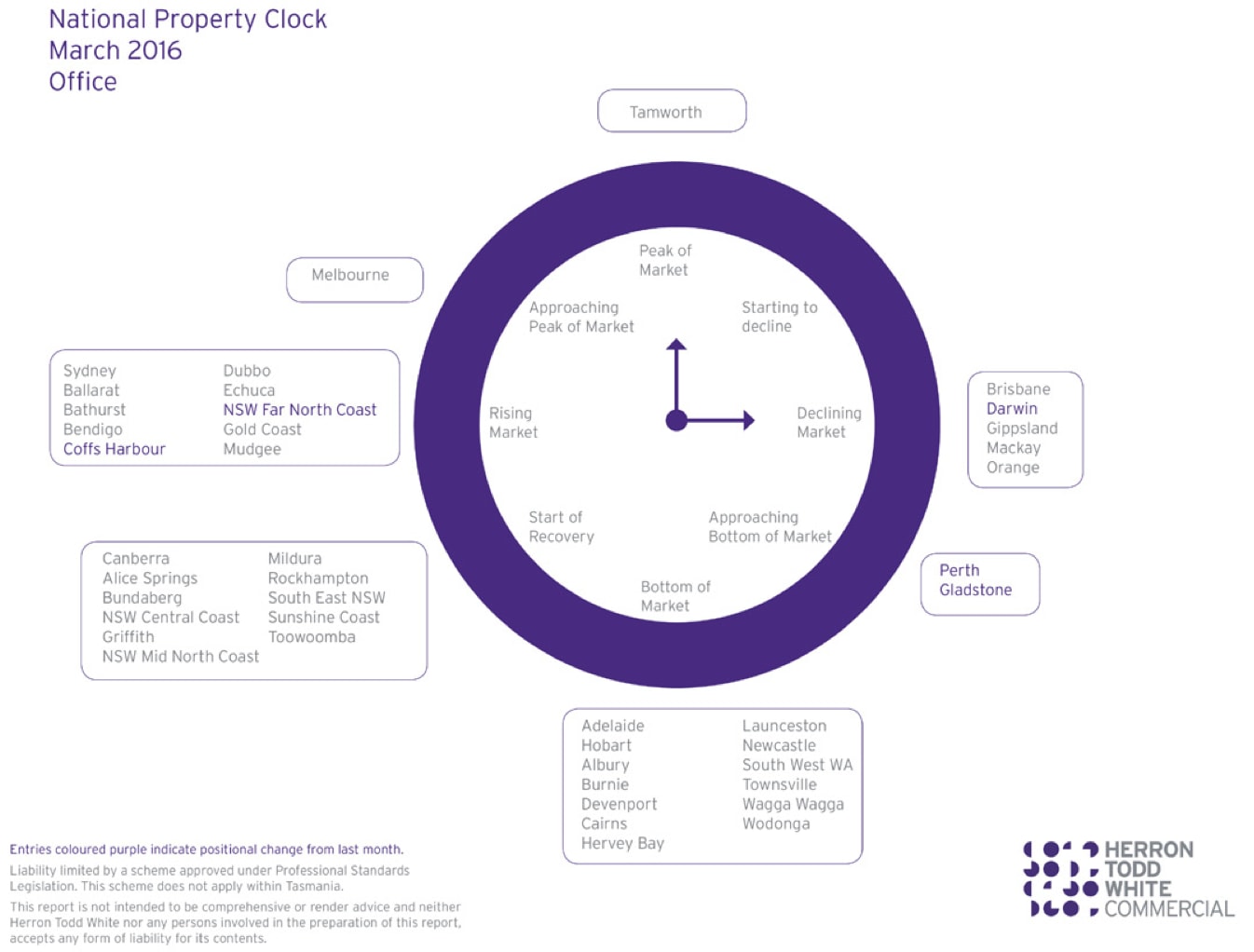

The March property clock is a simple broad brush means to suggest where property markets are and what direction prices are moving in.

Tamworth in New South Wales retains its place at the peak of the cycle and is the only one occupying the position.

NSW Far North Coast and Coffs Harbour are the new entrants to towns/cities approaching the peak of the market.

Darwin slips into the declining market position while Perth and Gladstone are approaching the bottom of the market, says the HTW clock.

In Coffs Harbour CBD, the demand and supply of office space remains stable and there has been a steady take up of oversupplied space. Rental levels are generally static with the most recent lettings effected at similar passing rental rates or subject to CPI increase. There is evidence of leasing incentives (generally two to three months rent free) within the market.

The capital value levels for office buildings demonstrated strong demand and firm yields throughout the year.

In Darwin’s case, the outlook for the commercial office market is best described as bleak. The Charles Darwin Centre is now open for business and a number of government departments have moved in, leaving a number of other office buildings in the CBD vacant. HTW estimates that the vacancy rate for CBD office space exceeds 20% and could well climb higher over the next 12 months.

As for Perth, the official vacancy rate in the CBD office market as at January 2016 was recorded as being 19.2%, up from 16.6% six months earlier and up 4.4% on the January 2015 result.

Overall, the current state of the Perth office market continues to decline. Forecasts for the following six months will see little respite in vacancy numbers, with predictions as high as 24% by the first or second quarter of 2016.

Lastly, in Queensland’s Gladstone, the office market for 2016 is anticipated to remain relatively in line with 2015, with tenants keeping hold of negotiating power in new leases and when exercising option periods. Over the past 12 months there have been some reductions in rental levels of about 30% and this is expected to continue until rentals begin to flatten out.