APRA data shows a further tightening of lending standards: Cameron Kusher

The Australian Prudential Regulation Authority (APRA) released its December 2015 quarterly data on property exposures by Australian authorised deposit-taking institutions (ADIs).

The data is always interesting to analyse in order to get further insight into the current state of the mortgage market.

The first data point is residential term loans to households which have a total outstanding balance of $1.384 trillion which has increase by 8.9% over the past year. The total value of outstanding owner occupier loans is $884 billion having increased by 12.8% over the past year and accounting for 63.9% of all outstanding loans. The remaining 36.1% of outstanding loans are to investors, having increased by 2.6% year-on-year to $500 billion.

Growth in outstanding loans has tilted away from investors to owner occupiers. After year-on-year growth in investor loans peaked at 18.2% in March 2015 it has slowed to 2.6% growth while owner occupier credit troughed at an annual rate of 2.2% in March 2015, before rebounding to the current annual rate of 12.8% (the fastest annual growth rate since June 2010).

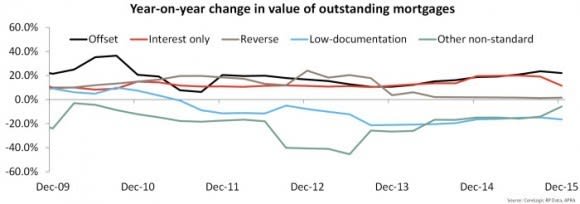

In terms of the types of loans outstanding, 42.3% have an offset facility, 39.3% are interest-only, 0.2% are reverse mortgages, 2.0% are low documentation loans and 0.1% are other non-standard loans. The year-on-year change across these loan types has been recorded at: +22.0% for loans with an offset facility, +11.6% for interest-only loans, +1.6% for reverse mortgages, -16.6% for low documentation loans and -5.7% for other non-standard loans. Importantly, the value of outstanding residential loans for low-documentation loans is now at a record low.

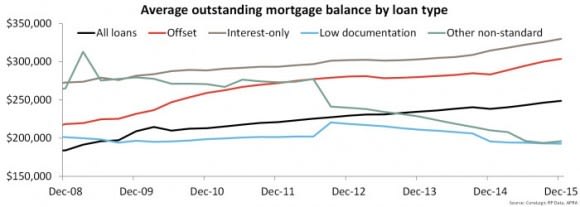

The data highlights that the average outstanding balance on a residential loan is $248,800, up by 1.0% over the quarter and by 4.4% year-on-year. Reverse mortgages ($95,700), low-documentation loans ($192,800) and other non-standard loans ($195,900) all have much lower outstanding balances. Meanwhile, loans with offset facilities ($303,700) and interest-only loans ($330,000) have significantly higher outstanding balances.

The year-on-year changes to the outstanding loan balances have been recorded as follows: +7.2% for loans with an offset facility (fastest year-on-year growth since June 2011), +4.9% for interest-only loans, +2.8% for reverse mortgages (slowest year-on-year growth on record), -1.5% for low-documentation loans and -6.8% for other non-standard loans. The data shows a slowing in the growth of outstanding loan values for reverse mortgages while riskier lending types (low-documentation and other non-standard) have seen an ongoing fall in outstanding loan amounts.

While the previous data looked at the total value of residential mortgages outstanding, the following data focuses on new residential mortgages over the final quarter of 2015.

Over the December 2015 quarter there was a record-high $98.130 billion worth of new residential mortgages approved, $69.091 billion worth were owner occupied with the remaining $29.040 billion being for investment purposes. Year-on-year the value of new owner occupier loans is 28.8% higher, its greatest change on record, while investor mortgage lending is -24.9% lower, its largest fall on record.

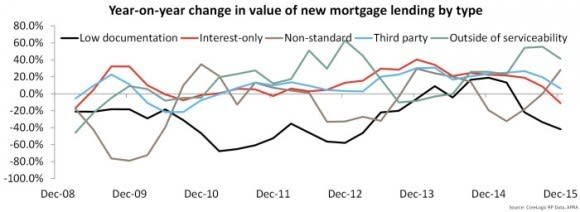

Looking at the types of mortgages approved over the quarter: a record low 0.3% were low-documentation, 37.0% were interest only which was its lowest proportion since March 2013, 0.1% were other non-standard loans, 47.4% were originated by third parties and 3.7% were loans approved outside of serviceability.

Focussing on the year-on-year change; low documentation loan approvals are -41.8% lower (their largest year-on-year fall since March 2013), interest-only loan approvals are -11.0% lower (their largest year-on-year fall since March 2009), other non-standard loan approvals are up 28.2% (their largest year-on-year increase since December 2013), third party originated loans are up 6.2% and loans approved outside of serviceability are up 41.3%. The data indicates there has been a significant pull-back in low-documentation loans and interest-only loans.

At the same time, non-standard and loans approved outside of serviceability are rising significantly which may be a potential point of concern for APRA. Although they make-up a small overall proportion of lending it will be something to keep a close watch on over the coming quarters especially since both have also recorded a quarterly increase.

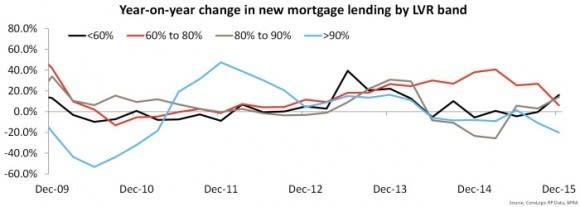

Finally the data breaks out new lending by loan-to-value-ratio (LVR) bands. Over the quarter, 23.4% of all new loans had an LVR of less than 60%, 53.4% had an LVR of between 60% and 80%, 14.5% had an LVR of 80% to 90% and 8.7% had an LVR of more than 90% which was its lowest proportion on record.

Looking at the year-on-year changes, the value of lending for LVRs of less than 60% was 16.1% higher, LVRs of between 60% and 80% increased 6.1%, LVRs of 80% to 90% increased 14.3% and LVRs greater than 90% fell by -20.1% which was the largest year-on-year fall June 2010. Based on the data it is clear that lenders have been tightening lending requirements over recent quarters which has led to a sharp decline in new mortgage lending for LVRs above 90%.

Overall the data indicates that the market is responding to regulatory changes in the lending space implemented over the past year. There is less new lending to high LVRs, fewer low documentation and interest-only mortgages being written.

On the other-hand some other potentially more risky lending types such as non-standard and outside of serviceability loans are continuing to rise. It will be interesting to see whether APRA starts to look to crack-down on some of these types of lending in order to ensure stability within the mortgage market.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.