Dwelling approvals remain elevated but fall in August: Cameron Kusher

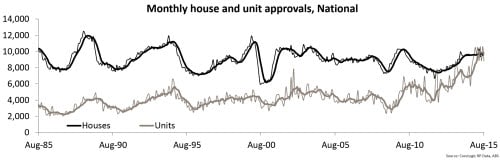

The Australian Bureau of Statistics (ABS) published building approvals data for August 2015 earlier this week. The data showed a month-on-month fall in approvals driven by a sharp drop in the number of unit approvals. Keep in mind that unit approvals tend to be much more volatile than house approvals on a monthly basis.

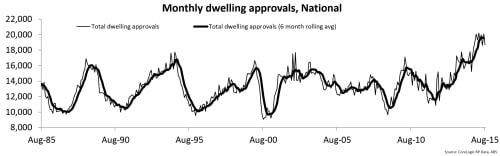

Over the month there were 18,071 dwelling approvals which was a decline of -6.9% over the month. Dwelling approvals hit a record high of 20,215 approvals in March 2015 and they are now -7.5% lower. It does appear that approvals have peaked notwithstanding the fact that they remain at historically high levels.

There were 9,882 houses and 8,819 units approved for construction in August 2015. House approvals actually increased by 4.4% over the month while unit approvals fell by -16.9%. Year-on-year house approvals have increased by 2.2% compared to an 8.4% lift in unit approvals. To further highlight the volatility of unit approvals the 8.4% year-on-year increase in August is well down on the 44.2% year-on-year rise in July. Although it looks as if approvals have peaked it would not surprise to see a sharp rebound in unit approvals next month.

Across the country there was a record high 226,415 dwellings approved for construction over the 12 months to August 2015. To put the magnitude of approvals in perspective, two years ago over the year to August 2013 there had been 166,658 dwelling approvals nationally. There has also been a surge in unit approvals over recent years with a record high 48.8% of all dwelling approvals nationally being for units over the past year. Again, 2 years ago units accounted for 42.5% of all approvals over the year.

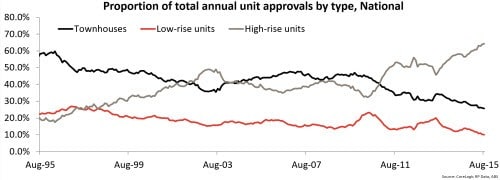

It isn’t just the fact that more units are being built, the type of units being constructed is changing dramatically. Over the 12 months to August 2015, 25.7% of all unit approvals were for townhouses, 10.1% were low rise (less than 4 storeys) and 64.3% were high-rise (4 storeys or more). The above chart shows that historically townhouses have received the highest proportion of approvals. Trends have changed quite swiftly, 2 years ago just 49.2% of all unit approvals were high-rise. The rise in high-rise approvals is reflective of higher densities within our inner city markets. High rise unit projects also take longer to build than a house or townhouse and as a result the economic benefit is stretched over a longer period. Of course the fact that we are approving high-rise units at an unprecedented pace also creates some challenges. Most notably who are buying these properties and over the longer term who is going to live in these units.

The data indicates that dwelling approvals have probably peaked for the current phase however, the number of approvals remains elevated. This has created a significant pipeline of new construction much of which is high-rise and will take some time to complete. Because unit development is so dependent upon presales it will be interesting to see just how many of these units are ultimately built.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.