Regarding this chart, the speech noted the following key points:

- Land is two things: it is both space and place. Many have observed that Australia has plenty of the former. But I think the lesson of past booms as well as recent times is that it’s place – location – that really matters. If we think back to boom–bust episodes of the past, whether in land for new development, railways or prime office buildings, in every case you can see people trying to get their hands on the best locations, to take advantage of whatever future economic outcomes they expect.

- Location explains far more of the variation in individual property prices than block size (Hansen 2006). Yes, some people like a bigger garden, for privacy or to enjoy in other ways. But being in the ‘right’ kind of neighbourhood with the best amenities, close to commercial centres and other services, is more important to most people, if their willingness to pay for it is any guide.

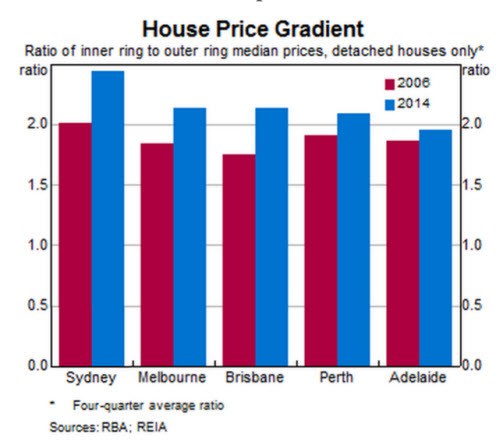

- The physical reality is that the supply of good locations is more or less fixed in the short term. So any sizeable boost to demand cannot be fully absorbed by more supply. The newly built property is simply not the same as the existing stock, because it’s somewhere else. We should therefore not be surprised that strong demand for property does not just change the general price level for that asset, but also its distribution. We can see this in the increase in prices of inner-ring properties relative to those further out, especially in Sydney

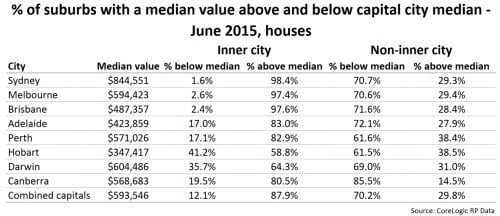

I agree with this analysis; housing closer to the city centres and closer to major working nodes is more desirable. Also in many capital cities, as we see houses in inner city areas knocked down to make way for higher density development, the underlying land component becomes intrinsically more valuable. Subsequently, the availability of houses in many inner city areas are actually reducing. After I read this section of the speech I decided to go digging in the data to see just how much difference there was in terms of inner city house values and growth in these values over the past year relative to values and growth across the rest of the capital cities. For the purposes of this analysis we have determined that the inner-city region is within 10 kilometres of each capital city.

The above chart shows that in terms of median house values, the proportion of homes above the city-wide median is substantially higher in inner city areas. Even in a city such as Sydney where housing is less affordable, once you shift more than 10 kilometres from the city centre, only 29.3% of suburbs have a median house value above the city-wide median. In all cities, more than half of all inner city suburbs have a median higher than the city-wide median and all non-inner city areas have less than 50% of suburbs with a median greater than the city-wide median.

While the fact that the cost of housing is higher as you move closer to the city-centre the magnitude of the difference is significant. The other factor to consider is the growth in values in the inner-city versus the rest of the city. This is where the results change somewhat.

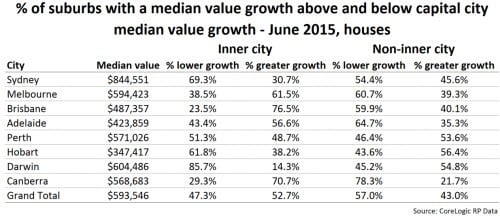

Sydney is probably the most interesting result here. Although it has seen the sharpest rises in home values over the past year, suburbs outside of the 10 kilometre inner ring have generally experienced stronger value growth. Of course it is important to recall that Sydney values have been rising for more than three years, and growth, while continuing, has shifted from inner city areas to more affordable outer housing markets.

Melbourne, Brisbane, Adelaide and Canberra were the only capital cities in which more than half of the inner city suburbs have recorded value growth in excess of that recorded across the cities. Notably each of Perth, Hobart and Darwin are seeing more outer suburbs outperforming than inner suburbs. Of course it should be remembered that home values are now falling in Perth and Darwin and clearly this is impacting the inner city performance.

The lesson here of course is just because inner city housing is generally more desirable, it doesn’t mean it is immune from falls in the event of a housing market downturn.

Inner city housing markets will likely remain more desirable than those suburbs further afield, due in large to the abundant amenity typically available in these areas. Although the desire to live in these inner city areas is strong, the reality is that the cost of housing in these locations is restrictive and the supply is relatively short, so many can’t access the housing they want in these areas.

As some of the examples show, although housing in inner city areas is more expensive, it doesn’t necessarily mean that value growth will consistently outperform growth across the rest of the city.

Furthermore, as the Perth and Darwin highlights, inner city housing isn’t bullet-proof and in the event of a housing market downturn it has in the past and will potentially in the future also see value declines.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.