Has growth in investor housing credit reached its apex? Cameron Kusher

As a result of new lending criteria delivered to deposit-taking institutions by Australian Prudential Regulation Authority (APRA) a lot of attention has been placed on the pace of lending for residential housing investment.

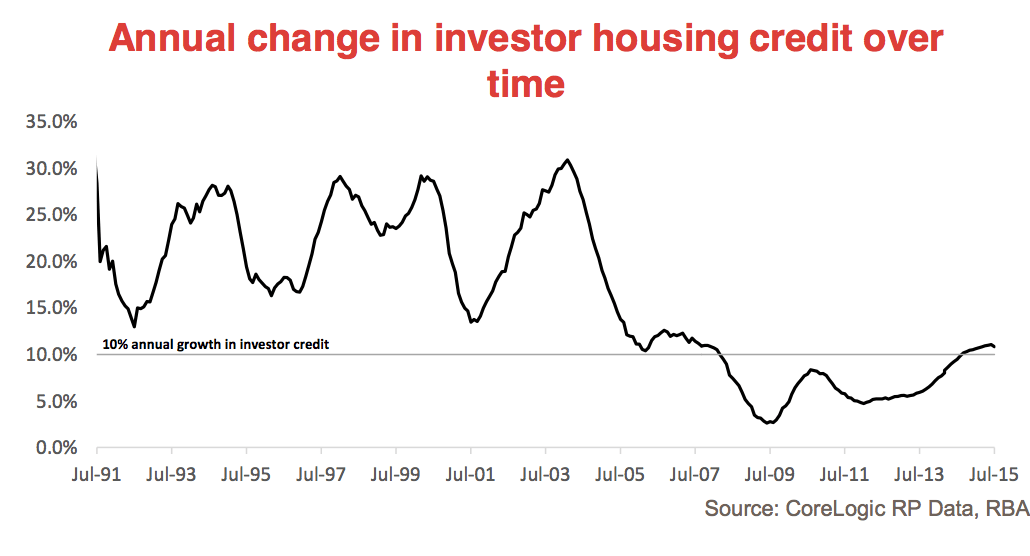

The APRA guidelines highlighted a limit on annual investment credit growth for ADIs of 10% however, from that point until June 2015 the annual rate of investment credit growth continued to increase.

Although it’s only one month of data, the latest housing credit data to July 2015 suggests that we may be finally set to see a slowing of investment credit growth.

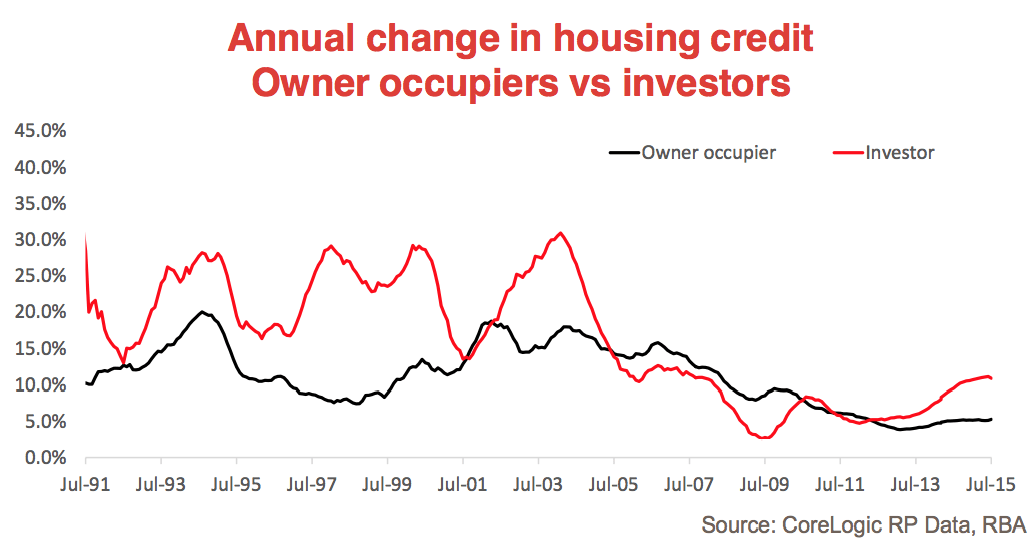

Over the 12 months to July 2015, the Reserve Bank (RBA) reports that total housing credit rose by 7.4%; its fastest annual rate of growth since October 2010, and consisted of a 5.3% annual increase in owner occupier credit (fastest growth since March 2012) and a 10.8% annual rise in investor credit.

Investor housing credit is still growing at a robust pace however, at 10.8% over the year it is down from 11.1% in June and at its lowest level since March 2015. “In fact, the monthly investor housing credit data shows credit advanced by just 0.6% in July which was its lowest monthly increase since October 2013.

Investment segment lending data on the investment segment suggests that following recent changes to lending policies by Australian ADIs, lending to the investment segment of the market is set to slow further over the coming months.

With mortgage rates remaining low we would anticipate the rate of growth will slow to around the 10% per annum benchmark, however this is unlikely to drop much further than that.

While any slowdown in investment growth may have an impact on overall housing credit figures, Mr Kusher noted that it’s important to recall that a much greater proportion of overall lending goes to owner occupiers.

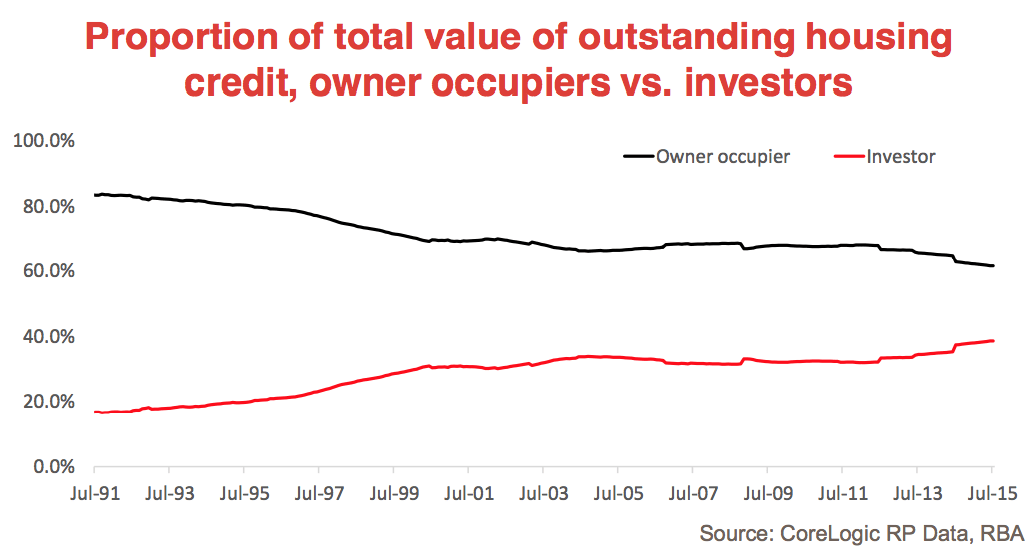

In July 2015, the total value of outstanding housing credit was $1.476 trillion. This figure was comprised of $906.4 billion in lending to owner occupiers and $569.8 billion to investors.

It’s important to remember that the rate of growth in owner occupier lending has also been rising although over the past year there was a $45.2 billion expansion in credit to owner occupiers compared to $56.1 billion to investors. Furthermore, the proportion of total mortgage credit to investors is at a record high 38.6%.

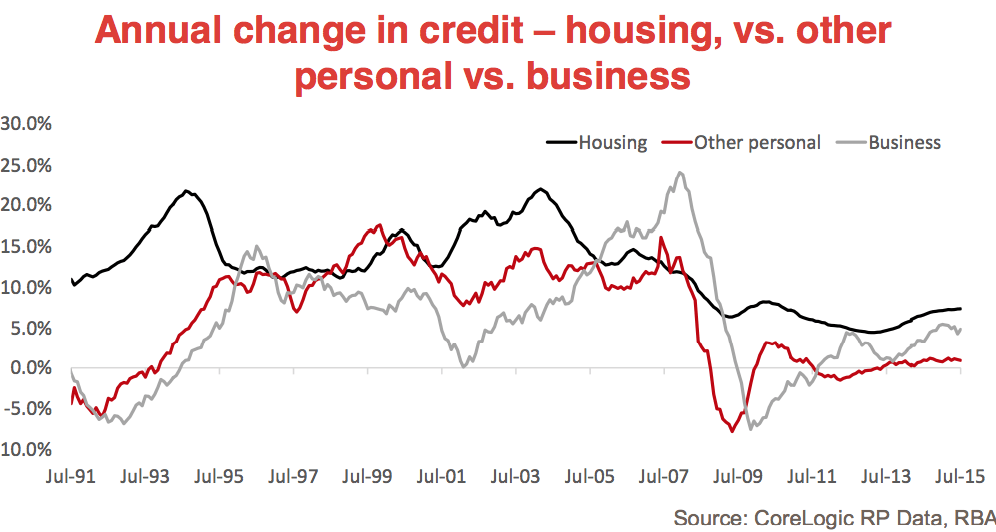

ADIs of course don’t lend exclusively for mortgages and the latest data shows an encouraging lift in credit to businesses. In July 2015 business credit rose by 0.7% to be 4.8% higher over the year. Total business credit is currently recorded at $799.7 billion, which is significantly larger than investment housing credit.

The RBA and APRA are likely to be very encouraged to see the first signs of a slowing of lending to the investment housing segment and would hope that it continues over the coming months.

While this may result in a slight slowing in overall housing credit growth increases, this shouldn’t be viewed as a negative outcome. If the recent increase in business credit can continue it would arguably provide greater economic benefit.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.