1 in 10 capital city home sales over $1 million: Cameron Kusher

Sales data over the 12 months to March 2015 shows that there have been more homes sold across the combined capital cities for less than $200,000 than there have been homes sold for more than $1 million. As you would expect there is a growing proportion of sales in excess of $1 million in Sydney and Melbourne while homes selling for less than $200,000 are almost exclusively found in Hobart and Adelaide.

Over the 12 months to March 2015, a record low 6.1% of capital city home sales were below $200,000 and 31.8%sold for between $200,000 and $400,000, the lowest proportion since the 12 months to October 2001. While we are seeing a decline in sales at the lower price points, predictably more expensive sales are increasing. Over the 12 months to March 2015, 10.0% of all homes sold across the combined capital cities sold for more than $1 million, a record high. As we will discover the proportion of homes selling in excess of $1 million is substantially higher within cities such as Sydney and Melbourne.

Over the 12 months to March 2015, a record low 8.9% of Sydney houses sold for less than $400,000 compared to a record high 34.0% of houses selling above $1 million. The remaining 59.2% occurred between $400,000 and $1 million. For the unit market, a record low 18.6% of sales were below $400,000 whilst there was a record high 71.1% between $400,000 and 1 million and a record 10.3% above $1 million. The impact of a surge in home values over the past year is being felt at the lower end of the market with a sharp drop in sales below $400,000 for both houses and units over the past year.

24.5% of Melbourne houses and 36.9% of Melbourne units sold for less than $400,000 over the 12 months to March 2015. In comparison, 16.5% of houses and 5.1% of units sold for more than $1 million. For houses, the proportion of sales below $400,000 was at a record low while it was just shy of a record low for units. Conversely, both houses and units logged a record high proportion of sales over $1 million. Like Sydney, the impact of the value rises over recent years is being felt most at the lower-end of the housing market with a sharp decline in sales below $400,000. This is highlighted both by the table above which shows a sharp drop in sales below $400,000 over the past 20 years. Unlike Sydney, finding more affordable housing options is relatively easier in Melbourne with almost 1 in 4 houses and more than a third of units selling for less than $400,000.

Across all sales, 30.6% of houses and 52.5% of units transacted in Brisbane over the year to March 2015 sold for less than $400,000. The proportion of houses sold for less than $400,000 was at a record low while the proportion for units was lower in the middle of last year. House sales in excess of $1 million were at a record high 5.9% over the past year while the 2.3% of unit sales over $1 million is still a way off the record high 3.1% in early 2011. Brisbane has seen fairly moderate value growth over recent years however, we are still seeing an erosion in sales at the lower end of the market, albeit the deterioration is moderate compared to Sydney and Melbourne. 10 years ago, almost three quarters of houses and more than 4 out of every 5 unit sales was below $400,000, as the above table shows there has been a marked shift over the past decade to fewer lower priced sales. Relative to Sydney and Melbourne properties selling for less than $400,000 are much more common across Brisbane.

Over the 12 months to March 2015 45.3% of Adelaide houses and 65.9% of units sold for less than $400,000. The proportion of houses and units sold for less than $400,000 was at a record low over the past 12 months however, lower priced housing stock is much more readily available than across all other mainland capital cities. While sales at a lower price point are falling, a record high 4.7% of houses sold for more than $1 million over the past year. For units, 2.6% of all sales were over $1 million which was lower than the 3.5% recorded in mid-2008. Value growth across Adelaide has been limited since the financial crisis, nevertheless the proportion of homes selling for less than $400,000 has continued to decline. Adelaide offers much more affordable housing options than all other mainland capital cities.

15.1% of Perth houses and 37.7% of Perth units sold for less than $400,000 over the 12 months to March 2015. In comparison, 10.8% of Perth houses and 4.2% of units sold for more than $1 million over the past year. The proportion of houses and units selling for below $400,000 is above the record-low of 14.7% and 36.9% respectively both of which occurred over the past year. The climb in more affordable sales over recent months is likely to be reflective of the fact that value growth has hit a stand-still in Perth over the past 12 months. Furthermore, new supply of homes is at close to record highs across the city currently. Perth has recorded one of the strongest capital growth rates over the past decade and as a result there has been a substantial decline in the proportion of homes selling for less than $400,000. This is highlighted by the fact that 10 years ago 81.7% of Perth houses and 88.0% of units sold for less than $400,000. In fact, Perth currently has fewer house sales below $400,000 than all capital cities except for Sydney and Canberra.

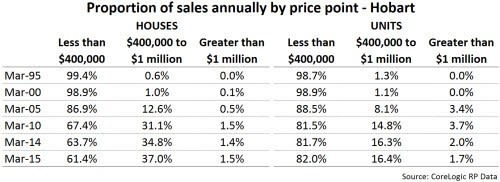

Hobart is the nation’s most affordable capital city and also sees an overwhelmingly larger proportion of lower priced house and unit sales. Over the 12 months to March 2015, 61.4% of Hobart houses and 82.0% of units sold for less than $400,000. Hobart is the only capital city in which a majority of houses have sold for less than $400,000 over the past year. Subsequently, relatively few homes sell for over $1 million with just 1.5% of all house sales and 1.7% of unit sales over that price point. Hobart’s housing market has seen very little growth in home values over the past 10 years yet there has still been a fairly substantial decline in house sales below $400,000 while unit sales below $400,000 have seen little change. 10 years ago, 86.9% of all house sales were less than $400,000 and 88.5% of unit sales sat within that price point.

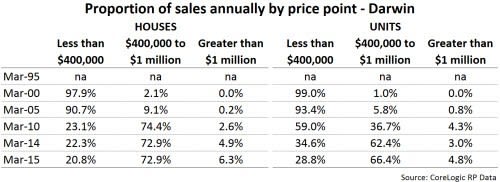

Darwin has recorded the strongest value growth of all capital cities over the past decade; as a result it has shifted from being one of the most affordable capital cities to now being one of the most expensive. Over the 12 months to March 2015, 20.8% of houses and 28.8% of units sold for less than $400,000. Alternatively, 6.3% of houses and 4.8% of units in the city sold for more than $1 million. The proportion of houses selling for less than $400,000 has started to trend higher over recent months as values have fallen while unit sales below $400,000 are at a record low. The proportion of sales above $1 million is below its record high for houses and units with the record high coming for houses over the past year and in late 2010 for units. With value growth in Darwin the strongest of all capital cities over the past decade, the decline in the availability of more affordable housing is clear. Around 1 in 5 house sales nowadays are below $400,000 compared to 9 out of 10 a decade ago. For units, just over 1 in 4 sales nowadays are below $400,000 compared to more than 9 in 10 a decade ago.

Over the 12 months to March 2015, 7.8% of Canberra houses and 42.3% of Canberra units sold for less than $400,000. On the other hand, 5.9% of house sales and 2.4% of unit sales were for more than $1 million over the year. The proportion of houses selling for less than $400,000 is currently at a record low while unit sales below $400,000 reached their low point throughout the past year at 39.7%. The number of houses selling over $1 million is below its peak of 6.2% a couple of months earlier, as are unit sales at this price point. Although home value growth in Canberra has been moderate over the past 5 years, there’s been a fairly substantial fall in sales below $400,000 over that time. 5 years ago, 23.2% of Canberra houses and 56.7% of units were sold for less than $400,000.

The data shows that whether you look at interest rates, household incomes or any other factor that can influence affordability; we have seen a sharp decline in homes selling at a lower price point in over the past decade. Of course, even a home priced at $400,000 won’t be cheap enough for some potential home buyers. It is to be expected that the cost of housing rises over time however, there are social issues surrounding the sharp decline in lower priced homes. The result is that more people have to choose to rent or alternatively they have to move away from our capital cities or to smaller capital cities. Of course, finding employment in smaller capital cities and regional markets can be more difficult.

Anecdotally we are also hearing that in markets such as Sydney and Melbourne first time buyers are purchasing investment properties rather than owner occupied properties for their first home. We also hear that a number are purchasing investment properties outside of these two cities where you can seemingly get better value for money. Of course, in most markets outside of Sydney and Melbourne the economies are currently weaker and capital growth has been much more moderate.

Housing affordability is a very individualistic issue however; the data contained here shows that housing at a lower price is becoming much harder to come by, particularly in our larger capital cities.

Cameron Kusher is RP Data’s senior research analyst. Follow Cameron on Twitter here.