Investment lending set to slow: Cameron Kusher

Investor activity has surged over recent years and now shows that in March 2015, investors committed to $12.9 billion in housing finance.

By comparison, investment mortgage commitments reached a recent low of $6.3 billion in April 2011.

The recent rise to $12.9 billion has seen the value of commitments rise 105% in less than 4 years.

While state data is seasonally adjusted, these markets tend to be a little more volatile. Nevertheless, it shows $13.5 billion worth of commitments in March 2015.

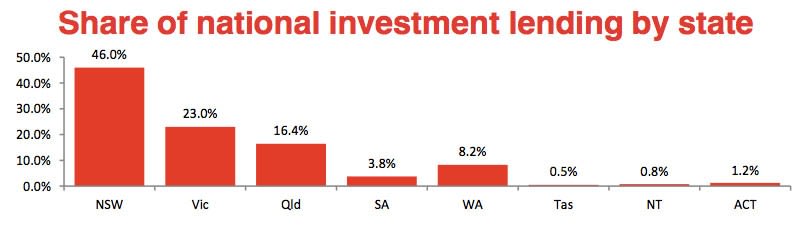

A state by state breakdown shows that nationally, NSW accounted for 46.0% of all investor mortgage commitments. The value of commitments in NSW was greater than the value of all states and territories combined except for WA. Of particular note is the fact that this data largely reflects what is happening in Sydney which experienced a significant rise in investment lending over the past 3 years.

Across all states the recent low in investment lending has been in either January or February of certain years and we’ve found that this time of year is a seasonally slower period for mortgage lending.

After APRA wrote to Australian banks, credit unions and building societies late last year re-affirming sound residential mortgage policies we have recently started to see many banks change their lending policies.

A large focus of these changes has been around investment mortgages and over the coming months we should eventually see investment lending start to slow.

NSW – in March 2015, investors committed to $6.2 billion in mortgages, a year-on-year increase of 37.2%. Over the past 3 years the value of investment mortgage commitments has increased by 155%. If you remove refinances, investors accounted for 60.0% of all new lending in NSW in March 2015.

Vic – investors committed to $3.1 billion in mortgages in March, a 17.1% year-on-year rise. Investors accounted for 48.6% of new lending in March and the value of commitments is 70% higher over the past 3 years.

Qld – at $2.2 billion in March, investor lending has risen by 43.1% year-on-year and is 69% higher over the past 3 years. Investors accounted for 47.2% of new lending over the month.

SA – investment lending has increased by 28.3% year-on-year to March 2015 to $508.8 million and has increased by 32% over the past 3 years. Investors accounted for 43.0% of new lending in March 2015.

WA – investors accounted for 39.0% of new mortgage lending over the month with $1.1 billion in commitments. Investor mortgage commitments have increased by 4.5% year-on-year and by 31% over the past 3 years.

Tas – investors currently account for 30.5% of new mortgage lending $with a total of $70.8 million. The value of investment commitments is 21.3% higher over the year and has increased by 41% over the past 3 years.

NT – at $103.5 million in March 2015, investment lending is -1.1% lower over the year. Investment lending has increased by 14% over the past 3 years and investors currently account for 55.3% of all new mortgage lending.

ACT – at $168.3 million in March 2015, investment lending is 2.9% higher over the year. Investment lending has increased by 8% over the past 3 years and investors currently make-up 41.8% of all new mortgage lending.