But the impetus will not come from traditional property developers, rather its insurance companies.

According to Knight Frank’s latest report, Chinese Outward Real Estate Investment Globally and Into Australia, the total value of Chinese outward real estate investment globally skyrocketed from US$0.6 billion in 2009 to US$16.9 billion in 2014 across the world.

Already over US$7.8 billion has transacted in the first four months of 2015 (data excludes residential dwellings).

Knight Frank’s Dominic Ong, senior director of Asian markets, capital markets, said so far the majority of the Chinese outward investment has been focused in gateway cities of Australia, the US and the UK.

“What first started as sovereign funds making exploratory investments has proliferated into buying sprees by Chinese developers, banks, Ultra High Net Worth Individuals (UHNWIs) and institutional investors, such as insurance companies.

"By 2020, authorities estimate that the Chinese insurance industry will accumulate a further RMB20 trillion worth of premiums, tripling the current pool size.

“This current wave of equity investors and insurance firms are seeking core, value-add and yield-driven opportunities," Dominic Ong said.

Among the big-cap players, only four of the top 10 Chinese insurance companies have made offshore investments so far, although the remaining six are considering overseas expansion.

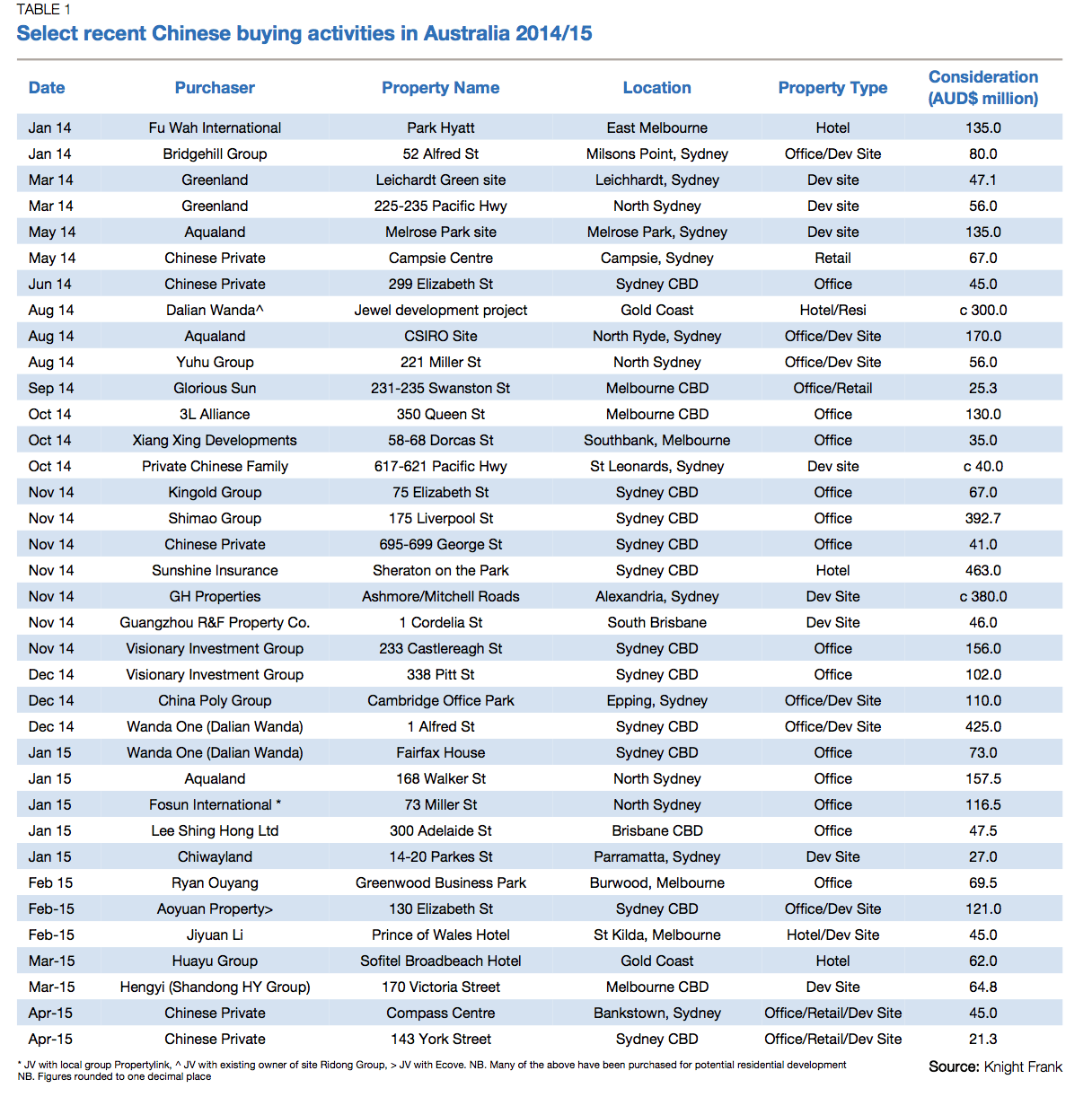

Sunshine Insurance Group is the only one to invest in Australia, purchasing the Sheraton on the Park Hotel in Sydney for a record AU$463 million.

“For Chinese investors in the Australian market, the gateway cities – namely Sydney and Melbourne – have been the most active market for Chinese investors.

"The next wave of Chinese investors are diversifying more and broadening to areas such as Brisbane, Adelaide, Gold Coast, Perth and metropolitan suburbs of NSW and Victoria, which will all start to gain more traction.

“These investors will also diversify by broadening their sector allocation from core office and residential developments into hotels and leisure, student accommodation, industrial assets and mixed-use developments,” said Mr Ong.

Click to enlarge