Offloading assets and home upsizing: the maze to keep your part-pension in 2017

The 2015 Federal budget left property well-alone, other than confirmation of the looming pension asset test changes in early 2017.

Last week Property Observer suggested couples approaching retirement - and aware of the rules in advance - will possibly compromise on their superannuation voluntary contributions - or sell one of the two $400,000 investment properties - and instead push the funds towards buying an untaxed, un-counted bigger, better home that can be beneficially sold later in retirement.

Now with budget confirmation, data and commentary confirm that some supposed asset-rich part pensioners will wisely upsize homes in order to retain their pensions, and then build up a tax-free asset for their late retirement years. The Scott Morrison aim was for older couples who own their home and have other assets between about $800,000 and $1.2 million to lose their part-pension altogether.

It presumes the asset test pension limit changes get through parliament.

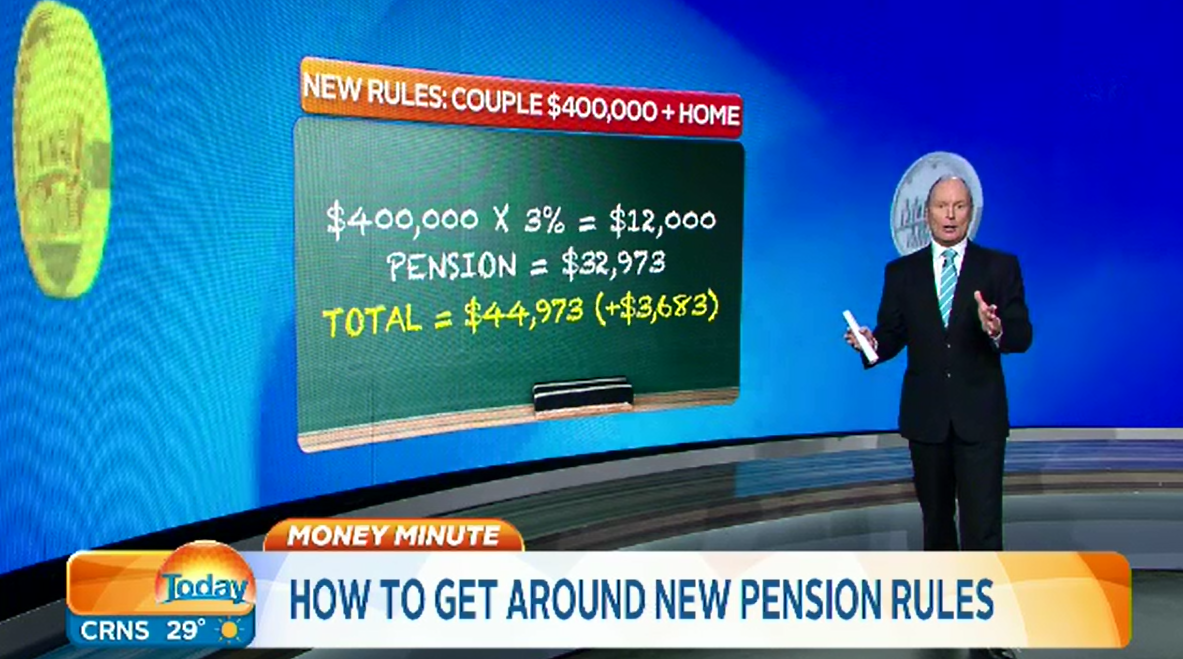

It will certainly take some planning by nearing pensioners and professionals to ensure it all works, but as one listener told 2GB's Ross Greenwood pre-budget it makes fiscal sense to sell that second $400,000 investment property in coming years to get below the asset test threshold.

"Clever people can work out how to get around Scott Morrison’s new pension rules," the morning show report advised, warning part-pensioners can't give the money away as otherwise Centrelink will nab you..

"Just before you reach pension age you buy something that is not subject to the assets test.

"That something is a new house.

"So in this case the people with $800,000 sell their current home and buy a new home that is $400,000 more expensive, so they reduce their assessable assets to $400,000.

"And they get a 75% pay rise in retirement.

"Infuture if they are desperate for their dough they sell the house which hopefully keeps going up with inflation," Ross Greenwood advised.

Ross Greenwood quickly sensed retirees set to lose their very small part pension could envisage the gradual destruction to the income under the 2015 Federal budget initiative set to start in 2017.

One pensioners was prompted to write that the Scott Morrison-Joe Hockey 2015 Federal budget proposal "can have only been dreamed up by comfortably well off politicians who have no appreciation of what it is like to try to live off one’s own assets."

And two charts compiled by the pensioner show how home-owning couples will be effected.

In the first chart, with an interest rate of 3% a couple with $800,000 of assets would only end up with a yearly income of $25,773, whereas a couple with $400,000 and almost a full pension will have a yearly income of $44,973.

A difference in income of $19,200 to the advantage of the couple with less assets.

In the second chart, where the interest is increased to 5% a couple with $800,000 of assets would only end up with a yearly income of $41,773 whereas a couple with $400,000 and almost a full pension will have a yearly income of $52,973.

A difference in income of $11,200 to the advantage of the couple with less assets.

It was calculated it is not until the interest rate is at about 7% that the couple on $800,000 earns an income more or less level with the couple on $400,000.

The outcome is not exclusive to home owning couples, but effects all four categories of retirees.

Pensioners acknowledge the present taper and thresholds can also show the same sort of warp in incomes, it is less evident and indeed at 4% interest most asset levels draw equal in the income they can achieve.

Retirees who are very cautious with investing their assets especially after their experiences in the GFC - are finding trying to earn even 3% is getting harder.

Pensioners suggest any riskier investments could invite loss of capital, which for a retiree can never be made up.

Lots of retirees will either have to dip into their capital and with the spiral down effect that this will produce, will sooner rather than later end up on the full and part pension anyway.

Many others will decide to spend their assets on holidays, upgrading homes or renovations, in order obtain a higher income via the full pension.