Office markets could benefit from rate cuts: Savills

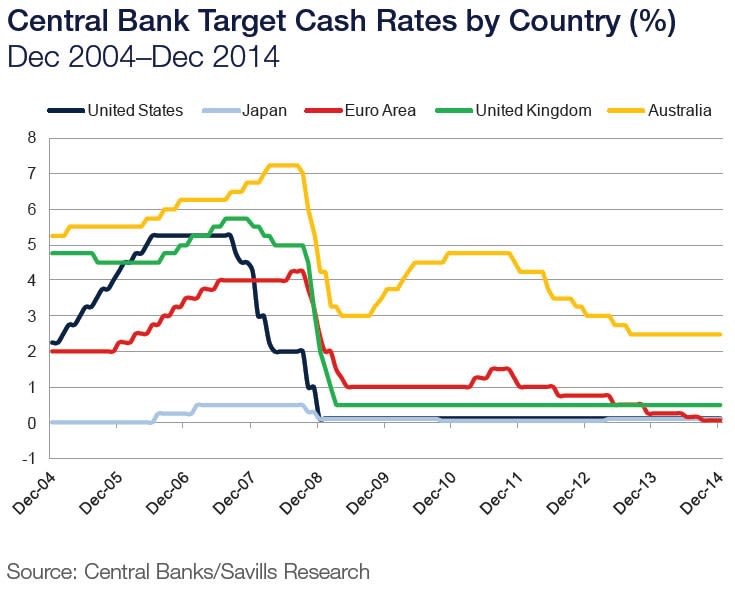

Melbourne and Sydney office markets could benefit from potential further interest rate cuts, according to a new report from Savills.

The Savills/Deakin World Office Yield Spectrum Report compares 43 cities across Asia, Europe, the US and Australia on market yields, accretion and risk, and offers buyer profile and price breakdowns.

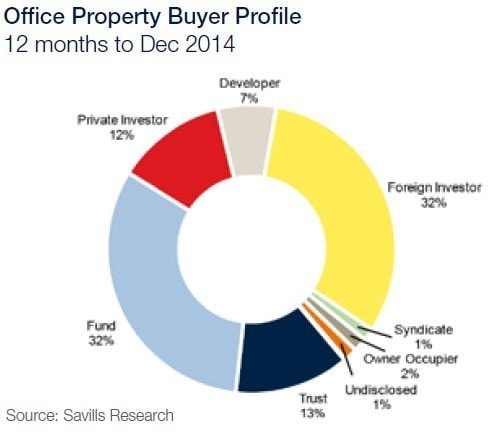

Tony Crabb, the national head of research in Australia, said the world capital markets continue to see large amounts of capital inflows and commercial property markets remain a popular home.

"Despite variable economic fundamentals around the globe, capital continues to chase some generous returns. Local operators continually cite a lack of fundamental support for some pricing," said Crabb.

"Nevertheless, the competitive tension to place capital remains."

Crabb said that Australia's tow largest office markets could stand to gain from future interest rate cuts.

"If the Reserve Bank of Australia is successful in stimulating growth in the non-resources side of the economy, then the office markets in both Melbourne and Sydney should be the beneficiaries of stronger tenant demand," he wrote.

"Signs of this were seen in the last six months of 2014 and Savills Research expects this trend to strengthen in 2015.

"Incentives are currently prevalent in the Australian CBD office markets in order to attract tenants into vacant space.

"These large levels of incentives are reflected in the difference between market and effective yields and can be seen in the charts. Incentives account for between 150 basis points and 340 basis points gap between market and effective yields."

Crabb concluded globally, commercial property yields in particular continue to look attractive.