Employment rebalances to capital cities and services: Pete Wargent

The ABS released its Detailed Labour Force figures for February 2015 and for the quarter, and the news was somewhat mixed.

This data series is not seasonally adjusted, and total jobs growth over the past 12 months was surprisingly strong, with the total number of employed persons surging to 11,762,700.

Employment growth was driven overwhelmingly job gains in Melbourne, Sydney, Perth and Brisbane.

It will be interesting to see whether this strength is ultimately mirrored in the seasonally adjusted Labour Force data in due course.

Let's take a look in four short parts.

Part 1 - Mining and manufacturing jobs go

While it can hardly be a surprise, the fall in the number of employees in the mining sector has been dramatic, tailing all the way from 270,000 to just 220,400, with nearly 50,000 positions cut in just 12 months.

Manufacturing industries have also shed -23,500 jobs over the past year.

It has long been my contention that the end of the mining investment boom will represent adverse news for many of Australia's regional property markets, a number of which had performed surprisingly well through a once-off decade long resources investment boom.

The decline in manufacturing employment is also in my opinion likely to represent a significant headwind for the city of Adelaide, though for the purposes of balance I do note that a number of other commentators strongly disagree with me on this point.

Part 2 - Services employment increases

On the positive side of the employment ledger there now is some evidence of rebalancing over the past 12 months, with construction and services jobs helping to more than offset the jobs losses in mining and manufacturing.

As I noted in by blog post last week, despite the inevitable contraction in the resources sector, total construction employment is still pumping with a net +45,800 jobs added over the past 12 months.

Meanwhile professional, scientific and technical services employment surged by +98,800 from 889,000 to 997,800.

Other non-trivial gains were seen in accommodation and food services (+43,500), arts and recreation (+31,300) and media and telecoms (+24,500).

Generally speaking this is good news for the four largest capital cities, and not such happy news for regional Australia or Adelaide.

Part 3 - Employment by region

Over the past year the greatest absolute employment growth has been seen in Melbourne (+94,800) and Sydney (+49,600).

By contrast, regional employment growth has been weak leading to a divergence in unemployment rates in New South Wales in particular - a dearth of employment growth on a net basis over the past two years has seen regional unemployment in NSW rising to above 8%.

This has partly been driven by mining jobs losses in the coal sector, and on a smoothed moving average basis, the unemployment trend becomes clear.

In other states, both Perth (+35,700) and Brisbane (+33,200) have recorded robust employment growth over the year to February 2015, with residential property construction having a key role to play.

However, regional employment growth has been weak in Queensland and Western Australia too.

Meanwhile over the past two years total employment in Adelaide has declined (-11,900), with further job losses expected due to Holden's departure.

Looking at these results across a range of time horizons shows how the bulk of employment growth has consistently been seen in the four largest capital cities plus regional Queensland.

Part 4 - Unemployment

The month to month unemployment figures are very volatile, but for completeness here they are.

In order to make some kind of sense of the capital city unemployment rates (which are not seasonally adjusted) I've run them below on a smoothed moving average basis.

One key takeaway point here for mine is that the unemployment rate in Perth has been trending upwards fairly sharply since 2013, continuing a trend away from near full employment in the period leading up to 2008.

There has been some talk of weakening employment markets in Darwin, though in truth there has not been much evidence of this in the data to date.

On the other hand, the outlook in Tasmania is improving with the unemployment rate beginning to decline and a number of other positive data releases being recorded here on this blog over the past 12 months, including for retail trade and state final demand.

In fact, while I don't recommend on this blog that anyone dashes out to invest in property in Hobart (or for that matter, anywhere), the Tasmanian capital could well be the surprise package property market of the next few years.

Firstly, this is because so many years of inertia have seen the rental market tightening considerably.

And while population growth and employment growth have certainly been very weak in Tasmania over recent years, the "X factor" could be Chinese investment capital, with record numbers of Chinese visitors enjoying the fresh produce and fresh air of the Apple Isle.

I haven't been down to Tassie since spending a month there while the dollar was busily crippling the forestry industry, but I've heard from more than one source this week that Chinese tourism is dribving a rebound.

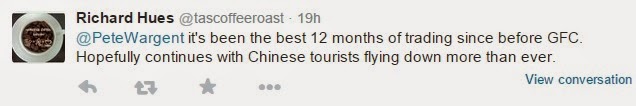

I even received a Tweet to that effect:

Moreover, Tasmania has a small enough population that new investment could impact markets more materially at the margin.

Regional unemployment

I'll cover the regional unemployment rates data in a separate blog post, but the areas of concern include:

- Central Coast

- Hunter Valley ex-Newcastle (now 12.4% unemployment in February 2015 as coal mining job losses bit)

- Newcastle and Lake Macquarie

- Richmond Tweed

- Logan-Beaudesert

- Moreton Bay North

- Mackay

- Wide Bay

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His book 'Four Green Houses and a Red Hotel' is out now.