Record 2014 industrial sales leaves commercial market on a high

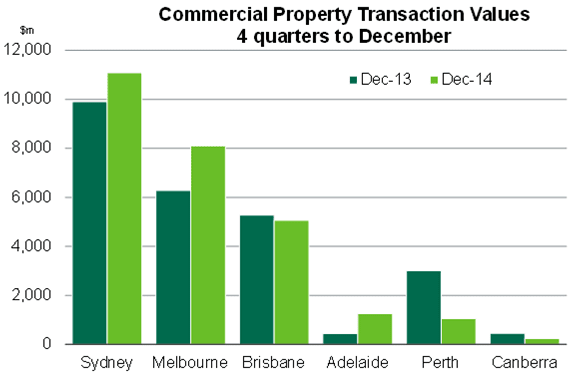

A record amount of industrial sales helped push commercial property sales to $26.8 billion in 2014, according to CBRE Research.

With commercial property sales up 6% on 2013 levels, office property was the largest contributor at $14.5 billion of sales, with retail assets at $7.3 billion. Industrial property clocked in $5 billion of transactions – up 55% from 2013’s total and surpassing the 2006 record of $4.9 billion.

CBRE head of research for Australia, Stephen McNabb, said that the last quarter of 2014 saw strong activity in the industrial market.

“Industrial sales grew by 55% year on year, driven by a number of large portfolio sales,” McNabb said.

“Activity is being prompted by divergence of opinion as to the degree to which yield compression can continue. Strong yield compression in the super prime sector (80 to 90bp in Sydney/Melbourne) through 2014 prompted selling from some owners, in an environment where new sources of demand are looking for income yield combined with an expectation that the risk of yield softening is low,” he said.

He also said that across the entire commercial market, foreign investors have maintained their presence, however a slowing was noted – to 12% after a 2013 doubling of investment.

Meanwhile, Matt Haddon, CBRE regional director, industrial and logistics services, said that they had been predicting the strong uptick in industrial in early 2014.

“Despite a slow start to industrial sales volumes in 2014 with only modest figures recorded at the end of Q2, based on the volume of sales and enquiries we were handling back in July, we made the call that 2014 would set a new benchmark and that’s how it’s panned out, reaching the $5 billion mark for the first time,” Haddon said.

“Given the volume of deals currently in the pipeline and the number of quality assets due to come to the market in Q1 this year, we see this volume of sales being sustainable for the foreseeable future and don’t believe that 2014 will be viewed as a ‘spike’ in any way.”

The office markets’ growth was sustained throughout 2014 with Sydney and Melbourne recording strong years for turnover – totaling 80% of the national turnover for office stock, when in 2013 they numbered 65%.

“This is consistent with stronger demand for assets in these core markets in which the vacancy risk over the next few years looks more contained for both prime and secondary assets,” Haddon said.\

Source: CBRE Research