Unit performance weak as rental growth slows to decade low

Rents across Australia's capital cities grew by just 1.8% over the last year, according to CoreLogic RP Data's quarterly Rental Review.

The data provider noted the rental markets performance is the weakest it has been since the mid-2000s.

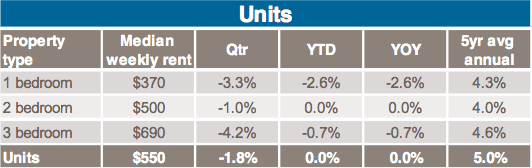

The median weekly rent for a capital city unit now sits at $410, with Darwin commanding the highest rental rate. Landlords in the Northern Territory capital are asking for $550 per week in rent at the median, which is down 1.8% from the previous quarter.

The fifth floor two bedroom, two bathroom apartment at 22/3 Brewery Place, Woolner is currently advertised to rent at $550 per week.

It was last advertised to rent for $450 per week in April 2008, and was listed as vacant with an asking rent of $350 per week the year before. Having paid $475,000 for the apartment in April 2012, the vendors will achieve a 6% rental yield if they secure a tenant at its current advertised price.

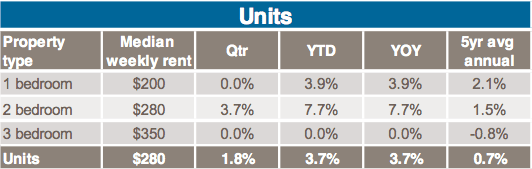

Hobart remains the cheapest capital city in Australia for unit rentals, with a median advertised rent of $280 per week.

CoreLogic RP Data notes that overall, the performance of the unit rental market was somewhat weaker than that of the house market over the past quarter, with Hobart and Brisbane the only capital cities to see an increase in rents over the three months to December. Hobart's unit rents were up 1.8% for the quarter, with Brisbane's up 1.3% over the same period.

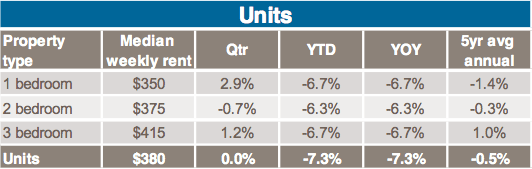

Canberra's unit rental declines slowed towards the end of the year, with no change recorded over the quarter, but the rents down 7.3% on a year-on-year basis. This one bedroom apartment at 78/10 Ipima Street in Braddon is currently advertised to rent at the city's median of $380 per week.

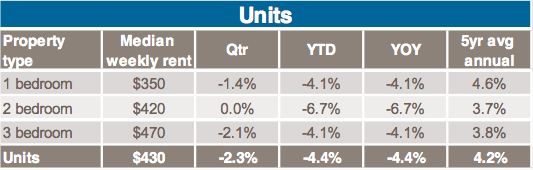

The asking rent for the 61.6 square metre apartment has not changed since December 2013. Canberra recorded the greatest drop in unit rents over 2014, while Perth landlords lowered their asking rents for units by 4.4% in the same period.

CoreLogic RP Data research analyst Cameron Kusher said declines in Perth, Darwin and Canberra were the exceptions, but capital city rental growth remained slow across all markets.

"Given the recent high number of dwelling approvals and commencements coupled with the high level of purchase activity from investors, we would anticipate that the rate of rental growth will remain soft throughout 2015," said Kusher.

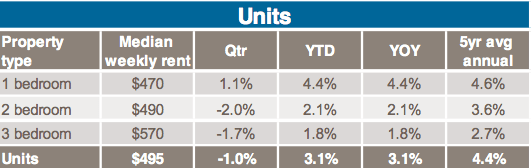

While rents in Adelaide also remained unchanged the three month period, Sydney, Melbourne, Perth and Darwin all recorded declines. Sydney's median unit rent was recorded at $495 for the quarter, down 1%.

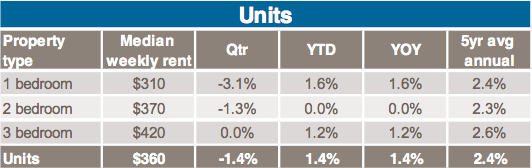

Melbourne asking rents for apartments and units have declined by 1.4% for the quarter, but were up 1.4% on a yearly basis. A two bedroom apartment in the complex pictured below is currently advertised at Melbourne's current unit median, $360 per week.

The advertised rent for the apartment at 21/14 Mitford Street, St Kilda has increased by only $10 per week since September 2011. Prior to that, it was advertised at $265 per week in March 2006.

According to Kusher, the performance of rental markets will largely depend on broader economic conditions.

To see CoreLogic RP Data's summary of the capital city rental markets, click below.

CoreLogic RP Data's capital city unit market summaries for the 2014 December quarter:

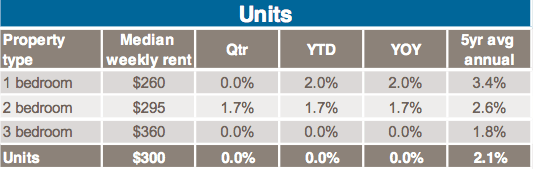

Hobart/Tasmania

Source: CoreLogic RP Data