How new property fund managers are changing the industry

GUEST OBSERVATION

The property funds management industry for individual investors has undergone significant change over the past six years as a result of corporate activity and restructuring. Stability and continuity of sound management is an attribute sought by all investors and alignment of interest.

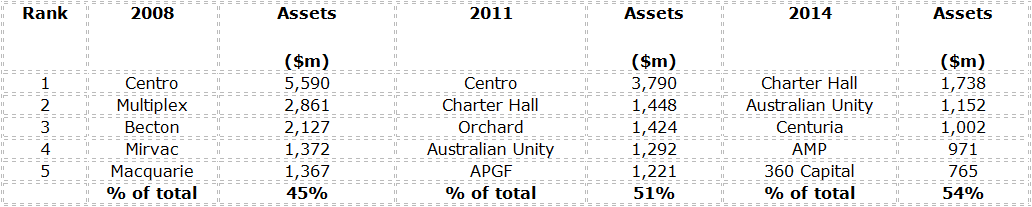

Table one, below, shows the ranking of the five syndicate and unlisted property trust managers with largest funds under management in 2008, 2011 and 2014. It shows a total change from 2008 to 2014.

Table one - Ranking of Property Syndicate and Unlisted Retail Fund managers (click to open in new window)

Source: PIR

In addition to changes in the list of largest managers the emergence of new managers has been a feature of the industry. This has been driven in part by regulatory changes and by departure of smaller managers thorough poor business management.

Basle III requirements have encouraged the exit by banks from property investment management.

Demands by superannuation regulators for liquidity have hampered the offering of property funds by major platforms.

Inability by owners and managers in arranging recapitalisation of funds and businesses has prompted total departure of some managers.

Many investors prefer unlisted funds over listed REITs. Investors in unlisted property have included high net worth individuals, family offices, SMSFs, dealer group syndicates and individual investors. Significant investment visa applicants are also participating in this sector.

Offerings of property funds or syndicates in 2014 have been made by 15 different investment managers including the large managers in table one and many new managers.

When assessing new property investment products, sustainability of the investment management business has become a more significant factor. Alignment of interest between investors and managers are sought. Real estate attributes, performance prospects and level and structure of fees remain significant.

Ken Atchison is managing director of Atchison Consultants.