Melbourne’s industrial market showing green shoots, but yet to spring into recovery: Savills

The industrial leasing market in Melbourne is showing green shoots of a recovery, according to Savills Australia’s Melbourne Industrial Spotlight Quarter 3/2014.

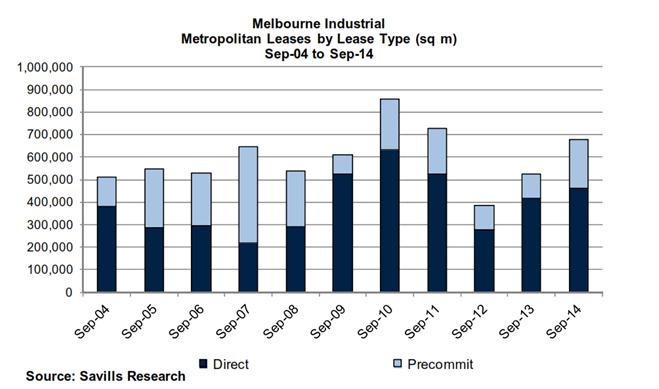

An extra 150,000 square metres were reported as leased over the past 12 months compared to the previous corresponding period.

The report recorded 681,520 square metres of industrial space leased over the past 12 months, with a total of 90 deals, in the year to September 2014.

The 12 months previous came in at 524,606 square metres with 60 deals.

The decade average is 594,221 square metres per annum.

Savills’ Victorian head of research, and author of the report, Glenn Lampard, said that it is not a definitive recovery quite yet, but that they are indicators of a possible market upswing.

“One swallow does not a summer make and neither does two, but leasing and land sales are the best indicators we have of a recovery. These figures are not one month, or one quarter but 12 months and more. While it’s certainly not definitive the figures are nonetheless very encouraging and at the very least suggest a new confidence in the market,’’ Lampard said.

Melbourne’s north-west industrial precinct was the recipient of the majority of leasing activity, responsible for 64% of the result, while the south-east took 35% of the total.

City fringe areas were responsible for less than 1% of the result.

This has Savills Victorian industrial director Greg Jensz note that there has been an upswing of the last 12 months.

“In the previous 12 months (2012/2013) there had been fairly good enquiry but that had not resulted in more than a modest outcome. This year we are seeing those enquiries taken that step further and the results are there including a substantial rise in pre-commitment deals and that’s a very good indicator of confidence returning to the market,” he said.

“On the basis of current enquiry we expect to see the current leasing trend continue throughout the remainder of 2014 as firms gear up for the new year.”