Will industrial property continue to perform?

Industrial property has been on a high growth trajectory, with many investors beefing up the industrial aspect of their commercial property portfolio, according to Colliers International’s research director Mark Courtney.

Courtney explains that the increasing scale of distribution centres and warehouse facilities, combined with strengthening returns in industrial property is pleasing for investors holding the assets.

"Major industrial markets have experienced consistently strong levels of investment at around $2.6 billion for industrial investment sales, above $5 million per annum in recent years," said Courtney.

However, is this growth trend expected to continue?

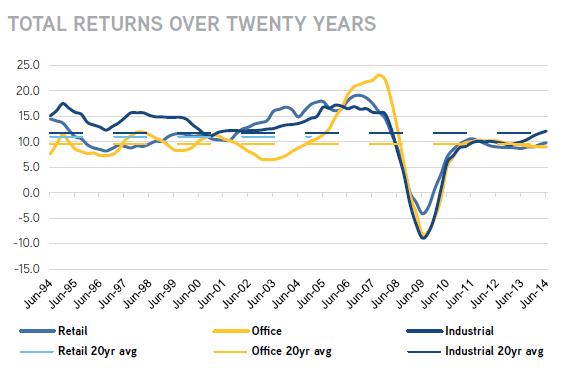

Currently, from an investment perspective, industrial property is a clear leader among commercial property, according to June quarter 2014 Investment Property Databank statistics.

Total returns have strengthened since December 2012, with an 11.7% increase in industrial total returns, compared to 11% result achieved in retail and the 9.6% return for office properties.

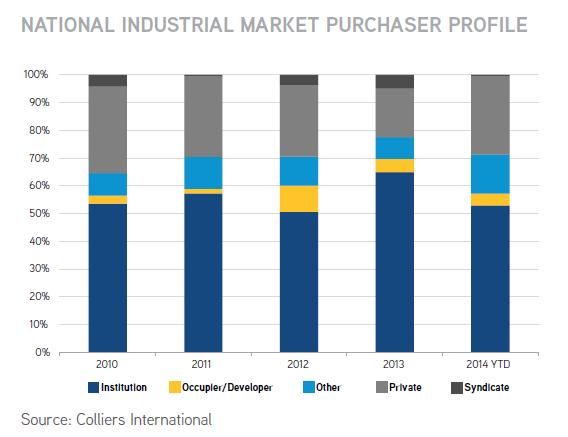

There was a 12.1% result in the June quarter, the highest quarterly increase since March quarter 2008, according to Colliers International's Industrial Second Half 2014 report. This high returning environment is what Colliers believes to be the primary factor driving industrial acquisitions from all types of buyers.

“The strength of these returns suggests a positive trend going into 2015,” the report notes.

Here’s Colliers’ state by state rundown of the industrial markets:

Sydney

- Real Estate Investment Trusts (REITs) have been prominent in the second half of 2014.

- Scarcity of stock has led to intense competition among institutional investors for prime assets.

- Domestic buyers dominate investment activity.

- Strong sales volumes in 2014 year to date.

- Private groups strongly buying industrial land and assets over the period.

- Sydney South had the greatest transactional volume by value (residential highest and best use draw card may have been a contributing factor).

- City fringe industrial market is becoming more tightly held (due to residential rezoning and the closure of Holden and Toyota facilities).

- Northern market investment sentiment is buoyant for industrial property, mainly for prime and secondary investments.

- North institutional appetite is still strong.

Brisbane

- Institutions have maintained their interest in the market.

- Fife Capital and 360 Capital Industrial Fund strengthened their holdings, buying in the south-west.

- Blackstone, Australia TradeCoast and the Industrial REIT made investments in south Brisbane.

Adelaide

- Institutional investors active, including Cromwell, Charther Hall and 360 Capital buying over the past two years.

- Total sales value boosted by Goodman's sale of Coles distribution centre in Burton (at $153 million to Charterhall, this was the largest industrial transaction ever seen in Adelaide)

Perth

- Demand coming from wide buyer spectrum.

- Private investors, in particular, are prominent.