Australia's macro markets: the numbers you should know

Time for an abridged gallop to sum up what's going on in Aussie housing markets.

Interest rates and inflation

First up, I have believed for some time that due to rising unemployment and inadequate jobs growth interest rates may need to fall further, which will in turn continue to support demand for housing. A recent Bloomberg survey of economists found that not a single one of them agreed with me on that point, however slowly but surely they are falling back into line.

Wages growth nationally remains sluggish at 2.6%, and, with evident slack in the labour market, non-tradables inflation has been declining as recorded in the chart below.

Although we haven't had an official Australian Bureau of Statistics (ABS) inflation reading since last month, the monthly TD-MI gauge is easing back towards the bottom of the 2% to 3% target band.

If this is followed by something similar in the official quarterly consumer price index that would leave the door wide open for another interest rate cut in 2015.

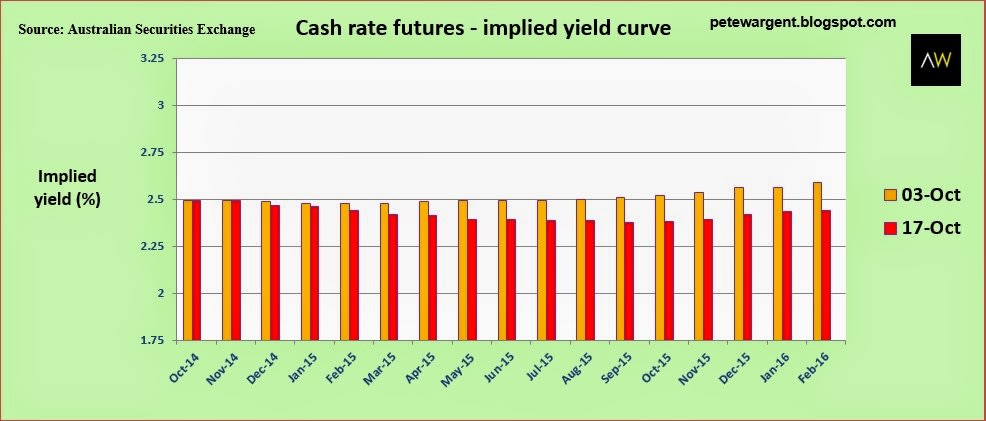

Note how futures markets now concur that there is more than a sporting chance of a rate cut in the first six months of 2015, and effectively zero chance of a hike.

Demand: population growth

Our analysis of the latest quarter's population growth revealed our expected rotation away from the mining states with population growth slowing significantly in Queensland and Western Australia, but exploding higher in financials and services-focused New South Wales to nearly +115,000 over the year. And how:

The long term trend in our chart below continues to show that almost all of the material growth in population takes place in only the four main states.

One of several challenges facing South Australia in particular is a brain drain, a demographic scourge involving the best and brightest heading to Sydney and Melbourne which becomes evident through analysis of the net migration sub-indices.

To date, this net interstate migration from South Australia has been countered by net overseas immigration. But this will only work effectively and sustainably for the state if new jobs are created, which has not been happening for the past half decade, hence rising levels of unemployment. Something needs to change in this regard.

South Australia may rise to and overcome this challenge, I merely note the risks facing the local economy here, which seldom seem to be mentioned elsewhere.

Demand: jobs growth

The Labour Force survey is presently suffering from a major credibility deficit and has led to the ABS to be something of a figure of fun over recent months (harsh, given recurring budget cuts) with the apparent largest jobs 'gain' in history followed next month by a total reversal.

As a long term buy-and-hold investor I would always advise following the longer term trend anyway, but this is even more so now the case given that the seasonal monthly data has been proven to be so wildly volatile.

The data below underscores the point about the problem child that is the South Australian economy, with close to zero jobs having been created on a net basis for nearly five years.

The strongest economy for the past two years, as discussed here frequently, has been that of New South Wales, while the mining states are now transitioning from construction to production.

Below the long term growth in employment chart shows New South Wales to be in relatively good shape, but the southern states – and now to a lesser extent the mining states – struggling.

But perhaps the real story in the jobs market is the alarming gulf in fortunes being experienced between the prospering capital cities such as Sydney and Melbourne and the simultaneous hollowing out of the respective regional economies, as I explored here.

The total number of full-time employed in the regions of the main states now sits below 2006 levels, and this casualisation of the workforce may have surprisingly harsh negative impacts for regional housing markets in the decades ahead.

This article continues on the next page. Please click below.

Demand: housing finance

The August Housing Finance data showed a slight decline on the preceding month, leading to a predictable knee-jerk response from commentators, but monthly data rarely rises (or falls) in a straight line and the trend in housing finance still looks to be strong overall.

The owner occupier housing finance data may have revealed the first signs of weakness in some states, but saw Queenslander financing looking particularly strong. Good times are ahead in Brisbane in 2015, it appears, after a lengthy wait.

Last week the ABS Lending Finance data was also released, which details where investors are buying. It's a clear cut Sydney boom which we anticipated long ago.

Supply: building

Rather than regurgitate our extensive chart packs, just a few takeaway points here on dwelling supply.

At this stage of the property cycle plenty of new supply should be coming online, rental growth should be easing and property investors need to be wary of areas with a looming oversupply of dwellings.

Melbourne and Victoria continue to approve thousand of houses for construction, as has been the case for more than a decade.

However, it is actually apartments which generally represent the greater oversupply risk in this cycle.

Note that after an approvals boom, we now see Sydney approvals and construction rolling over and the risk of oversupply easing back, except in a few specific suburbs.

Apartments commenced are picking up very strongly in Queensland.

The apartments completed chart below underscores a key point – New South Wales has completed a meagre 17,500 units (as well as 19,100 houses) in the year to June 2014, which compares to state population growth of somewhere approaching 115,000 across the same time horizon.

The raw numbers should tell you straight away that the risk of a massive Sydney oversupply in aggregate is tenuous unless approvals and construction get a second wind, with the Greater Sydney population set to leap higher by almost 90,000 heads in only one year.

It is true that there is plenty more to come in the pipeline - Greater Sydney has approved just over 26,500 units in the year to August 2014, but this uptrend has already peaked some six months previously on a rolling annual basis, and is set to ease back to around 20,000 in due course.

House approvals also have risen very steadily in Greater Sydney to above 12,500 on a rolling annual basis, but even if 100 percent of these approvals in the pipeline make it through to commencement and then completion (which they won't) there is no pressing risk of a huge oversupply at this juncture.

Melbourne on the other hand already has a clear oversupply problem in existence in some inner locations, while the commencements data also shows that inner Brisbane is steadily getting around to constructing thousands of apartments.

Investors in attached Brisbane dwellings should steer away from those city locations with an oversupply risk and in particular purchase only properties with a point of scarcity (e.g. great outlook/river view/exceptional location).

This article continues on the next page. Please click below.

Supply: stock and vacancies

Penultimately, Melbourne has absolutely stacks of stock on the market, about double that of Sydney, with an unprecedented 1800 Melbourne auctions coming right up on Cox Plate weekend. This will likely slow the market. Sydney has the opposite problem with a dearth of stock on the market while demand remains strong.

When markets move into the increasing supply phase vacancy rates should eventually rise, and this has happened to some extent in Melbourne and Perth with vacancy rates up at 2.5% on a city-wide basis. Perth investors should look for well-located houses over units and apartments, in our opinion.

Meanwhile Brisbane and Canberra have vacancy rates sitting around the national average of 2.2% on SQM Research's measures.

For all the expert talk of a Sydney oversupply, the harbour city's vacancy rate slipped back to just 1.7% in August.

Meanwhile, in further proof that real estate markets do cycle, the years of flat markets, lack of price gains and therefore moribund levels of dwelling construction in Adelaide and Hobart has resulted in low vacancy rates, and these markets could in turn pick up a little as a result.

Although I used to live in Darwin I haven't been up that way lately, so will just note here that there are just a few worrying indicators in the "Top End", with sliding prices, rising stock on market, signs of quite rapidly rising vacancy rates and a resources boom which is threatening to roll over.

The Darwin property boom may risk follow the mining boom back down from whence it came, so watch this space.

Dwelling prices

By this time of year most of the year's property market predictions have normally been conveniently forgotten about or subtly amended. Not ours! Let's see what we got right and what we didn't.

Our Adelaide 2014 market forecast was +0% to +3% capital growth, and RP Data's index has a year to date gain of 3.39% with a couple of months still to run.

Brisbane and Gold Coast tracking nicely for our +2% to +5% capital growth prediction. Brisbane has some of the best prospects for 2015 and beyond after a lean half decade.

Melbourne looks set to do better than the top end of our +5% gain forecast, though from a macro perspective it does now seem likely that the market is set to slow up, with whispers afoot of the much-vaunted "buyers market" returning.

The Perth market is holding up OK, and notably houses are faring much better than apartments on most indices. Our forecast is on track.

The Sydney market has been rock solid and will finish 2014 ahead of our +6% to +9% capital growth forecast.

SQM Research believes that the Sydney market will replicate this capital growth once again with another 8% to 12% growth in the year ahead too. We'll release our own 2015 forecasts in due course as well as our 2015 Buyers Eye housing market outlook reports for London, Sydney and Brisbane.

Overall we could yet score a hit with our forecasts on all five markets, but the Melbourne data needs to start slowing for that to be the case, which it just never quite seems to do.

Watch out for sliding unit rents at this stage in the cycle as new supply comes online. Owners of properties with a unique appeal, in an outstanding location or with a key element of scarcity value will of course have few problems with rental vacancies in 2015, but lower quality stock in other locations could see asking rents getting dropped or have issues securing tenants.