Has the market mispriced the odds of a rate cut?

Perhaps our easing cycle is not yet over?

Posssibly so. Markets have all but priced out any further interest rate cuts in this cycle - partly due to worries about cuts bringing more speculators into the housing market, and partly due to one seemingly very strong set of employment data - but it still seems to be very much in the balance to me.

One of several reasons I think that another cut or two might be needed is the decline in mining construction, which has yet to gather any real pace but remains a threat.

Construction phase of the mining boom fading

The Australian Bureau of Statistics (ABS) released its Engineering Construction activity data yesterday, which is something of a proxy for mining construction activity.

We are now clearly beyond the peak of this construction phase of the mining boom as production begins to ramp up in its stead.

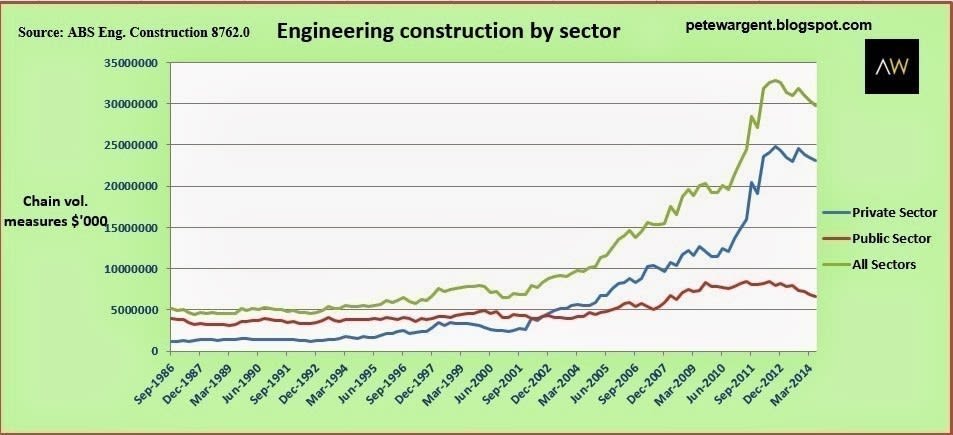

The total value of engineering construction work done across all sectors has now declined by 2.3% over the past year on a seasonally adjusted basis.

In chain volume measures terms the charts show that although activity remains at a highly elevated level, the peak of the mining construction boom appears to have been way back in the September 2012 quarter.

And while the decline has not been devastatingly steep, in chain volume measures terms we are now tracking at around 9% lower than we were, with 3.8% of that decline taking place over the past year.

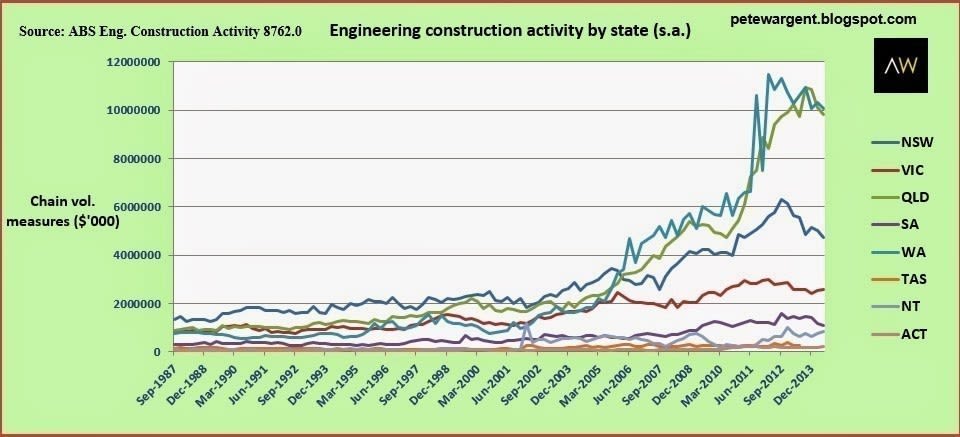

In terms of the construction activity by state, it was the mining states which benefited most from the boom, so it will be the same states which feel most of the pain as the construction boom unwinds.

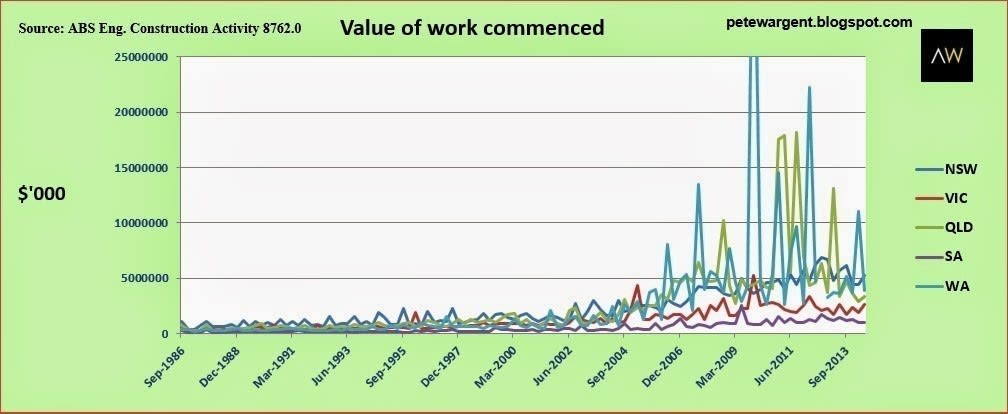

As recently as March 2014 there were still major resources projects getting underway in Western Australia, but the big ticket items are now largely visible in the rear view mirror.

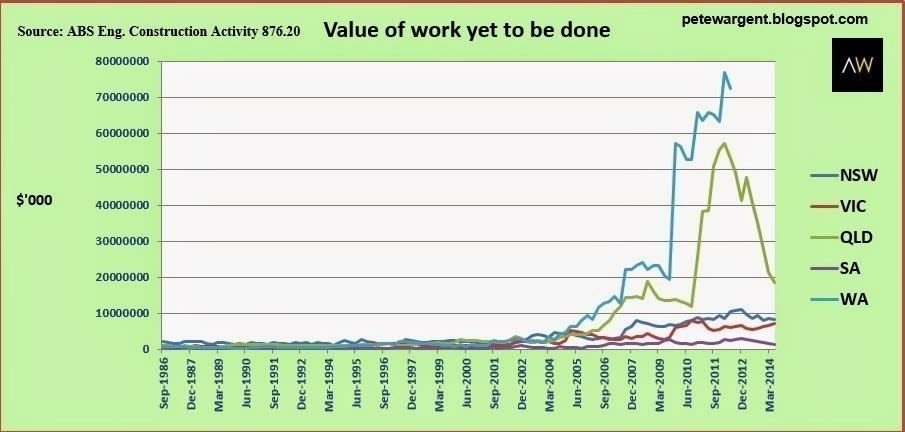

In terms of the value of activity yet to be completed, work in the pipeline for Queensland has tanked. The full data set for Western Australia is not available from the Bureau of Statistics, but the sub-indices imply that the work in the pipeline is almost certainly declining there too.

This article continues on the next page. Please click below.

With the weighted index of commodity prices continuing to "ease" by another 2.4% in September (and another 16% over the past year in Aussie dollar terms) according to the Reserve Bank of Australia, marginal projects will certainly not be commenced in the current environment.

In short, mining construction activity has not collapsed, but it is set to keep declining for several years to come.

This leads me to think that another interest rate cut or two could still be at least an each-way bet, but only if the large number of investors pouring into the housing market slows. We will know more in the next week or two on that front.

WA property bust?

There has been some talk of whether or not the collapse in mining construction will result in a property bust in Western Australia.

The answer to that riddle is: that depends.

The Pilbara has transitioned into the export phase of the mining boom. which is the less labour intensive phase of the boom, and unsurprisingly several property markets have crashed, both in terms of rentals and prices.

This is hardly a shock, except to perhaps investors who were lured in by promises of fast returns and sky-high monthly rents.

The Perth property market is a different matter entirely. Western Australia, and especially Perth, has benefited from by far and away the strongest percentage rate of population growth in Australia over recent years.

The key to successful property investment in Perth has always been to own well located land. Unit and apartment prices may well feel some pain ahead, but with rapid population growth having underpinned the market the price of well located houses will fare much better.

Indeed, the median price of land in Perth reportedly "skyrocketed" by $40,000 in the past year.

This represents a 7.5% increase in the median value of Perth land, which outpaced Adelaide (+7.3%) and Sydney (+5.2%).