Sydney's office market can withstand even worst scenario: DTZ

Those expecting an uptick in the office market across 2014 and 2015, particularly in terms of tenant demand, will not be disappointed, according to DTZ’s forecast.

DTZ’s latest Sydney CBD Offices research alert notes that even in their most severe downturn scenario, the net absorption rate remains positive, though well below baseline.

However, this will be a slow and steady situation with out-performance not expected. Risks are also expected to continue, with a prospective financial crisis in China as a result of unsustainable credit growth in their property sector.

When the supply cycle closes in 2017/2018, tenant demand is forecast to push rents up from 2% to 5% depending on the forecast scenario. Late 2016 will start to see the situation become neutral for tenants, while the present environment offers them the choice of the market.

Property Council of Australia figures are already pointing to a shift. For instance, over the two and a half years to the first half of 2013, net absorption was 37,000 square metres. However, in the 12 months to the first half of 2014, net absorption totaled 57,000 square metres due to a resurgence in the IT sector.

Office supply, however, is one of the biggest aspects of the Sydney market analysis provided by DTZ. With large scale additions and withdrawals from the market, the timing is crucial in determining the performance of the market. Supply is expected to strongly increase, with more than 700,000 square metres planned for between 2015 and 2018, which exceeds the long-term 140,000 square metre per annum average. This is due to large projects, such as International Towers Sydney and George Street-located projects.

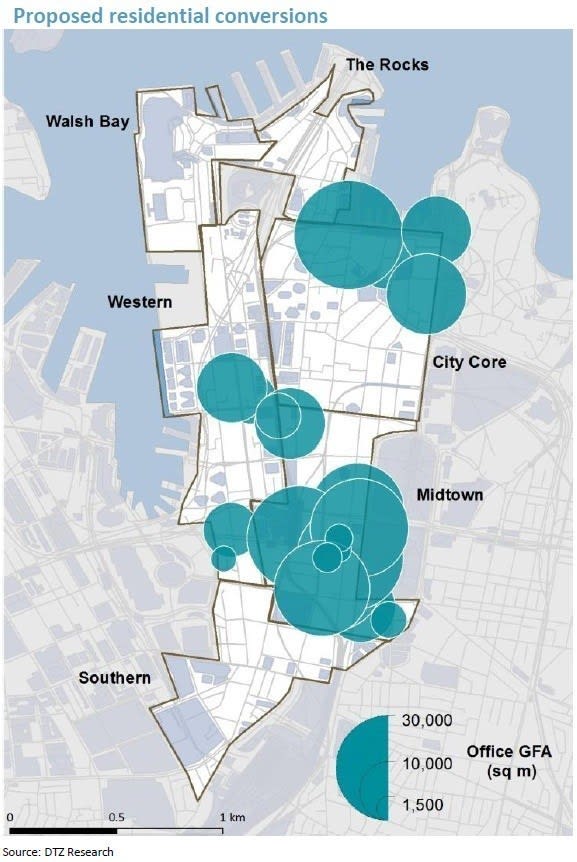

The number of offices set to be permanently removed from the market is also noted, as they undergo redevelopment into residential and even hotel offerings – often by offshore purchasers.

They record almost 275,000 square metres of secondary-grade office space which is expected to be removed from the office market over the medium term, all for alternate uses. You can see their locations on the map below. Much of this appears to be in mid-town.

In Sydney, developers are looking to get a foothold in the profitable residential market, snapping up lower grade stock for this purpose.

Just last week, Property Observer reported that Colliers International’s latest reports forecast cities Australia-wide facing an imminent shortage of office supply due to these redevelopments.

Despite this, 303,000 square metres of additional stock is expected between the second half of 2014 and the end of 2018, while the outlook remains stronger than in recent past years.

“In line with the baseline forecasts, tenant demand is expected to increase and diversify beyond its current limits of the IT and Telecommunications sector, as economic recovery gathers momentum,” the DTZ report explains.

Vacancies are expected to remain at a range between 8% and 11.3%, even as rents grow. The resurgence, it appears, is in its infancy.