Supply v demand: A political game of smoke and mirrors

Australia’s low-income residents are expected to take on a colossal amount of private debt just to put a roof overhead in our rentier economy, and the only explanation they are being offered is that Australia is suffering from a ‘housing shortage’.

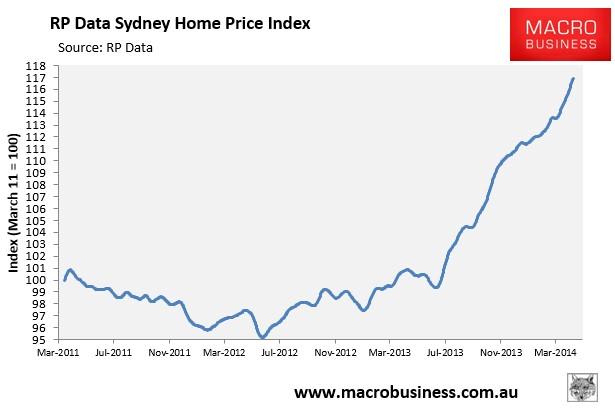

Speaking at the 2014 Bloomberg Economic Summit in Sydney, where the investor share of the market is close to 50% and finance commitments have sky rocketed some 44% higher than July 2013. Treasurer Joe Hockey, denied that prices were ‘credit fuelled’ because: "Fundamentally we don’t have enough supply to meet demand (and) that doesn’t suggest a bubble.”

His views were supported by David Cannington, senior property analyst at Australia & New Zealand Banking Group Ltd (ANZ), who referenced an apparent shortage of ‘300,000 homes’, while at the same time welcoming an elevated level of foreign speculation “as adding about $4.5 billion every quarter to total dwelling construction”.

The shortage Cannington refers to, is derived in part from research put together by the National Housing Supply Council (NHSC) established in May of 2008, just prior to the last Senate inquiry into housing affordability, yet promptly disbanded by the incoming Abbot government who are now only too willing to use its findings to support their populist view.

Using ABS data, the NHSC assessed what is known as ‘underlying demand’ - the amount of extra housing needed per annum over the last decade for all residents in Australia (not just active buyers) - ‘if’ we had continued to produce enough homes for an increasing population based on existing household composition figures.

The supply side findings of the report were hotly debated and justifiably so.

Planning for population growth is not an easy task, it is predictive in nature and makes many assumptions and revisions along the way.

However, this was not the NHSC’s only role.

It was also commissioned to produce a comprehensive evaluation of Australia’s affordability problems, which included the status of those impacted most – homeless, renters, first home buyers, low wage families and tenants in the public and social housing system, which helped clarify its findings.

For example, the reports showed utility costs such as electricity, gas, water, and sewerage, have been increasing at more than 10% per annum – yet they are not typically calculated as part of current analysis of housing affordability constraints.

They gave a good statistical overview to show a dramatic shortfall of affordable rental accommodation for low-income families. And clear evidence that our housing crisis is not that we do not produce enough homes ‘per se’ – but that we do not produce enough affordable and feasible options across the sector as a whole – in both the public and private sphere.

For example - the report noted a “shortage of housing for lower-income people (specifically families) that results from a mismatch of housing prices relative to income”.

It made a point of stressing that Australia’s supply challenges cannot be met by ‘simply adding to the housing stock’. And further elaborated on the inability of apartment construction to meet both need and price for the majority of family residents - the value of the land and associated costs being too high, and the size of apartments being too small to adequately fulfil the task.

This places Cannington’s second comment – regarding the level of foreign investment pushing an unprecedented inner city boom in apartment construction, into context.

For individual renters, students and a small percentage of couples living downtown, the increase in high-density accommodation will assist in placing downward pressure on rents.

It cannot however assist in addressing Australia’s real housing shortage or accommodating the growing number of family and low-to-middle income residents, that want to buy – not just rent - and in the face of declining wages, find it increasingly difficult to do so.

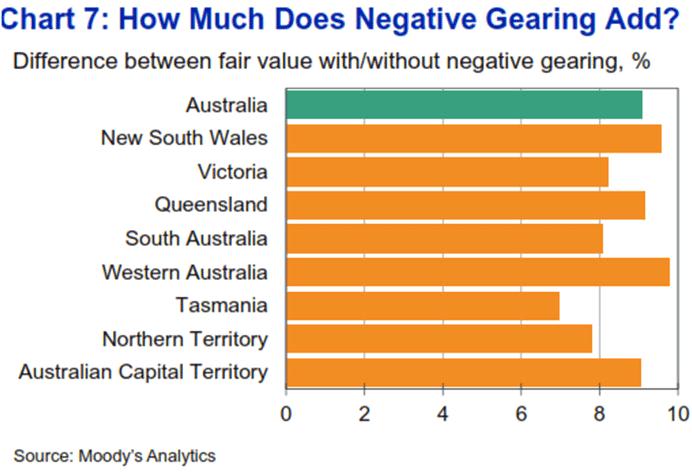

This is not because we have booming population growth and a shortage of roof space, as our ministers are fond of sermonizing. But because our tax policies work directly against it, subverting supply side policy and negatively affecting wage growth by pushing up the price of land and the associated costs of doing business.

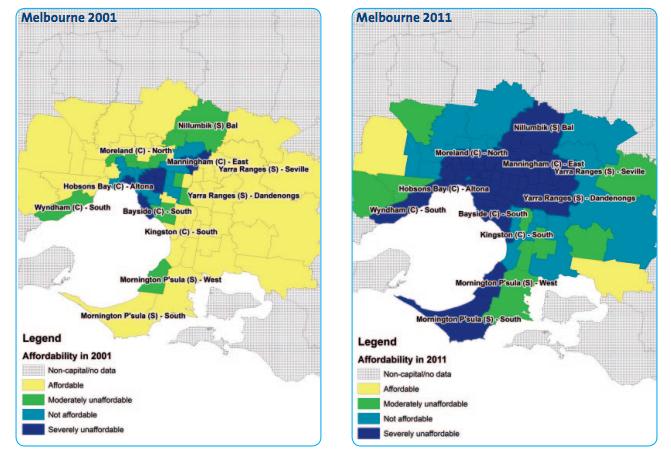

They encourage a system of false scarcity, in which land and dilapidated housing is hoarded and not effectively utilised, forcing a process of social polarisation, as low income residents are forced to ‘hop’ both the middle and outer rings, in search of cheaper options further afield.

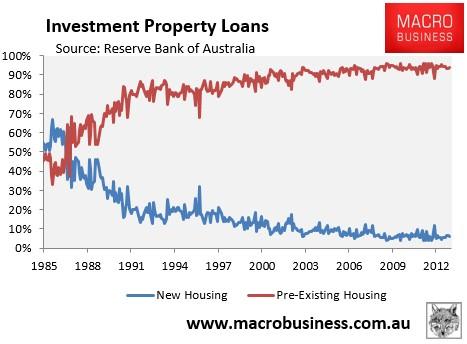

They distort the use of the nation’s savings, encouraging speculation on rising land values. This negatively affects the financing of new supply, as investors chase the capital gains associated with established stock, over and above rental income.

The behavioural impacts are profound, amplifying the boom and bust swings of the market cycle.

The financial sector accommodates, with property prices dependent on how much ‘endogenously’ created credit a bank chooses lend, subject once again, to our dysfunctional tax system.

Negative gearing, depreciation and lower land taxes, leave more economic rent available to be pledged to the banks in the form of higher prices, producing a rentier economy which prioritises ‘creating wealth’ through asset inflation and rising levels of private debt - rather than improving living standards by supporting tangible investment into value adding activities.

Article continues on the next page. Please click below.

The distortion that inflated values have on the economy acts to subvert housing policy as any danger of a marked decline in prices, places an associated risk on financial stability.

Affluent neighbourhoods are therefore protected from ‘over development’, while inelastic responses to market conditions, allow professional land-bankers to squat on sites at low cost and secure windfall gains when they are later rezoned for residential development.

Stamp duty further restricts labour mobility and the regular turnover of housing stock.

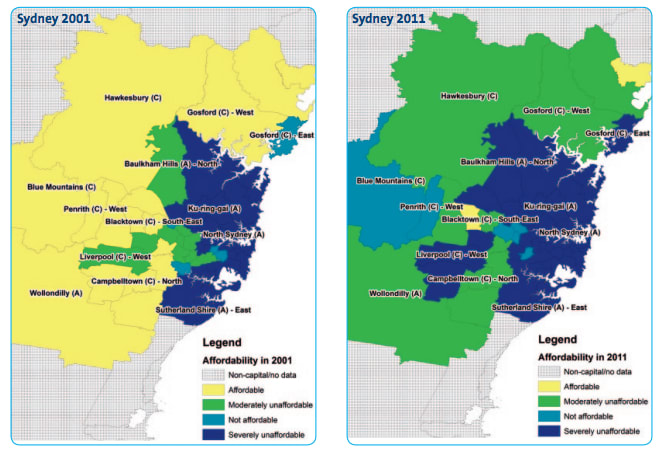

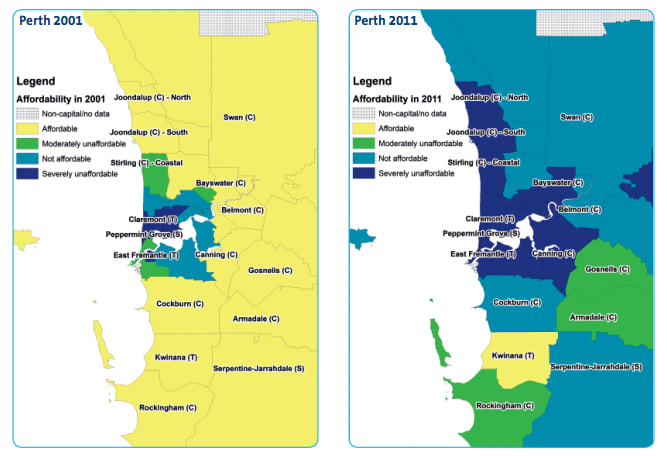

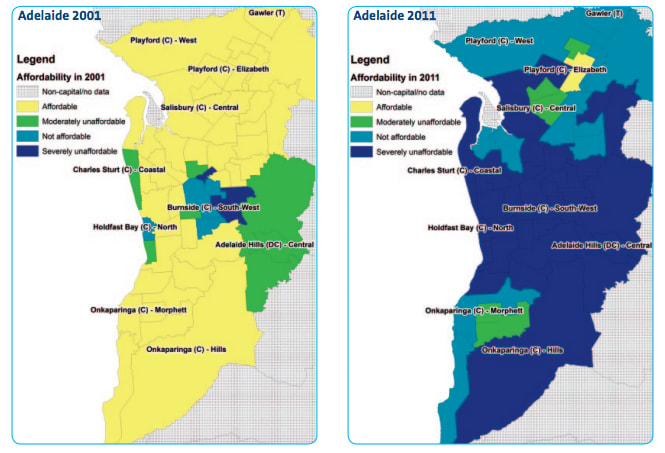

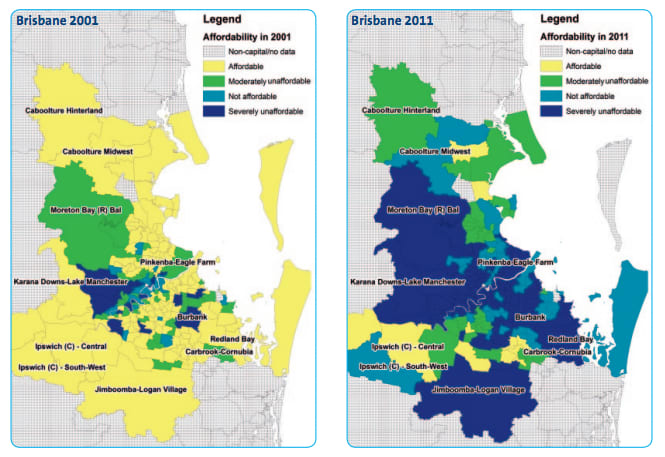

The resulting effect is illustrated on the maps below that show where affordable options were located in 2001 for low-to-middle income buyers, compared to 2011, in all of our major capitals.

The yellow patches being affordable, and blue patches unaffordable.

Source: NATSEM Income and Wealth Report Issue 29 - The Great Australian Dream - Just a Dream?

Prior to the 1970s, infrastructure financing was funded in part through the capture of economic rent from the land that directly benefited from the accompanying improvements.

Now, infrastructure costs are financed through deadweight taxes on productivity from residents who derive no benefit in their own local neighbourhood, or loaded onto the upfront cost of new dwellings and promptly passed to the buyer.

The banking lobby loves minsters like Joe Hockey that offer no threat to their profits and instead, waft away any necessary concern over rising prices with simplified responses that fail to identify the root cause.

It has driven up the cost of housing – damaging the potential of future generations, with a lifetime worth of debt sold as “forced savings”, while the interest is re-packaged an into an array of obscure financial instruments, allowing the country’s wealth to gravitate into an elite nuclei of financially strong hands.

Notwithstanding, all the above points were highlighted in the last Senate inquiry into housing affordability, as well as being set out clearly in the Henry Tax review. Yet studiously ignored in a budget that surgically set about reducing the living standards of Australia’s low to middle-income earners, the most productive sectors of our economy, rather than collecting the tax revenues from resource rents and monopoly profits.

Joe Hockey has reaped substantial unearned gains from an impressive portfolio of property investments - reportedly, picking up his Canberra home “for a song” in 1997 at $320,000, and watched that land value more than triple in nominal terms to an estimated $1.5 million today.

In light of the above evidence, it can only be assumed that Hockey’s comments are based on a vested interest to protect his own back pocket and seat in power, rather than the urgent need to invest in Australia’s future by eliminating the losses inflicted by our current system of taxation that forces up the cost of land and associated levels of private debt.

Instead we need to move toward a system that finances society’s needs and infrastructure requirements, from capturing the economic rents currently capitalised into the price that buyers negotiate when they purchase a home, which would eventually act to improve the living standards of all, not just the privileged few.