Is it "insane" to invest in mining towns now? Well, it was never a good idea in the first place

I noted recently how I was bemused that investment advisors have recommended buying property in mining towns.

Looking back, I said that my view is that this is "madness" - in retrospect an unfortunate choice of word - perhaps "foolhardy" would have been a better choice.

Anyway, this morning I received this podcast in my inbox from Real Wealth Australia which went even more to the point:

"The mining industry is over. Resources is over. People buying in those towns...it's just insane".

Clearly, I agree that it's necessarily a very smart idea to speculate in mining town property, right down to the misuse of inappropriate terminology.

But what really left me scratching my head was it that was Real Wealth Australia that was recommending mining town property in the first place.

What I can't for the life of me fathom is what has changed to cause the reversal in viewpoint.

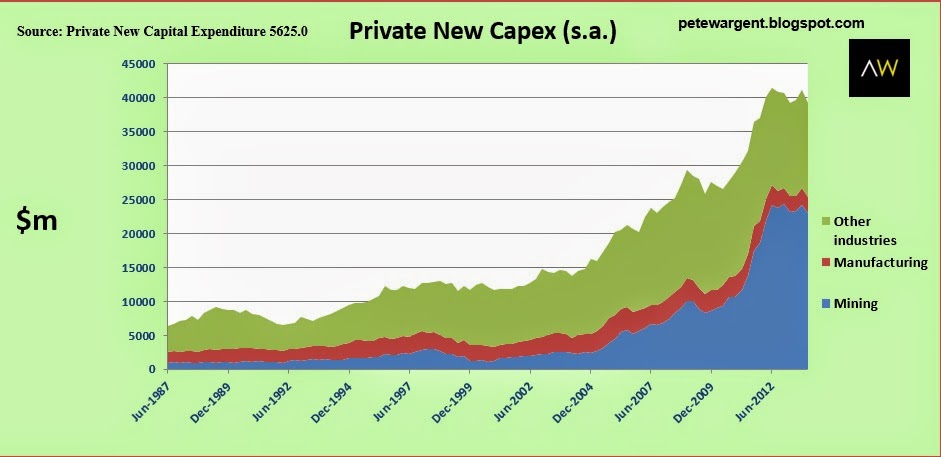

It surely can't be the peak in mining investment as the construction boom gets set to recede, since that has been well known about for years and well documented all over the press and the internet.

In fact my former employers Deloitte have been warning about the forthcoming peak of the mining boom for so long that it had become something of a point of general amusement and occasional mirth in certain media circles.

And it certainly can't be the reversion of commodity prices which has caused the shift in viewpoint, since I don't know of anyone who seriously believed that Australia's terms of trade could remain so grossly inflated against their long-term averages.

It wouldn't make any sense to have based any strategy on such a hugely obvious anomaly.

Of course commodity prices globally are somewhat unpredictable and, for example, the copper spot may eventually rebound as the global economy recovers and should demand from Asia remain strong.

But the fact of the matter is that the RBA's index of commodity prices is heavily weighted towards Australia's bulk commodities (iron ore, thermal coal, metallurgical coal) which account for 56% of the index. If they tank, so does the index.

The iron ore price has taken a shellacking this year, but again it seems highly unlikely that anyone could have believed that a price which had run up from $1 per tonne to $180 per tonne in a decade could ever be sustained.

Even now back down at around $95 per tonne, there are plenty who are arguing the spot price must revert towards its longer term average.

So I'm basically stumped.

The transition from construction phase of the boom to production phase is the only thing I can come up with, but even that has surely be known about for years.

Property investment can be a very effective long-term strategy and act as an inflation hedge if you invest in landlocked suburbs of capital cities which have growing populations.

This is because new dwellings must be constructed to house the new population and new houses must always be built in today's dollars and at today's labour and materials costs.

However, when people focus on the cash-flow element of property as being more important than the basic fundamentals they can get themselves into a real mess, because they are trying to wrench investment property into something it's not meant to be (i.e. an income asset).

If income today is your primary focus, residential property is the wrong asset class.

I saw this first-hand in Britain when investors who focused on yield at the recommendation of seminar promoters were buying in small towns in the north-east or the Potteries before the financial crisis.

Prices crashed to zero in some extreme cases (and if you're going to buy regional, it's post-crash that you should buy).

Mining towns sit right at the top of the risk spectrum - frankly, they never were a very good idea for most investors, and they certainly aren't right now.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .