Inner ring the best bet in Sydney and here's why

GUEST OBSERVATION

If NSW and Sydney are representative of the market dynamics on the national scale then there is a straightforward answer to question “Where to buy?”

Centrally located properties in the capital city offer the best return long-term for passive property investors, whether owner occupiers or those buying to let.

A Common Dilemma

Property buyers face a choice between more affordable properties which offer attractive rental yields but are further away from the city centre or in regional locations, or more expensive properties in central locations but with possibly much lower rental yields.

Many property advisors would recommend the first option, as it offers better cash flow from day one with reduced capital commitment, all things being equal.

However, for passive investors the second option is a much more sensible choice. This also holds true for those who buy and hold properties over a long period and are not into more adventurous activities like buying to renovate or redevelop, looking for a quick flip, or to access an exceptionally high yield over a short period of time.

Let’s examine historical information that leads to this conclusion.

The Evidence

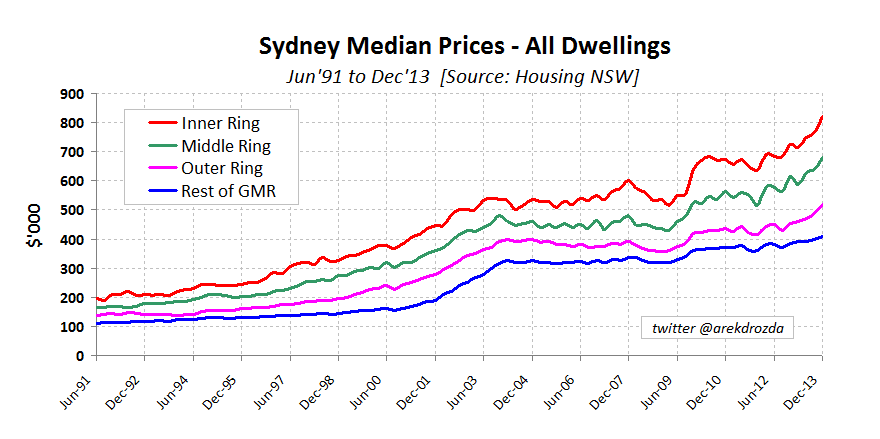

Housing NSW publishes quarterly sales statistics for Local Government Areas (LGA) and the records date back to 1991 for many locations, totalling just over 22 years of data.

The information is grouped into inner, middle and outer rings for Sydney, as well as into regional centres (i.e. “Rest of Greater Metropolitan Region”) and the rest of NSW.

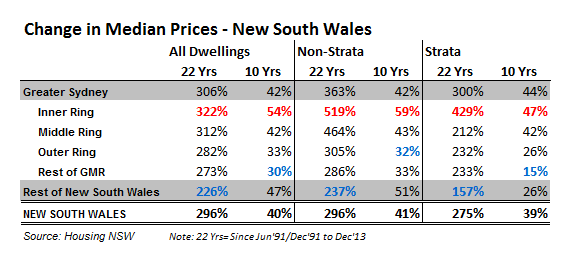

Simple analysis of changes in median prices over the past 22 years (from July 1991 to December 2013) reveals quite an interesting picture, as summarised in the table below:

The increase in median prices in LGAs located in the inner ring outstrips the rate of growth in any other region in NSW.

This is particularly the case with non-strata dwellings which increased over five times in the last 22 years (that is, December 2013 median price is now six times 1991 median price), comparing to 2.4 times rise for the “Rest of NSW”. The difference over the 10 year period is not as dramatic, with the exception of strata dwellings, but still the pattern is obvious.

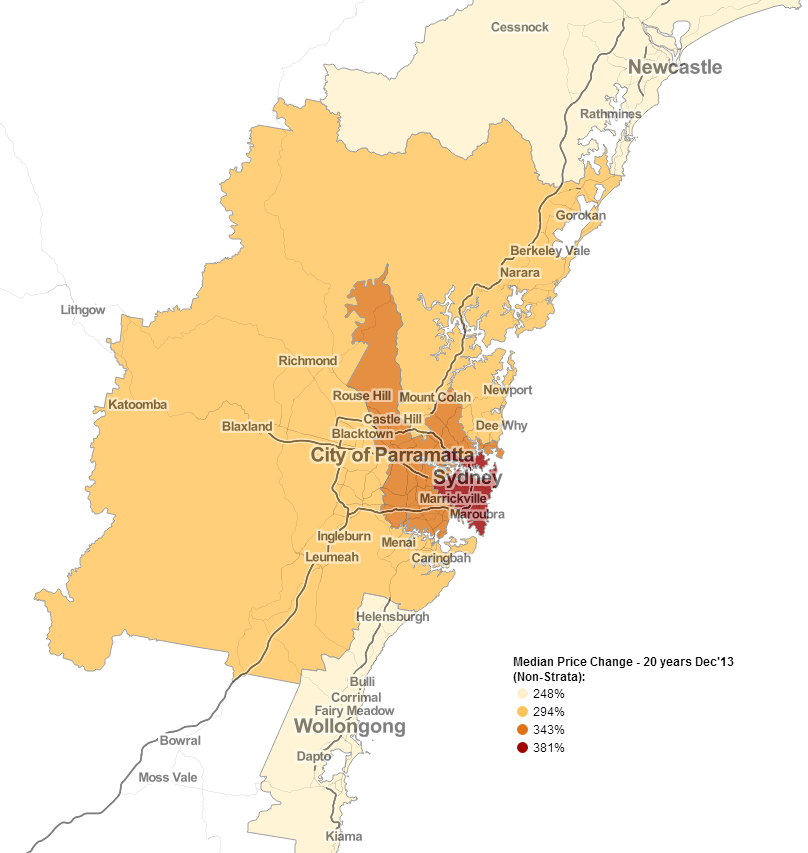

The following map presents a 20-year perspective on median sale price growth of non-strata dwellings to highlight the key point [click image to launch interactive map]:

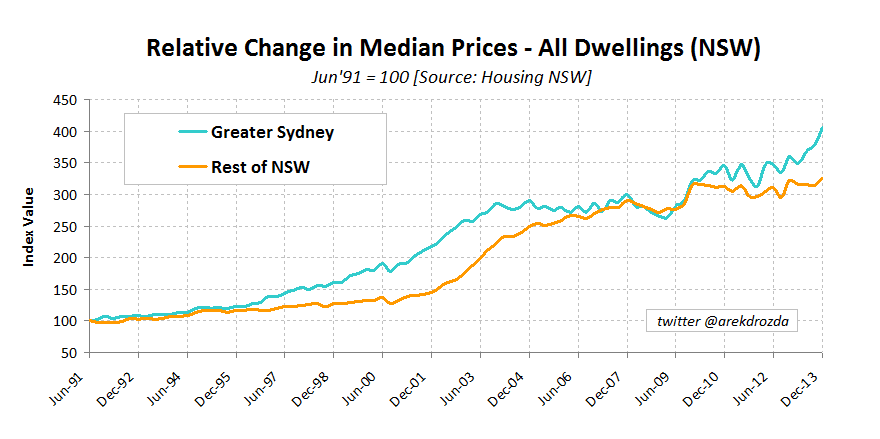

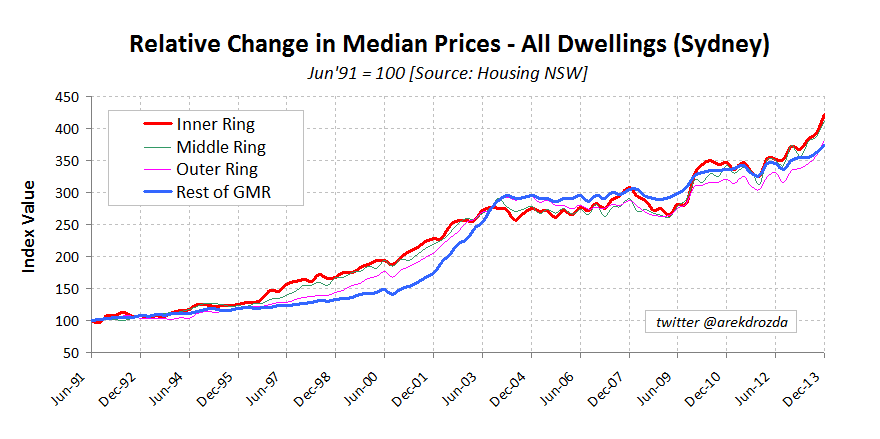

Let’s chart the relative change in median prices over time for additional insights.

The picture is quite clear – over the long term, median prices grew faster in the metropolitan area than in the rest of NSW.

Again, over the long-term median prices in the inner ring LGAs grew faster than for the rest of Sydney (with exception of a short period between 2000 and 2003).

Article continues on next page. Please click below.

What It All Means

There are important clues in the above charts for property buyers. In particular:

- The inner ring properties show higher volatility in median price movements at the time of economic uncertainty – which means, timing of purchase decisions is crucial and there are bargains to be found for those with contrarian views (or well informed!).

For example, median price for the inner ring increased from $515,000 in March 2009 to $822,000 in December 2013 – a jump of over $300,000 or 60% in just four and a half years, comparing to a $98,000 or 28% increase for the regional part of GMR. The bargain buys can deliver even more substantial returns than indicated by changes in median prices.

- Between 2003 and the end of 2007, which is generally perceived as a period of no price growth in Sydney, the inner ring still recorded material gains in median prices.

This illustrates that attractive and desirable locations tend to maintain the momentum when the rest of the market stagnates.

- Unless you buy two properties in the outer areas for the price of one in the Inner Ring, the math favours buying in the more expensive area.

That is, if you opt for a cheaper property instead of buying in the Inner Ring, even if that location experiences comparative price growth to the inner ring, the higher priced location would have delivered better overall profit.

For example, based on the above chart, a $100,000 property purchased in 1991 in regional part of Greater Metropolitan Region would quadruple in value to $400,000 by December 2013 (i.e. $300,000 rise). Not bad. However, a property purchased for a median price in the inner ring, which also quadrupled in value, would increase from $200,000 to over $800,000, delivering $600,000- a whopping $300,000 more- in capital gains.

“But the yield!” you may say. Well, in this case 1% or even 2% better rental yield on the cheaper property would not make up the difference.

- Outer regions can outpace price growth of the inner ring properties over a short period and price growth in those regions generally lag the metropolitan region – which presents an opportunity for late comers who missed out on the “city boom”, including first home buyers.

However, since timing of the purchase plays a crucial role in catching the maximum price movement, investment in regional properties should be viewed as rather opportunistic (not to say speculative) and therefore as suitable for only more adventurous investors or buyers who are prepared to stick to their decision for a long time.

Zooming In For more details

We know now that the inner ring offers the best opportunity for price growth but it has to be acknowledged that not all locations within the region perform equally well over time.

The following table summarises change in median prices in the last 10 and 20 years for LGAs located in the inner ring.

Some locations are better for non-strata dwellings – Marrickville for example did quite well with median price increase of almost 4.5 times over 20 years, while other are more favourable for strata properties, like Waverley which increased by a similar proportion.

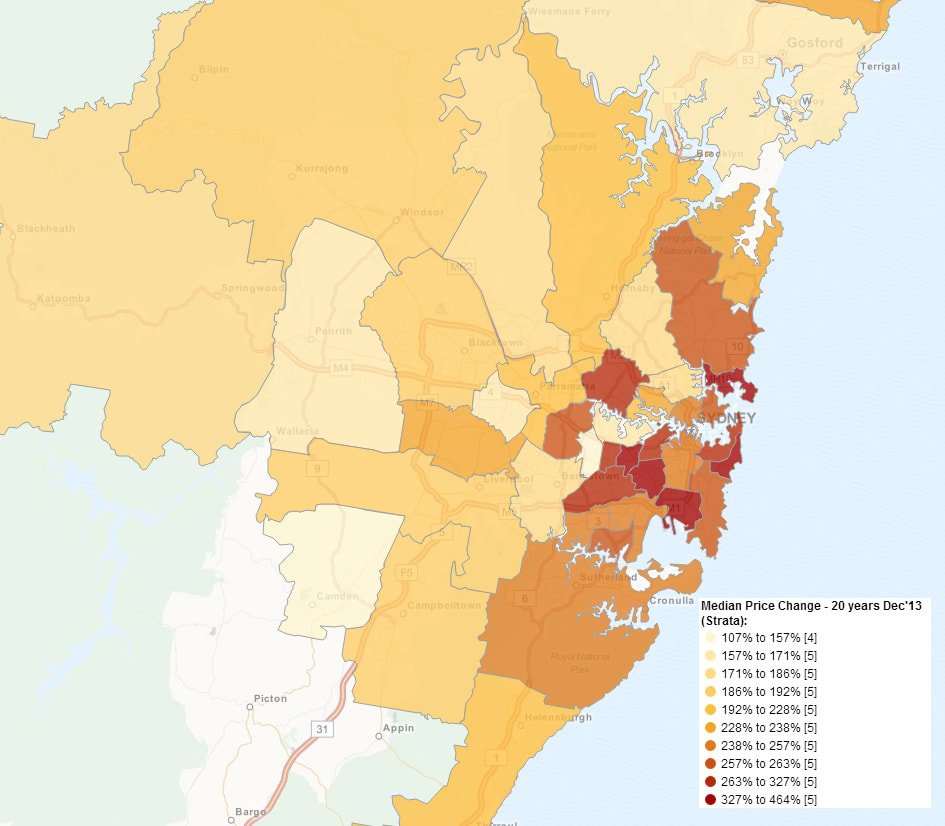

The map below highlights where the largest change in median prices was for strata dwellings over 20 year period [Click image to launch interactive map]:

View all maps, click here.

This illustrates that choice of location and compatible property type are very important considerations in making purchase decisions.

Another observation worth mentioning is that even the worst performing locations in the inner ring did better for strata and non-strata dwellings than the worst regional locations. This should give confidence to the first time buyers or novice investors that buying in the inner ring can compensate to some degree for less than optimal choice of specific location.

End Note

As a prospective buyer – whether investor, upgrader or first home buyer – you are facing three fundamental questions: What to buy? Where to buy? When to buy?

Each of these questions can have quite a complex answer, which I will continue to explore on Property Observer with detailed analysis as well as via regular features, like my monthly State of the Market reports.

However, in the end, it all boils down to a simple, frankly quite boring but well proven formula – location, location, location! One cannot go wrong following this simple advice.

Arek Drozda is an independent property market analyst.