Letter from the editor: FHBs, if you're not wealthy you will have to compromise

In the middle of articles about Tinder, student actors, Asperger's Syndrome and book reviews an article called 'Gen rent' jumped out at me. I was reading Issue Two of Catalyst, the RMIT student magazine and I began reading with enthusiasm.

It discusses Sarah (her name "changed for privacy reasons"), a Gen Y who has purchased a unit and lives with her parents while repaying the bank and renting the property out.

Later in the article AHURI director Wendy Stone discusses that there's no typical way of becoming a home owner, and points to it being time for "lateral solutions to housing issues" and adaptive behaviours, whereby siblings and friends purchase together. She notes that "... young people should definitely think creatively with each other" on how to get into property. An interesting discussion itself.

And then writer Alan Wedon gives the floor to "Sarah", where the following is written:

She also says Gen Y is being pushed out of home ownership by Baby Boomers, who have a greater capacity than in previous decades to invest in private home ownership - driving house prices up even further.

"It's a wicked problem really," she says. "Because as well as competing against investors, wealthy retirees and other first-home buyers for housing, members of Gen Y are also forced into competing with each other in the private rental sector.

Anger, it may appear to those new to the debate, is rampant among FHBs. Affordability is a numbers issue, and one discussed heavily on Property Observer. But attitude is another issue entirely, and the attitude from those who are interested in getting into the market is fascinating.

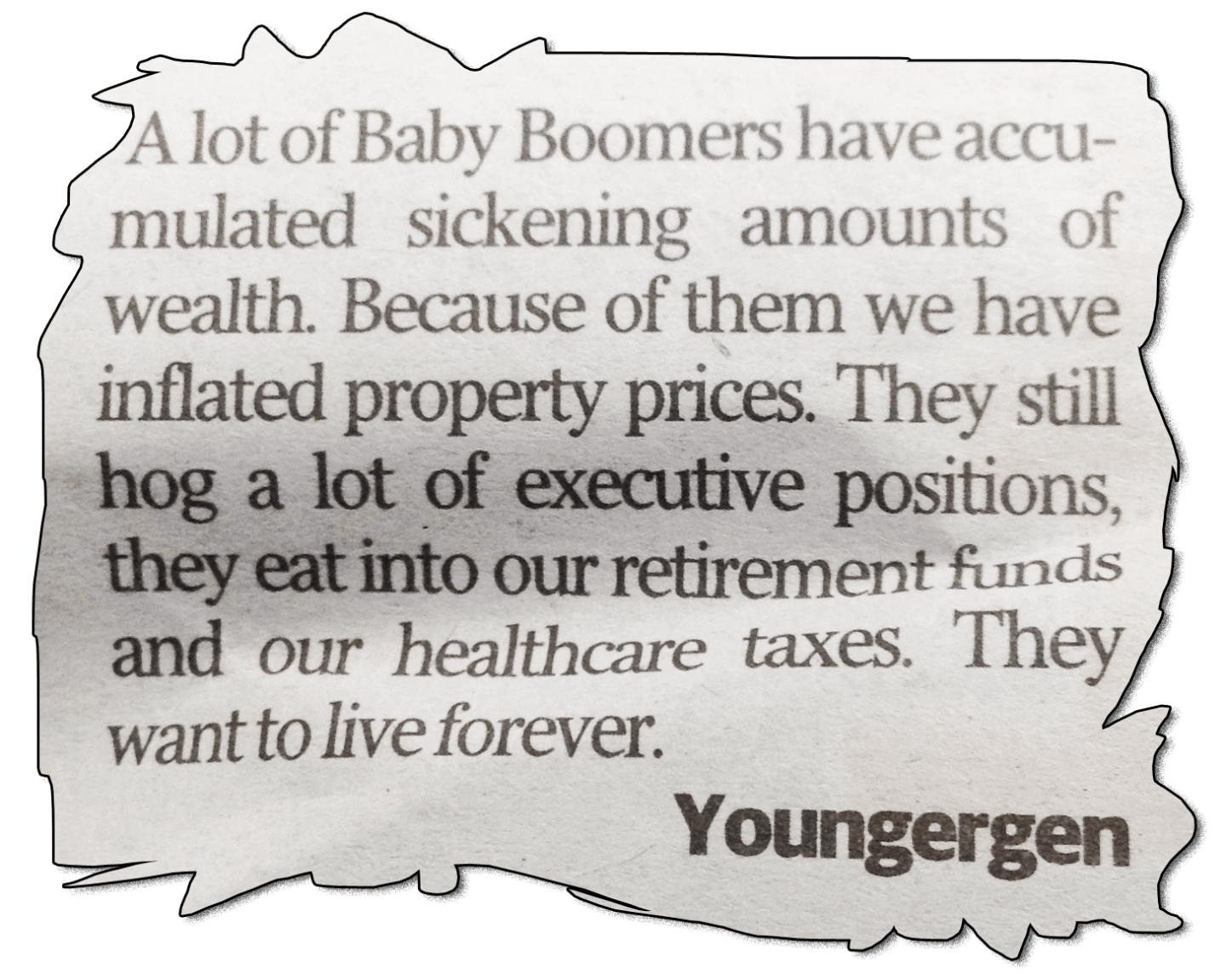

A comment in mX had me saving it a while back (pictured below), and it reflected the above sentiments almost to the word.

Source: mX - Vent your spleen

I'm assuming, hoping, that the above is satire. But if we're at the point where someone can satirize in a non-property related publication about the anger and blame coming from first home buyers, then it's worth noting.

With the news that the Abbott government has scrapped the First Home Saver Accounts scheme in its first federal budget, many account holders have understandably been left confused about what will happen to their money.

But should we be blaming the older generations and investors for ruthlessly pushing up prices? And, shoe on the other foot, should we be slamming first home buyers for being too picky and swanning off on European holidays one time too many?

Blaming other people is completely human and, for that reason, spills into property. In the same way that some like to violently blame foreign investors for facing off against the battlers, which I have not been able to see myself at a single auction, the younger generation likes to blame the older generation for pushing up house prices. And the older generations like to blame the younger generations for being far too selective.

As Terry Ryder has previously written for us, and discussed with myself, the 'real' questions around first home buyers are not being asked.

He says that the real questions we should be asking include the following:

- Why do you think you can't afford to buy?

- Have you tried to buy?

- Where have you looked?

- Are you willing to compromise to get into the market?

Compromise - the 'c' word that no one wants to hear. It relates not only to compromising on where and what you buy, but potentially also your lifestyle. Those who claim our parents never had to do these things are sorely mistaken. Speaking of the UK market, and then the Australian market, my parents tell stories of keeping the heating off in the coldest English winters and eating chilli-con-cabbage to afford their property as young 20-somethings. There's no shame in this, and I have huge respect for them for managing to raise us simultaneously. whether or not you must compromise more now if you want to get into property is debatable, but the reality remains that if you're not born into a wealthy family (who are then willing to provide you funds) and if you don't immediately step into a high income earning role (if you ever get to this position) then compromise is going to be a requirement.

A conversation I had recently with someone looking to buy their first home so they could move out together, revealed that they were looking for an apartment within the inner ring of Melbourne, in a few choice desirable suburbs that they listed to me. They were not looking for something new, necessarily, but well-presented and sizable, preferably with a car space. Fair enough.

But then they were finding themselves quickly outbid by "older people" when they attended at auction. They expressed frustration with the process. I suggested that they look further out west and ignore Melbourne's city, suggesting that in parts of Melbourne's west (and we're talking past Rockbank) there are house and land packages for four-bedroom, two-bathroom houses on around 600 square metres of land for a sum amazingly less than that. Not to mention the established property market, where three-bedroom, one-bathroom houses for around the $200,000 to $300,000 bracket.

The reasons for saying "no" without even a Google, was not due to the slow capital growth prospects, which are of course an issue, but because the area is "too far out" and they "like" the area they're look at.

I had a painfully similar conversation with someone who was looking to buy in the Eastern suburbs, but was then told that Melbourne's west was too far from their friends and family, and from work. It's 35 to 45 minutes on one train from Southern Cross Station. I happen to live in one of these areas, and do so because it's cheaper - not because it's my dream area to live in.

This, to me, sounds as though it answers those clarification questions.

But it doesn't mean Generation Y is full of whingers, or picky - and, indeed, not all of them even want to own property - much has been said on the demographic shift we're seeing. Plenty of those who are prospective buyers are completely prepared to "wait it out" until they find the property that suits them. Others will eventually consider suburbs further out, or they'll buy something smaller that needs doing up. Or, they might not want to rent in the first place.

I discussed with Charles Tarbey, the chairman of Century 21, his first property. He told me it was a run-down property in a rough area of Sydney's west that still has a bit of a bad reputation today. It did grow in value, he sold it, and he used the profits to help open his first real estate agency.

Those who say buying a first home isn't hard are mistaken - a deposit even on a "cheapie" property is not an easy achievement. However, we do have an issue on both sides of the fence about blaming other generations for their own individual problems. It's far too easy to ignore the reality - that for those who are not wealthy, it has never been easy to purchase a first home and it will require a great deal of compromise one way or another.