Highest national vacancy rate for April ever recorded: SQM Research's Louis Christopher

New figures from SQM Research have seen vacancy rates jumping across the country, to see the national figure hit 2.3%, compared to 2.0%.

It’s the highest vacancy rate recorded for April since the inception of SQM’s index, in 2005, and SQM's head of research Louis Christopher expects that for some areas this could be about to get worse.

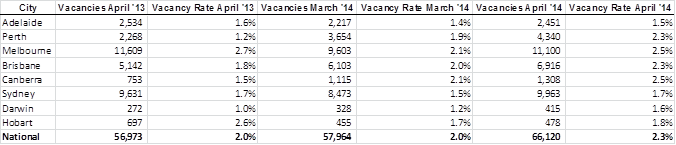

As can be seen in the table above, increases were seen across all states and territories in April 2014, compared to March 2014. When compared to the corresponding month in 2013, the story is somewhat more mixed.

Adelaide is down 0.1% since April 2013, and the market is also tighter in Hobart and Melbourne.

Perth and Canberra “are clearly looking sick” Christopher explained to Property Observer, “and I would say Darwin is going to follow suit.”

Melbourne, he noted, is bouncing back after two tight months previously.

“Nevertheless [it’s] more than just coincidence as our asking rents also recording a stagnant rental market,” he said.

National asking rents have remained flat, and over the past 12 months to May the capital city increase for units was just 1.7%, while dropping back 1.5% for houses.

“As we predicted this time last year, rental growth is slowing to the point where we are recording a flat rental market and in some instances significant rental falls as is the case with Perth and Canberra. With the national recovery in building approvals and completions, I can only surmise that the rental market is increasingly going to favour tenants over the next 12 months. And so rental yields for potential property investors will look even less attractive from their current low levels,” Christopher said.

Despite this, the Real Estate Institute of New South Wales’ vacancy rate statistics have seen pressure remain on Sydney’s market, as well as Wollongong, Albury and the Northern Rivers.

However, they also recorded a vacancy rate rise – bringing the number of properties for rent up 0.3% across Sydney, explained REINSW president Malcolm Gunning.

“Inner Sydney vacancy rates remain the tightest, despite an increase of 0.3% to 1.6%. In middle Sydney availability rose 0.4% at 2.0% and outer Sydney was up 0.2% at 1.7%,” said Gunning.

Inner city LGAs include Ashfield, Botany Bay, Lane Cove, Leichhardt, Marrickville, Mosman, North Sydney, Randwick, Sydney, Waverley and Woollahra.

Middle Sydney LGAs includes Auburn, Bankstown, Burwood, Canterbury, Canada Bay, Hunters Hill, Hurstville, Kogarah, Ku-ring-gai, Manly, Parramatta, Rockdale, Ryde, Strathfield and Willoughby.

And outer Sydney includes Baulkham Hills, Blacktown, Blue Mountains, Camden, Campbelltown, Fairfield, Gosford, Hawkesbury, Holroyd, Hornsby, Liverpool, Penrith, Pittwater, Sutherland, Warringah, Wollondilly and Wyong.

Wollongong vacancy rates are now at lows that were last seen three years ago, said Gunning.

“Wollongong is an attractive proposition for those who wish to relocate from Sydney. Its beachside location is a more affordable option for those who are seeking a more relaxed lifestyle and this is putting pressure on the number of properties available,” he said.

Meanwhile, vacancy rates dropped 0.5% in Albury and the Northern Rivers, while Newcastle’s increased by 0.5%.