Labour market headwinds see east coast suburban office vacancies up: Knight Frank

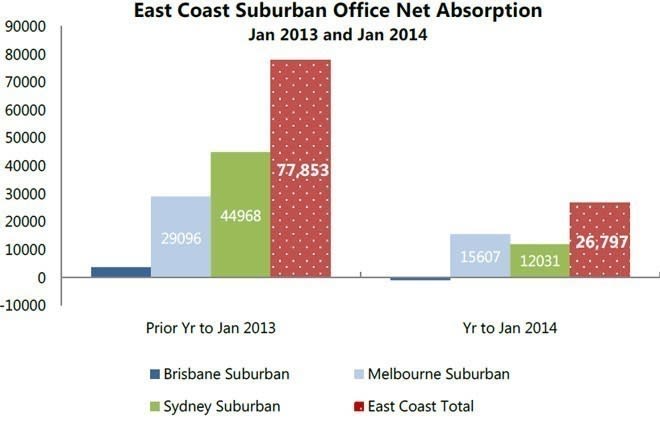

Moderate growth in office stock take-ups from government related leases in Sydney and Melbourne and demand from smaller private tenants has not been enough to overcome slowing tenant demand, according to Knight Frank’s Annual Eastern Seaboard Suburban Office Report.

However, in spite of the understated performance in leasing markets, the report noted that east coast investment sales activity reached record levels over 2013, with $1.15 billion worth of sales greater than $10 million, a result that was up 62% from 2012 level and that exceeded the previous record in 2007 by 12%.

The report cites sluggish labour market as a primary factor in decelerated demand in the suburban office market. The east coast suburban vacancy rate for January was at 8.2%, up from 7.5% the year prior, said Knight Frank head of research and consulting, Matt Whitby.

“The only market to buck the upward trend in vacancy rates over the past year was Brisbane (9.3% down from 10.2%), albeit this was solely driven by the improved performance and take up which occurred in the inner north eastern precinct, including suburbs such as Lutwyche, Nundah, Eagle Farm and Hamilton,” said Whitby.

“Over the past year, the suburban vacancy rate in Melbourne increased from 6.1% to 7.5%, whilst Sydney’s suburban vacancy reached 8.7%, up from 8.4% a year earlier.”

Frank Knight reports that supply levels have remained relatively benign, with gross office supply levels in all markets over 2012 and 2013 below the historical average. In 2012 the total east coast office supply was at 87,996 square metres, while in 2013 84,527 square metres were supplied.

“Development activity in the suburban market is expected to pick up in 2014, with just over 100,000 square metres expected to be completed, driven by larger developments in Melbourne and Sydney,” noted Whitby.

“These projects are underpinned by government/public sector entities such as the Australian Taxation Office (two buildings), South East Water, Australia Post and the CFA. The suburban markets are expected to remain largely pre-commitment led for the larger projects, attracting cost sensitive but location indifferent entities which seek modern, large floor plate accommodation. In addition, some smaller speculative construction in the office parks is expected to continue.”

Average east coast suburban office gross face rentals have recorded approximately 0.4% growth for A-grade assets over the past 12 months. Weighted average A-grade gross face rents are currently $403 per square metre, ranging on average from $441 per square metre in Brisbane to $396 per square metre in Melbourne.

However, gross effective rents (rents averaged over the full term and taking into account incentives or rent-free periods) fell by 1.9%, as incentive levels over the year. Prime incentives were up over the year, according to Knight Frank, averaging 22%, from 20% a year ago on a weighted basis.

The eastern seaboard suburban market’s highest average face rentals were found in Brisbane’s inner north precinct, at $475 per square metre.

“Although the majority of sub-markets recorded flat to negative rental growth over the past 12 months, the exceptions were the relatively strong performing markets of the outer east in Melbourne along with the south and inner west in Sydney,” Whitby commented.

“Gross face rental growth was highest in the outer east precinct in Melbourne at 4.1% and the majority of which came from the lift in prime rents associated with the development of new generation projects built over the past two years.

“In Sydney, the south region, which recorded gross face rental growth of 2.4%, has been one of the better performing markets in terms of leasing activity as a result of relatively firm enquiry levels seeking creative style accommodation along with access to the improving amenities of the area. In the Sydney Inner West, face rental growth of 2.4% has been recorded on the back of the steady momentum in the Sydney Olympic Park and Rhodes markets, albeit the rise in A-grade incentive levels to 24% from 22% offset the growth on an effective basis.”

Of the suburban market’s performance in comparison to results from the CBD, Whitby noted that the suburban market continues to trail behind.

“The suburban market continues to lag the yield compression being experienced in the CBD and core markets. However an average 20 basis points of firming occurred over the past year, driven by Melbourne which recorded a 40 basis point compression in prime and 50 basis point of firming in secondary assets,” he said.