Residential v commercial property: The different return characteristics

The two fundamental characteristics of property investment are rental income paid by tenants and the value of land and buildings which form the income and capital return components of property returns. Return characteristics of residential property differ significantly from commercial property.

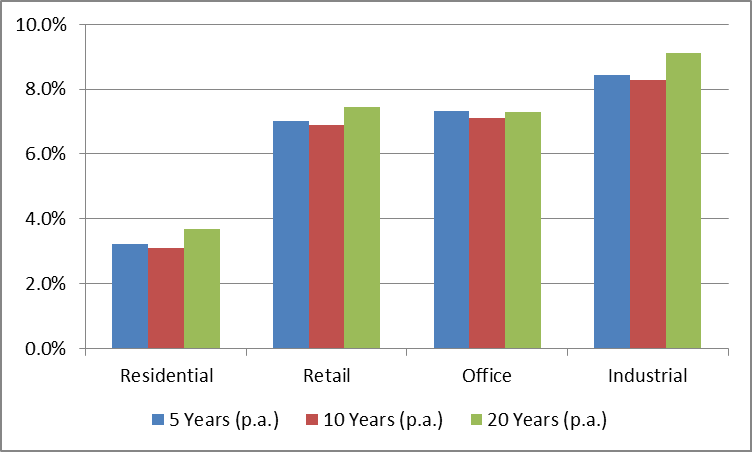

Chart one (below) shows the income returns or yield of residential property and retail, office and industrial property sectors for periods to September 30, 2013.

Chart one – Income returns – Periods to September 30, 2013

Source: REIA, IPD/PCA, Atchison Consultants

Income returns are calculated by dividing the net annual rental income by the value of the property. As shown in chart one, commercial property income returns over medium to very long-term periods are reasonably consistent across each sector. The income return for residential property at around 3%-4% per annum is significantly lower than that of the commercial property sectors at around 7%-9%.

Owners of commercial property receive substantial rental income as the location of the businesses that are its tenants is vital to the profitability of those businesses. Rents for commercial property are dictated by demand, with premium locations providing premium rents. Retailers require the right demographics and access to foot traffic; industrial tenants require access to suitable infrastructure such as freeways and rail and office tenants require the proximity to key markets, clients and qualified staff.

The attractiveness of residential or commercial property investment is heavily reliant on the ability to attract and retain tenants. Appraised value of commercial property is directly related to the quality of the leasing schedule and the current or expected level of vacancies.

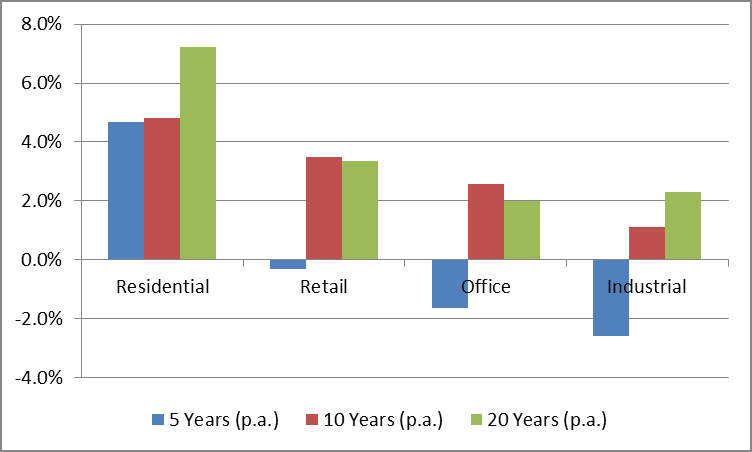

Chart two (below) shows compound annual capital returns over five, 10 and 20 year periods to September 30, 2013 for residential and commercial property sectors.

Chart two – Capital returns - Periods to September 30, 2013

Source: REIA, IPD/PCA, Atchison Consultants

Residential property has outperformed commercial property sectors in terms of price growth over all measured periods, particularly the 20 year period. A range of factors has contributed to this significant growth, including government incentives such as the first home owners grant, population growth and booms in industries such as mining. The absence of tax on capital gains for owner-occupiers and the tax deductions for investors through negative gearing are also significant contributors to residential property capital gains.

Residential property is generally considered as a capital return investment, rather than an income producing investment. Commercial property investment returns comprise relatively high income returns and is less reliant on capital gains. Capital gains for commercial property tend to be around inflation levels (when positive), reflecting leases that are indexed to inflation or a fixed rate in years between market rental reviews. Capital gains for residential property tend to reflect demand drivers, such as population growth and affordability, and supply drivers such as the availability of finance and the feasibility of development projects.

Investment in residential property is limited to direct purchase of single assets, whereas commercial property can be accessed through purchase of an asset or indirectly through property syndicates, unlisted property funds or listed AREITs.

Paul Easton is a senior analyst at Atchison Consultants.

RELATED ARTICLES

SMSF gearing versus personal gearing in residential and commercial property by Michael Laurence

Should you invest in residential or commercial property? By Mark Armstrong