Some positive signs for the economy, but residential construction is going nowhere

The reported seasonally adjusted estimate for total construction work done rose by +2.7% to $53,427 million for the September quarter, outshining expectations and being driven by increases in non-residential and engineering construction.

Source: ABS

It was pleasing that total construction work done beat analyst expectations, yet not so smart was the fact that residential construction once again went nowhere, for a third consecutive print. Given that the economy is supposed to be rebalancing away from engineering construction (i.e. mining) and into residential projects, this doesn't look so great.

If you live or work in inner Sydney this might come as a surprise given that there is an uplift in construction happening here. However, it is not so elsewhere, and for this reason property analyst Michael Matusik is in the camp of those expecting further rate cuts:

"The continued subdued nature of new housing starts – despite record low interest rates & a high number of actual dwelling approvals – means a lower than anticipated economic growth rate for next year; something below 3% per annum. Very few new jobs will be created across the country if GDP stays below 3%. Anything less than 2.5% usually means job losses.

"Whilst the RBA jawbones for a lower Aussie Dollar – yes, something in the mid 80 cent range would be very good – the only real tool we have to help get housing starts increasing again (and by ten-plus percentage points per annum) - and with that type of growth rate, many more jobs – is interest rates.

"At present new housing construction – for the year ending September – grew by just 1% across Australia. New housing construction is actually contracting across Queensland – down 2% on last year.

"Despite talk to the contrary of late, interest rates need to fall again and soon. We need to build more new homes."

Matusik is bullish about the outlook for east coast residential property and in particular for Sydney, Melbourne and south-east Queensland, noting that prices could rise by as much as 25% over the next 3 years.

Private capital expenditure - actual and expected

Most of us are probably familiar with the doomsday scenario by now: mining capital expenditure tanks "off a cliff" through 2014 and beyond, our terms of trade collapse, unemployment rises and Australia sinks into recession. In contrast, what we actually want to happen is a relatively smooth transition from mining construction to mining production.

In this context, total new capital expenditure rebounding by 3.6% in the third quarter was a welcome surprise to the upside.

Source: ABS

The "estimate four" figure for total capital expenditure in for 2013-14 came in strong at $166,832 million which is 3.2% higher than the estimate three for 2013-14. In plain English, this means that capital expenditure next year is expected to hold up a little better than had been feared - perhaps more of a plateau or a gentle taper rather than a cliff?

Source: ABS

Similarly, the estimated figure for expected mining capital expenditure ticked up a little. The widely feared 'capex cliff' has not materialised to date.

Source: ABS

There could be any number of reasons for this, including project cost overruns. Paradoxically, such inefficiencies appear to be a positive in capital expenditure actual prints (in line with the 'parable of the broken window' - if our aim it simply to boost GDP we should all go and smash a window tomorrow).

From my own experience I know how hard it can be to estimate capital expenditure in mining surveys and material blowouts are not uncommon. Expected figures which may appear entirely reasonable at the feasibility/FID stages can go badly awry over time. Labour costs are high in Australian mining and construction activities are tightly regulated (as they might say in mining parlance: "you can't go to the bathroom without filling out a form", or words to that effect).

New home sales

A weaker month recorded by the Housing Industry Association in October. The small sample sizes mean that the data set is volatile, particularly at the state level. Clearly, new home sales are significantly stronger than they were in Q3 2012, with total sales up by around 25% year on year (in particular house sales are up strongly by more than 33%).

The largest increase across the three months to October this year was in South Australia (+10.5%), followed by Victoria (+6.0%), Western Australia (+5.3%), Queensland (+5.1%), and New South Wales (+2.0%). The trend in new home sales remains up, albeit not in an earth-shattering manner.

Source: HIA

Affordability

The HIA caused a stir by also releasing its housing affordability index this week, showing 'affordability' at an 11 year high thanks to 225 basic points (2.25%) of interest rate cuts since 2011. Clearly repayments have dropped sharply, but entry prices remain elevated.

Dwelling prices

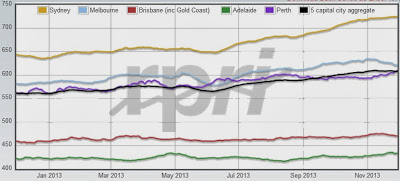

RP Data's Daily Home Value Index sees dwelling price growth lately as moderate or having moderated everywhere except for Sydney. Melbourne dwelling values will be reported as having fallen by more than 2% in November, although to some extent the index is likely have been impacted by a change in the sales mix.

Source: RP Data

Summary and risks to the outlook

So, where does this all leave us? The rebound in total capital expenditure combined with improved retail sales suggests that the Q3 GDP print next week might be a little better than had been expected, perhaps in the realm of 0.6%-0.7% for the quarter. However, residential construction is not firing across Australia and the official cash rate appears set to be stuck in the 2-3% range for the foreseeable future.

Source: ABS

I've alluded to some of the risks for 2014 and beyond above, including any severe drop in mining capital expenditure or a major weakening of our terms of trade from historically very high levels.

Mining production is increasing, the iron ore spot has held up well at $135/tonne at a time of year when support may begin to return to the price, and the Aussie dollar is threatening to sneak into the 80-90%range which may help producers to remain competitive.

The biggest unknown is probably the outlook for China. No surprises that growth in China looks set to hit its target, but significant question marks still remain about the stability of the model. The Chinese economy is imbalanced, with a very high percentage of GDP growth being driven by investment rather than by consumption: the building of apartments (tens of millions of which reportedly sit vacant), infrastructure and factories.

Whether or not China is able to rebalance away from investment towards consumption in the years ahead is unclear, and consequently it needs to be considered whether the growth rates that we have come to expect from China are sustainable going forward.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.