Balance is best: Why Melbourne's office market is well placed to withstand economic gyrations

A recent article in the Australian Financial Review reassured investors that the anticipated short-term surge in sublease space (within Australia's CBD Office markets) has simply not eventuated:

"Sublease space spikes at times when the economy is weak and business confidence is low because companies are restructuring and downsizing."

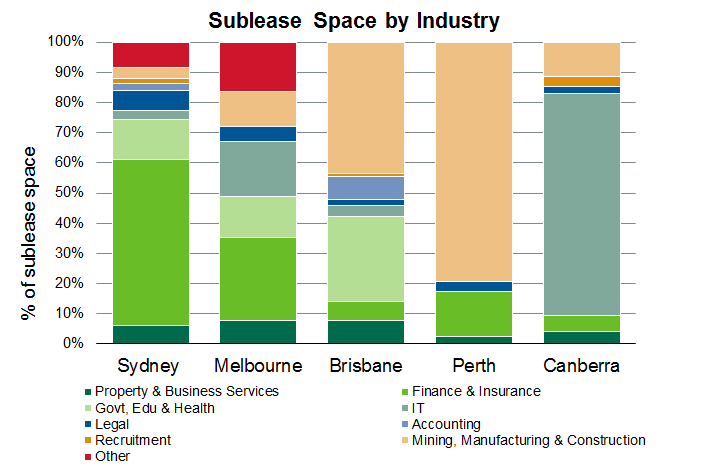

Source: CBRE

Furthermore, the article suggested that the overall amount of sublease space is expected to fall sharply over the next few months — following the post-election improvement in business confidence.

And of all the capital cities, the CBRE research shows Melbourne has provided the greatest improvement over the past year.

What else does the chart reveal?For a number of years now, this blog is pointed to Melbourne having far greater stability — when you compare it to other capital cities. And my reasoning has been that Melbourne enjoys a far more diverse tenancy mix.

However, there has never really been any definitive analysis, to clearly confirm this particular assertion.

That is until now!

As you can see from the chart above, every CBD (other than Melbourne) has a major exposure to one specific market sector:

Sydney: Finance & insurance;

Brisbane: Mining, manufacturing & construction;

Perth: Mining, manufacturing & construction; and

Canberra: Information technology.

As you would appreciate, when any of these business sectors begin to surge those capital city office markets respond rapidly — with escalating rentals and prices.

However, during an economic downturn (like the GFC ) those same markets tend to suffer the most.

Bottom line is with a more-balanced spread within its tenancy mix, Melbourne's office market is better placed to withstand such economic gyrations.

While it may not reach the same heady peaks, nor does Melbourne plumb the depths experienced by the other capital cities.

Perhaps it lacks some of the excitement. Yet instead, Melbourne has historically been able to offer investors solid and predictable returns.

Chris Lang is an advisor to commercial property investors, sell-out author and regular speaker on how to invest in commercial property. You can visit his website Property Edge Australia to help you get the most out of your commercial property investing.