Glut of national office sublease space appears to have peaked

The glut of office sublease space facing most Australian capital cities appears to have peaked.

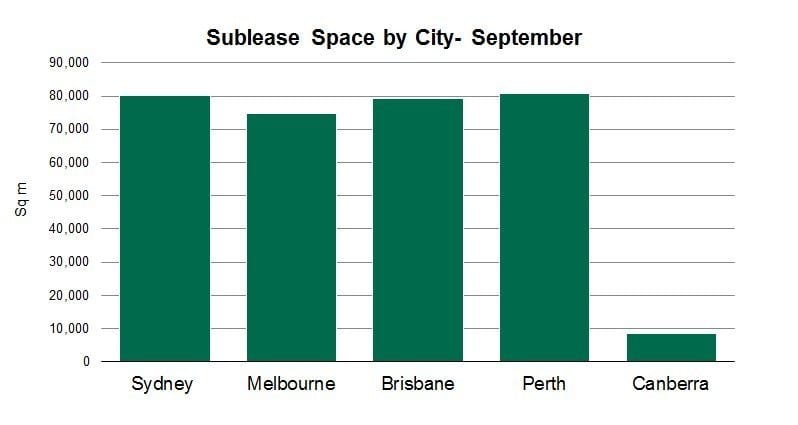

A national review of the sublease office market by CBRE, titled Sublease Barometers - showed that the amount of sublease space is hovering between 70,000 square metres and 80,000 square metres in Sydney, Melbourne, Brisbane and Perth.

And while the figures are above historic average, the expectation was that no significant tranches of new sublease space were expected to come to the market in the near future.

Source: CBRE

CBRE regional director, office services, Andrew Tracey pointed out that "much of the available stock is subject to very short lease tails with expiries in 2014 and 2015."

"This is more of a deferred direct hidden vacancy issue given the inherent difficulty in leasing space with less than a three year lease expiry.

"Much of this stock is expected to revert back to direct vacancy, which will significantly reduce the volume of available sublease space."

In short, CBRE believes that the availability of office sublease space nationally is likely to have peaked

In assessing the state of the national office sublease market, The Sublease Barometers tracked both the volume of sublease space, the trends occurring within different industry groups and market sectors in the major capital city markets.

The results varied significantly between the small and bigger cities. Canberra recorded the least sublease space available at just 8,553 square metres in September. Conditions are expected to change any day as various government departments are restructured, leading to public sector rationalisation.

Market influencers also varied by city. It said the mining sector, as expected, had a much more significant influence on the Perth and Brisbane markets given the recent slowdown in this sector to which both cities have a high exposure.

At the same time, Brisbane’s high exposure to government tenants also resulted in that city being hit by Queensland state government job cuts and consolidation, with almost 2,500 full-time equivalent jobs in inner Brisbane cut from the Queensland public service in 2013, CBRE said.

While Sydney's high exposure to the finance industry saw it hit hard by the low sentiment in that sector.

But Mr Tracey noted that employment in the Sydney finance and insurance sector had increased by 4.5% in the September quarter, surpassing the national figure of 0.4%.

"With this sector being the main contributor of sublease space, overall availabilities may start to decline as business sentiment improves,” he said.

He concluded by saying that the national office leasing market was expected to show signs of improvement in the second half of 2014 and early 2015 as business confidence improved.