Asia-Pacific region forecast to have largest average rental growth globally: DTZ Research

The Asia-Pacific region is forecast to have the highest level of average rental growth of any region globally over the next five years but Australia is not expected to achieve the same highs.

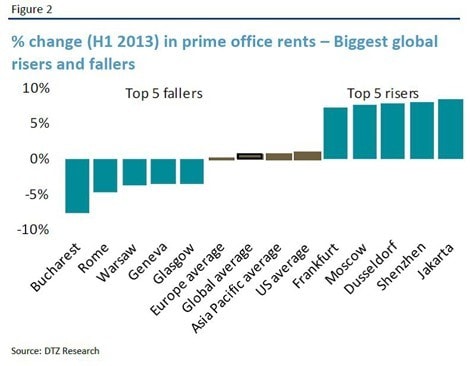

In its first ever global office review for the first half of 2013, DTZ Research showed "subdued rental growth globally" of less than 1% as the slowing Chinese economy, subpar US growth and persistent European economic difficulties continued to weigh heavily on corporate tenants around the world.

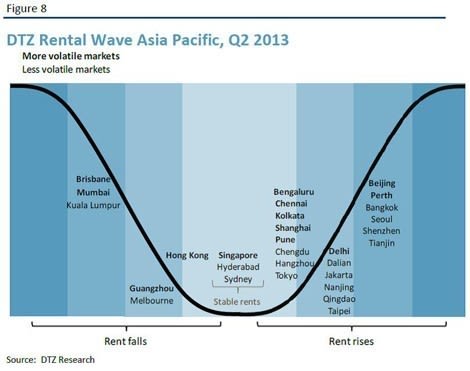

The weaker China economic growth story saw general sentiment and demand for office space in the Asia-Pacific region "cool" over the same period, with the exception of the emerging south-east Asian markets.

Click to enlargeThe results for the Australian office market were weak. Melbourne registered a decline in rents and the report stated that "the lack of rental movement in the other Australian markets is masked by significant increases in incentives.

"Consequently, net face rents have remained unchanged while effective rents have declined."

It also noted that negative net-absorption was recorded in the Australian markets due to weak demand.

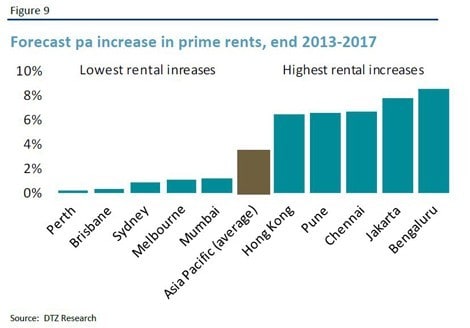

Conditions in the domestic office market are expected to remain challenging, with DTZ tipping only small rental increases over the next five years.

Click to enlargeThat comes despite its expectations that rental growth in Asia-Pacific will be the "strongest globally" over the next five years, driven by large uplifts in the Indian market.

"Occupiers in Australia are expected to benefit from the weakest regional rental performance," it concluded.

"The slowing economy and lack of demand drivers is likely to inhibit rental growth over the next five years."

On a positive note, DTZ's head of south-east Asia, Australia and New Zealand research, Dominic Brown said its research had also showed that the Sydney and Singapore markets had stabilised "at a low point, offering tenants excellent opportunities to lock in leases before market rents start to increase again.”

Click to enlarge