Change of leadership not a fix-all, but signs for economy positive: Robert Simeon

What a difference a week makes given Australia has a change of leadership and – woe and behold – all of Australia’s problems are removed.

If only it were that easy although consumer confidence is a key factor. National Australia Bank’s (NAB) monthly business survey, conducted prior to the September 7 federal election, showed business confidence rose nine points to six, up from the -3 in August 2013.

NAB chief economist Alan Oster said while an August rate cut and lower dollar may have helped sentiment “it appears more important were political factors – including an expectation of political change and more certainty about the future policy framework.” From the election results it is most clear that Tony Abbott has a clear mandate to reform that he must fulfill and the consumer backlash will be unforgiving should there be attempts to block and delay.

In all probability the Labor party will find itself in opposition for the next six years where it is hoped in time they will learn from the mistakes they made over the past six years. Since the election it is pleasing to note that all three ratings agencies have reconfirmed Australia’s AAA credit ratings.

Following the election of a majority government this should see retail spending pick up in the September quarter, with a more sustainable improvement kicking into 2014/15. Consumers just want to read and hear good news and it was a good news week – Westpac Melbourne Institute Index of Consumer Sentiment increased by 4.7% in September to 110.6, its highest point since December 2010.

So where to now with interest rates being a good start. I really can’t see any more cash rate reductions by the Reserve Bank of Australia given the change in government. Chris Joye makes some very interesting revelations when he wrote about why we should be worried about Australia’s housing market:

"The RBA’s rate cuts have gone too far. And if they stay this low for too long, there is a real chance Australia could, belatedly, have an acute housing crash with real consequences for the economy.

"While this is not my current central case, several factors give me pause. The first is that households have not really deleveraged despite much spruiking about our “cautious consumers”.

"This highly leveraged consumer is an artefact of Australia’s even more leveraged banking system. The major banks are leveraged about 80 times across their $1 trillion home loans books. Put differently, they are only holding about $1.25 of true loss – absorbing capital against every $100 – as opposed to the “risk – weighted” value of their assets.

"A third issue is that the banking system is under tremendous pressure to maintain its internationally lofty returns on equity.

"A stunning 33% of new home loans are today being advanced with LVR’s greater than 80%. In some countries they don’t even allow banks to lend at these levels, period.

"A final concern is Australia’s housing supply challenge. We do need to build many more new homes to accommodate the circa 15 million additional residents that will live here within 35 years."

Source: RP Data, Australian Financial Review

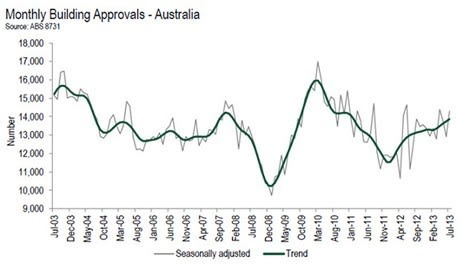

The release this week by the Housing Industry Authority revealed residential building approvals have embarked on what can be best described as a variable path of recovery over the past 12 months, illustrated by the graph below. With the 2012/13 financial year recently concluded, and the first update to approvals in the new financial year generating much comment and conjecture, it seems timely to conduct a comprehensive update on residential building approvals across the country.Total residential building approvals reached 158,111 in the financial year 2012/13 quite a modest increase of 5.5 % on the very weak year that was 2011/12. Following two consecutive monthly declines at the end of 2012/13, approvals started the new financial year with a partial recovery, increasing by 10.8% in the month of July 2013.

Click to enlargePeople quickly forget that the mining boom enticed many from our building industry where today, as mining projects slow down, these very same builders are back doing what they did before the mining boom.

Well, Mosman stock levels went backwards this week despite a change in government. If you look at the volume of houses on the market this time last year to this week our Mosman houses are down 36% and Mosman apartments down 40%.

Robert Simeon is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985.

He has also been writing real estate blog Virtual Realty News since 2000.

The RWM real estate model has sold in excess of $1 billion in database sales globally.