Cashed up foreign investors scouting Australian commercial property market: Cushman & Wakefield

A wave of cashed up international investors are on their way to Australia, with an estimated war chest of about $18.5 billion ready to be invested in commercial property assets around the country.

A new report from Cushman and Wakefield - titled “Capital Flows: How heavy is the weight of money?” - showed that more than 50 offshore firms are scouting the Australian commercial property market for assets, with an estimated war chest of US$16.5 (AU$18.5bn) billion in offshore money.

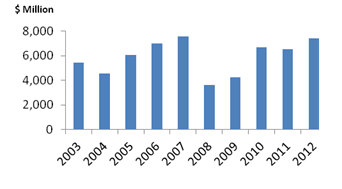

Office transactions

Source: Cushman & Wakefield

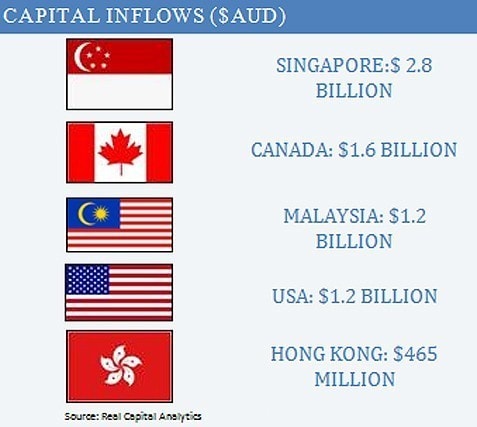

And leading that overseas charge, the report said were the Singaporean firms, with an investment allocation totalling an estimated US$4.1 billion, followed the US, Malaysia and China.????

Cushman & Wakefield Associate Director of Research and consultancy, Peter Ainge, said that up until now the major international investors had merely “dipped their toes in the water” when it came to Australian acquisitions.

"A more direct and aggressive move is on the short term cards," said Mr Ainge.

Investment managers, equity funds and open ended funds, the report said, were expected to have the largest allocation for Australian property investments, totalling about US$3.8 billion.

Source: Real Capital Analytics

"The next biggest category was the pension funds, with an estimated US$3.6 billion slated for investment. Among the pension funds identified were the Teachers Insurance and Annuity Association; College Retirement Equities Fund (TIAA-CREF) from America and the National Pension Service from Korea.

“Existing asset owners are approaching a critical stage, as the intense weight of international money coupled with the growing investment capacity of domestic superannuation firms creates a scenario in which it may be attractive not to take their assets to market,” said Cushman & Wakefield director of investment sales, Mr Tony Dixon.

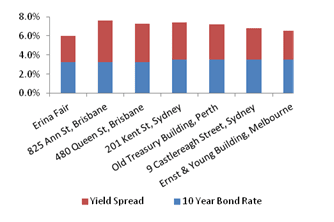

Source: Cushman & Wakefield

The report also highlighted that while offshore investors have been focused on core assets, with many adopting a “trophy hunter” approach, "the lack of investment opportunities is expected to see these investors move up the risk curve towards core plus and value add opportunities."

“Some offshore investors with firm ambitions to invest in Australia may find they need to broaden their investment mandates beyond the prime assets and core markets,” said Mr Ainge.

“While this is yet to materialise into actual purchases at this stage, Cushman & Wakefield can confirm that enquiry levels for secondary assets have increased.

"Hence any cap rate compression in the secondary asset market is likely to be driven by an increased weight of money rather than underlying property fundamentals."