Significant depth in Sydney's non-core office market: Jones Lang LaSalle

If ever there was a reason for property investors to be looking at the Sydney suburban office market for investment opportunities, it is now, according to Jones Lang LaSalle.

Based on its analysis of the nine key suburban office markets - Sydney Fringe, South Sydney, North Sydney, Chatswood, St Leonards, Parramatta, Macquarie Park, Norwest and Homebush/Rhodes - JLL found that the combined commercial footprint stood at 4.39 million square metres and the value was $19.5 billion, incorporating 190 A-grade assets.

Source: Jones Lang LaSalle

There was "significant depth" in Sydney's non-core office market, said JLL research analyst Leighton Waugh.

Specifically, he said there are four fundamental criteria that support the argument for investment in the non-CBD office markets - tenant demand and vacancy levels, rental growth, incentive levels and the yield spread between CBD and non-CBD markets.

"Tenant demand for suburban office space has been buoyant in the 12 months to June 2013, with gross take up totaling 140,700 square metres,'' he said.

And while prime net absorption was a modest 2,000 square metres over the same period, he made a point of saying that the Sydney CBD prime office market recorded negative net absorption of 20,700 square metres.

Of the nine suburban markets, JLL said demand was highest in Homebush/Rhodes, Macquarie Park and Parramatta ,which recorded positive net absorption of 47,300 square metres in the 12 months to June 30. North Sydney, Sydney Fringe and Sydney South reported negative net absorption of 81,400 sqm.

"The number of tenant briefs for space has increased in the majority of the suburban markets as prospective tenants look to take advantage of the modern amenities and lower gross effective rents," said Mr Waugh.

He said the average gross effective rent for the nine Sydney suburban office markets was $341 per square metres per annum.

"The lower gross effective rent for the suburban office markets compared to the Sydney CBD ($608 square metres per annum) makes the suburban market attractive for tenants despite the stronger rental growth (4.2%) against the Sydney CBD (-2.5%) year-on-year," he added.

The JLL research also showed that prime vacancy across the nine suburban markets sat below the CBD vacancy level, at 9.2% and 11.3% respectively.

"Quality supply is scarce in the Sydney suburban office markets and little supply is forecast to come on stream in 2013 and 2014, which should see a tightening in the vacancy rate as was recorded in Parramatta, Macquarie Park and Homebush/Rhodes in Q2/2013," said Mr Waugh.

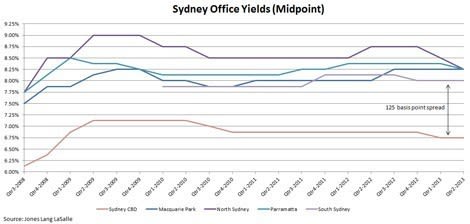

Sydney suburban upper yields ranged from 7.25% to 9.00% compared to 6.00% to 7.50% for the Sydney CBD, JLL said. It is forecasting yields to compress in the North Sydney and Parramatta markets in 2013 and 2014.

A number of institutional investors were preparing to raise capital for non-CBD office funds, said Mr Waugh, as those markets offered a combination of high yielding assets together with strong income streams.

"As a result, the demand for non-CBD product is likely to increase over the next 12-36 months, " he added.